The Dow Jones index was somewhat lower during the US session, with dip buyers absent for now, but it remained near its all-time highs reached earlier in the week.

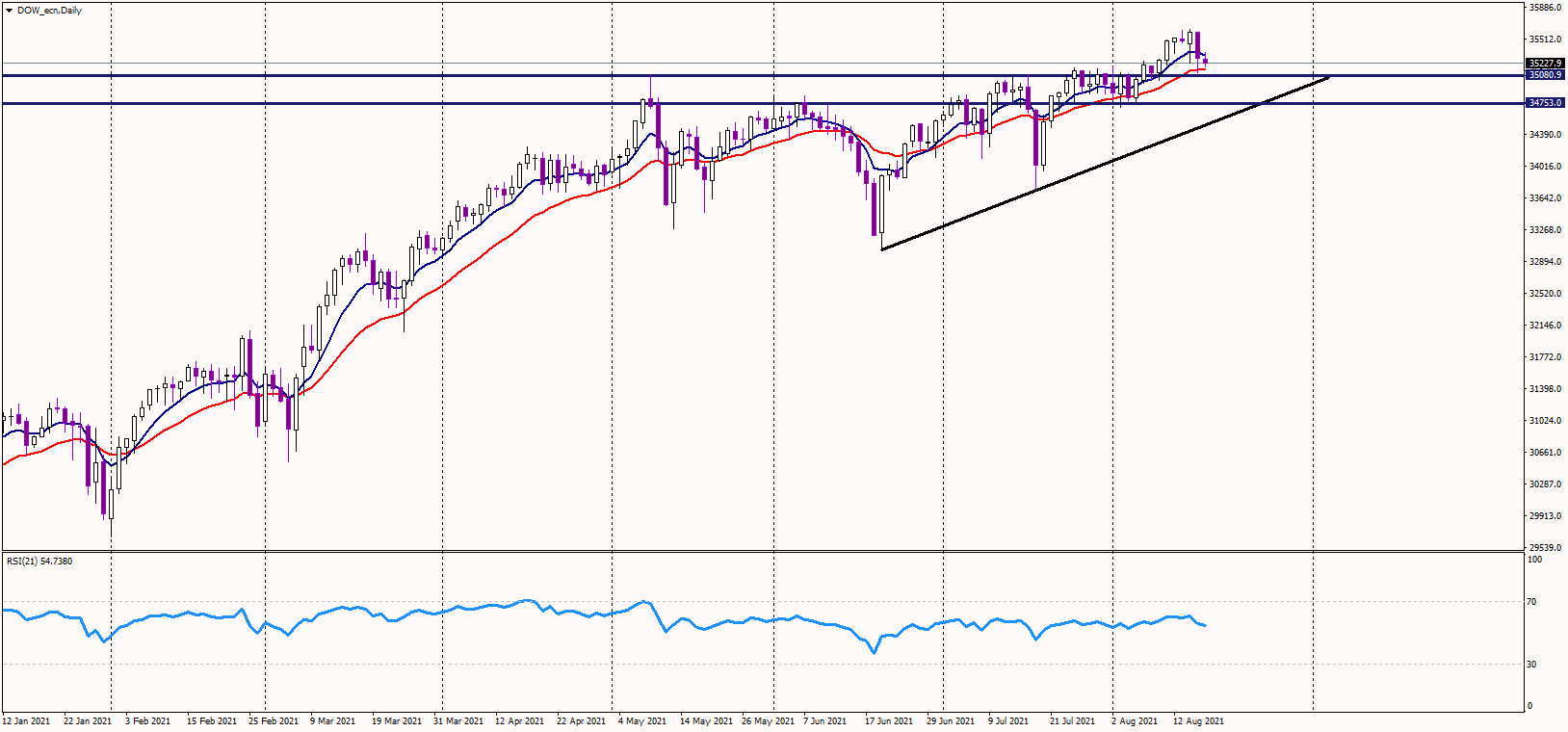

The major support now seems to be at around 35,100 USD, where previous cycle highs are converged with the 21-day exponential moving average.

The index needs to stay above that level to defend the short-term uptrend.

If that support is taken out, the next level to watch could be 34,750 USD, followed by the important bullish trend line near 34,550 USD.

Should the index drop below the mentioned trend line, the medium-term bull market could be over, and a larger correction/sideways trading could occur.

Alternatively, if bulls buy the dip again, the first intraday resistance is expected to be at the current swing highs near 35,600 USD.

Sentiment remains positive as central banks continue to pump money into the financial system.

Later in the day, the FOMC minutes are due, and if there are any dovish surprises, stocks could accelerate further higher.