The French CAC index notably outperformed the German DAX index today, as it was trading 0.7% higher at around 6,780 EUR, while the DAX remained marginally lower on the day.

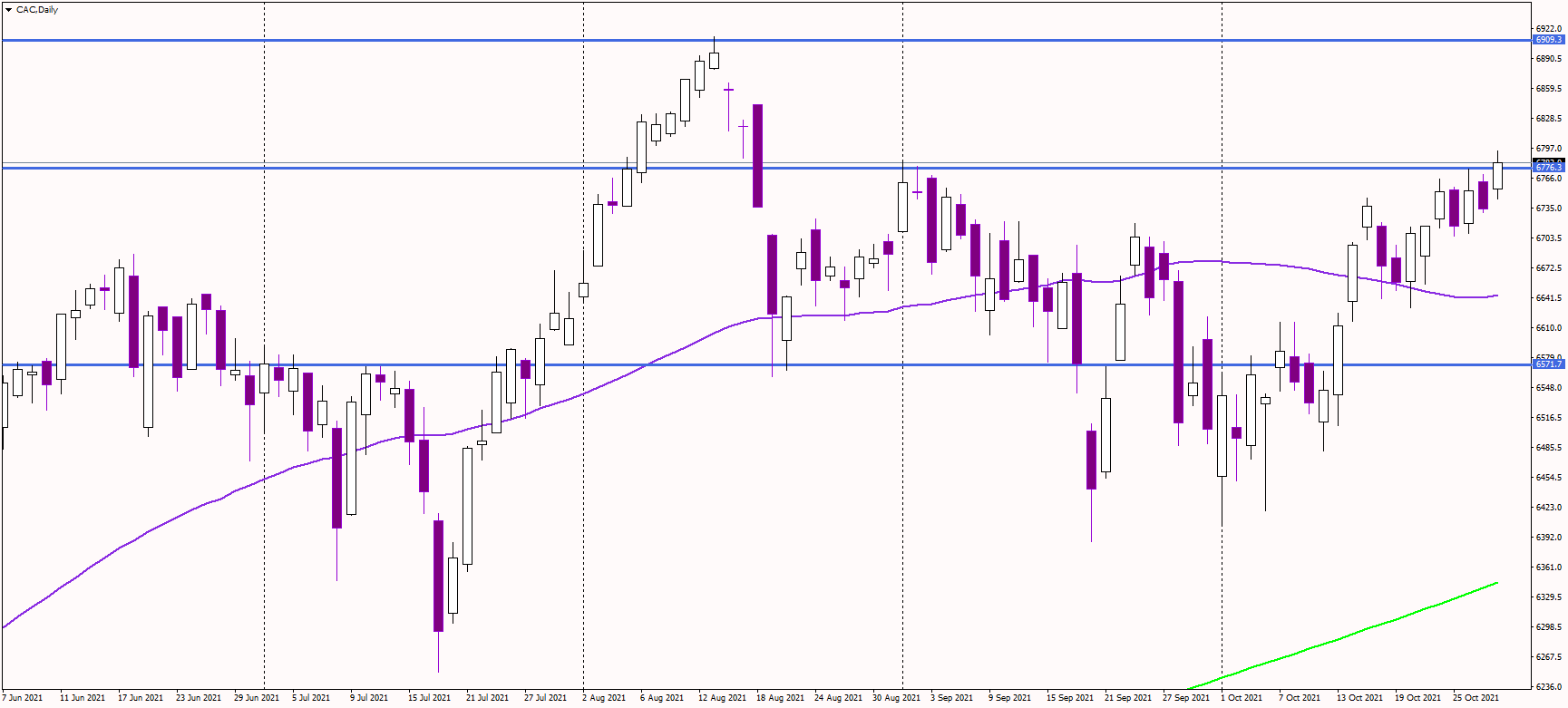

The index is now trying to break above September highs near 6,785 EUR. If bulls are successful, it could be a short-term bullish impetus, possibly targeting the current cycle highs near 6,900 EUR.

Alternatively, a failure to rise above that level could result in a decline, targeting the 50-day moving average at 6,640 EUR. Another strong support is seen near 6,570 EUR.

However, the two-hour chart looks a bit bearish, as a rising wedge pattern is forming there, reinforced by the bearish MACD divergence. The triangle's support is near 6,750 EUR, and if the price drops below it, the pattern could become valid, targeting 6,650 EUR.

Sentiment remains positive as the ECB is in no rush to tighten monetary policy, further supporting European stocks. Additionally, the EURUSD pair remains in a medium-term downtrend, which tends to be bullish for EU equities.

CAC daily chart 2PM CET