The EURUSD pair is now down three days in a row and trading 0.2% lower on Wednesday, erasing most of its post Jackson Hole gains. At the time of writing, the pair was changing hands at around 1.1815 during the US session.

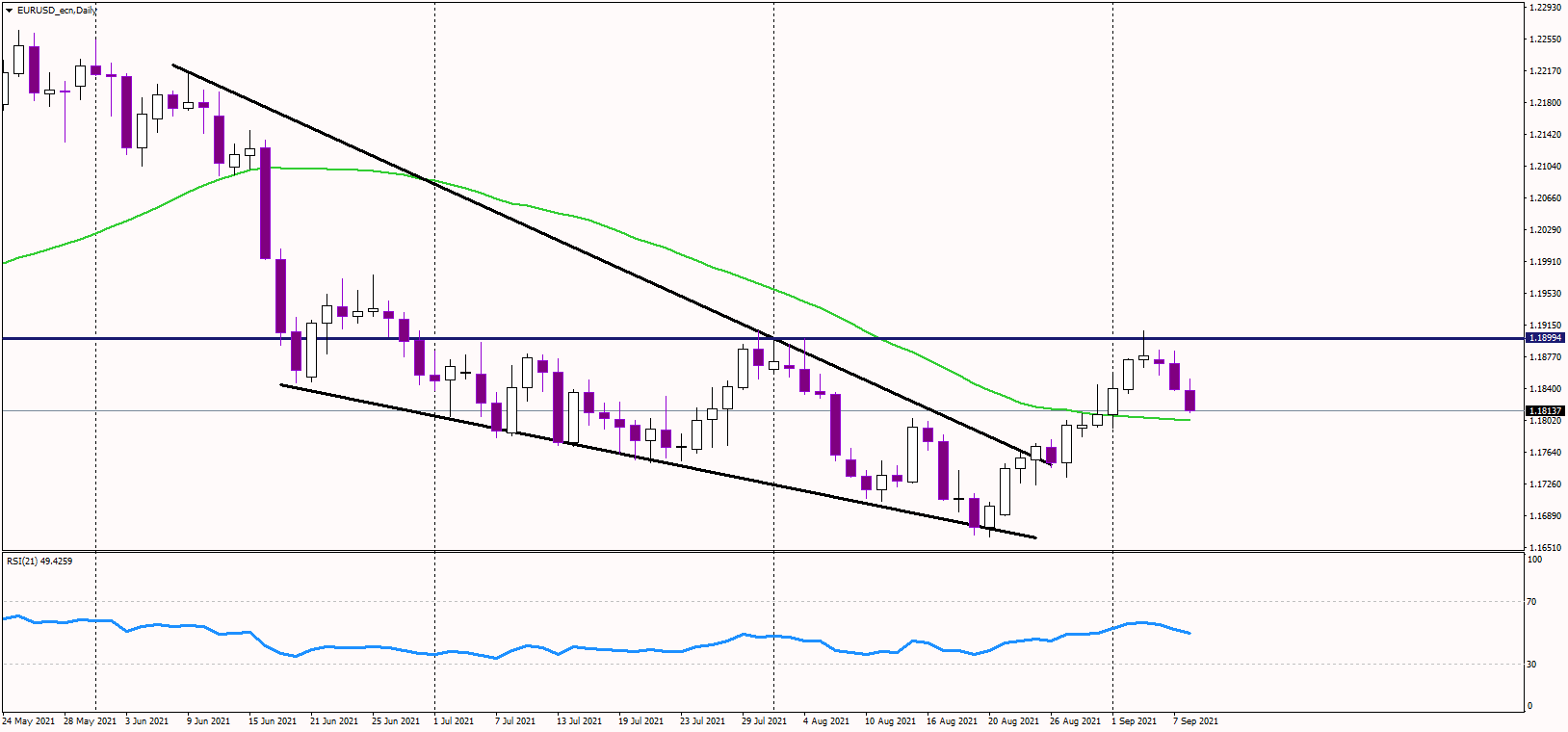

The 50-day moving average (the green line) is now the immediate support, and it is located at 1.18. If the euro drops below it, the short-term outlook could change to bearish, while the medium-term outlook might turn to neutral.

In the case of a bearish breakdown, the next support to watch will be at 1.1750, but the pair needs to defend the 1.18 zone or risk exhausting the bullish signal from the falling wedge pattern.

Alternatively, if the euro defends the 50DMA, we could see a nice rally, considering the medium-term trend still seems bullish. The first target is spotted in the 1.1850 zone, while the essential resistance remains at 1.19, and the pair must close above it on a daily basis to confirm the bullish breakout from the falling wedge pattern.

The USD is still driven mainly by the US yields and the 10-year benchmark yield must rise above 1.40% to confirm its bullish bias. In that case, we might see a decline in the EURUSD pair below the 1.18 support. On the other hand, should yields start to fall again, the greenback is expected to weaken in that scenario.