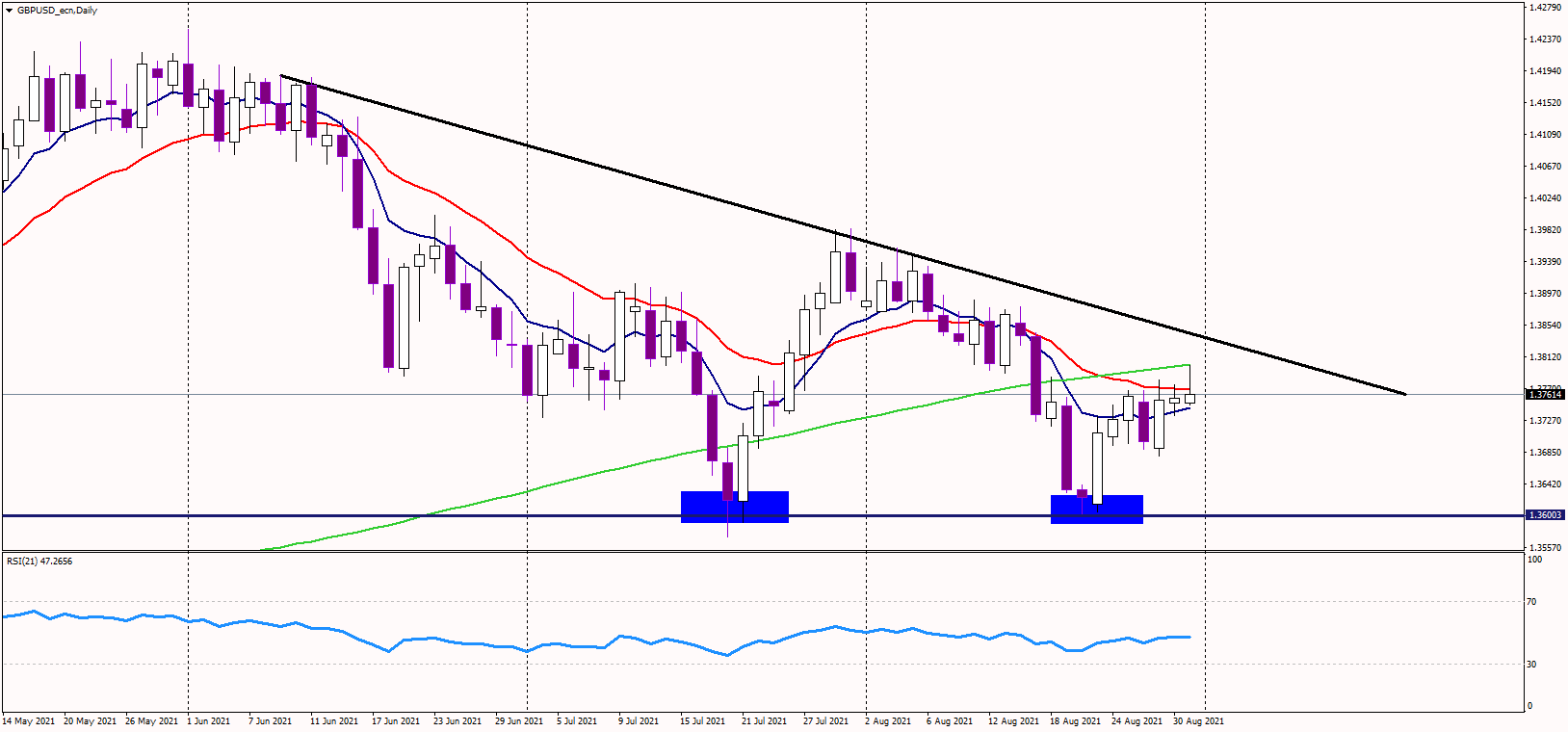

The GBPUSD pair continued in its uptrend on Tuesday and was trading near 1.37750 at the time of writing, rapidly approaching the important resistance at 1.3805, where the 200-day moving average stands.

That is the critical resistance for the next few days, and if the pair manages to get above it, the medium-term outlook could change to bullish again. At the medium-term downtrend line, another important level will be found, currently some 20 pips above the 200-day MA. Once the Pound is above them, bulls should be in control.

The first target will be at previous highs near 1.39, while the psychological zone of 1.40 could be tested as well. The greenback faces some serious bearish sentiment, possibly pushing the GBPUSD pair further higher in the near term.

In addition, the double bottom pattern on the daily chart is still valid and active, supported by a nice bullish divergence between the MACD indicator and the price.

Alternatively, if sterling starts to decline again, the support is seen near 1.37, and if not held, we could see a drop toward the double bottom at 1.36. The pair must defend that support or risk a larger correction below 1.35.