The EURUSD pair was trading 0.15% higher on Thursday, rising every day this week and trying to settle above the 1.1850 level during the US session.

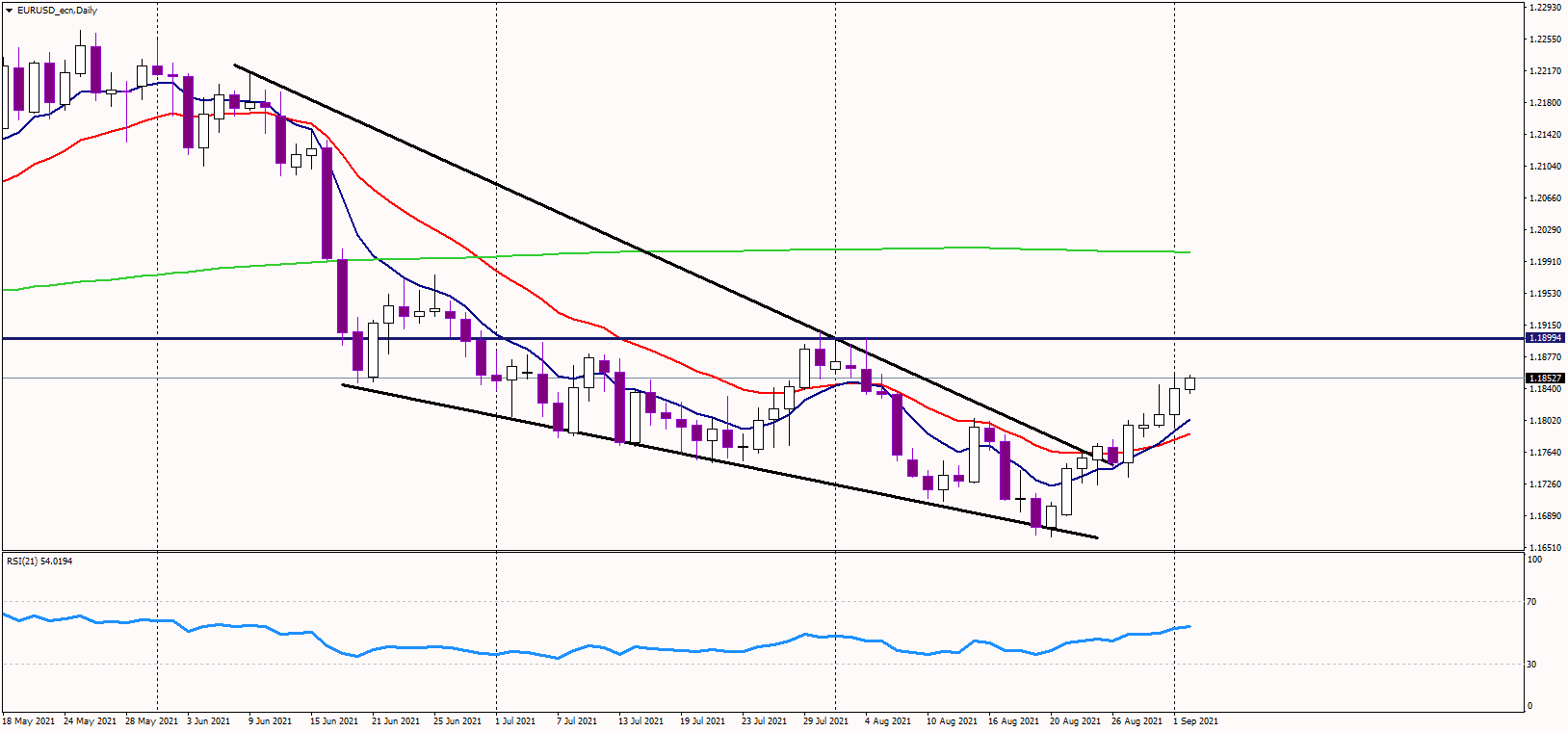

The next key resistance is expected at previous highs near 1.1900. However, should the euro rise above it, the medium-term trend could change to bullish, targeting the 1.20 level, where the psychological threshold meets the 200-day moving average.

There is a very nice bullish divergence between the price and the MACD indicator on the daily chart, supporting the bullish bias.

Additionally, the price has broken up from the falling wedge pattern, a bullish formation reversal. The full target of this pattern is near the 1.22 zone, suggesting more upside potential.

Alternatively, if the greenback starts to strengthen, the support is seen at 1.18, while the euro needs to stay above 1.1750 to keep the falling wedge breakout valid.

On Friday, US labor market data will be released, including non-farm payrolls and the unemployment rate, potentially causing large volatility. Sentiment remains bearish for the USD as Jay Powell failed to deliver an exact starting date for tapering.