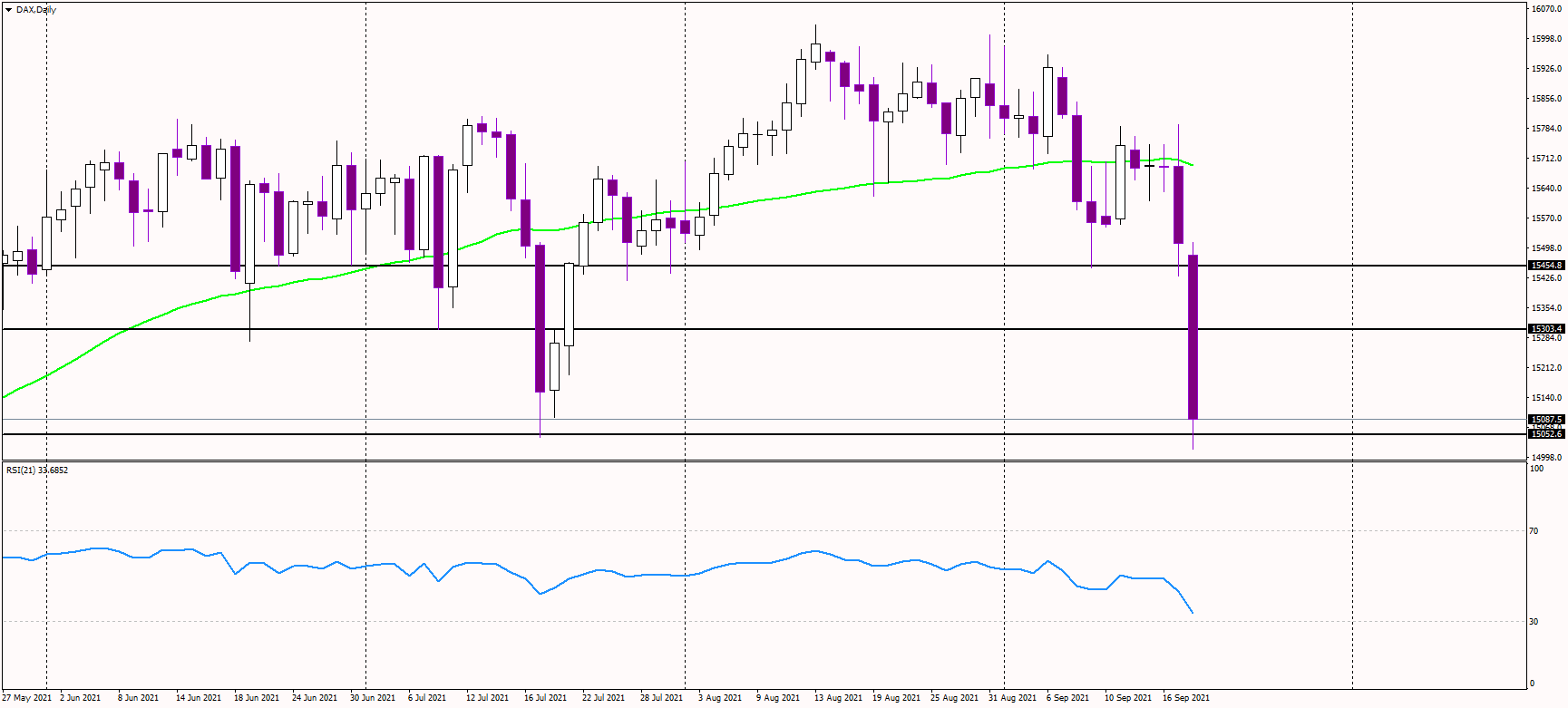

It has been a miserable September so far for stocks, and the German DAX index is down nearly 3% on Monday, trading at 15,095 EUR at the time of writing.

Sentiment remains very bearish amid the looming Evergrande default, undermining stocks across the globe.

The index is now testing the critical support near 15,060 EUR, and it needs to hold for the medium-term uptrend to remain intact. However, the short-term timeframes are heavily oversold, getting ready for a possible bounce. Therefore, speculative traders might start buying the dip here, where the bullish idea is reinforced by the presence of significant support and heavily oversold markets.

However, larger stop-losses could be hit if the support cracks to the downside, potentially sending the DAX index way below the psychological 15,000 EUR level.

Alternatively, if bulls reappear and the decline stops, the first selling zone is spotted near previous lows at 15,300 EUR, while the key resistance now stands near 15,450 EUR.

This week's Fed decision is expected to sound dovish, considering the ongoing collapse in risk assets, possibly supporting equities later in the week.