Gold and silver soared on Friday, fueled by the frustrating non-farm payrolls, and gold was trading 1% higher during the US session, advancing toward the major resistance.

The US economy added only 235,000 new jobs in August, well below the official consensus of 750,000 and sharply lower than 1,053,000 jobs added in July. Thus, investors could now price in a possible delay in the Fed's tapering plans, possibly boosting gold and silver prices.

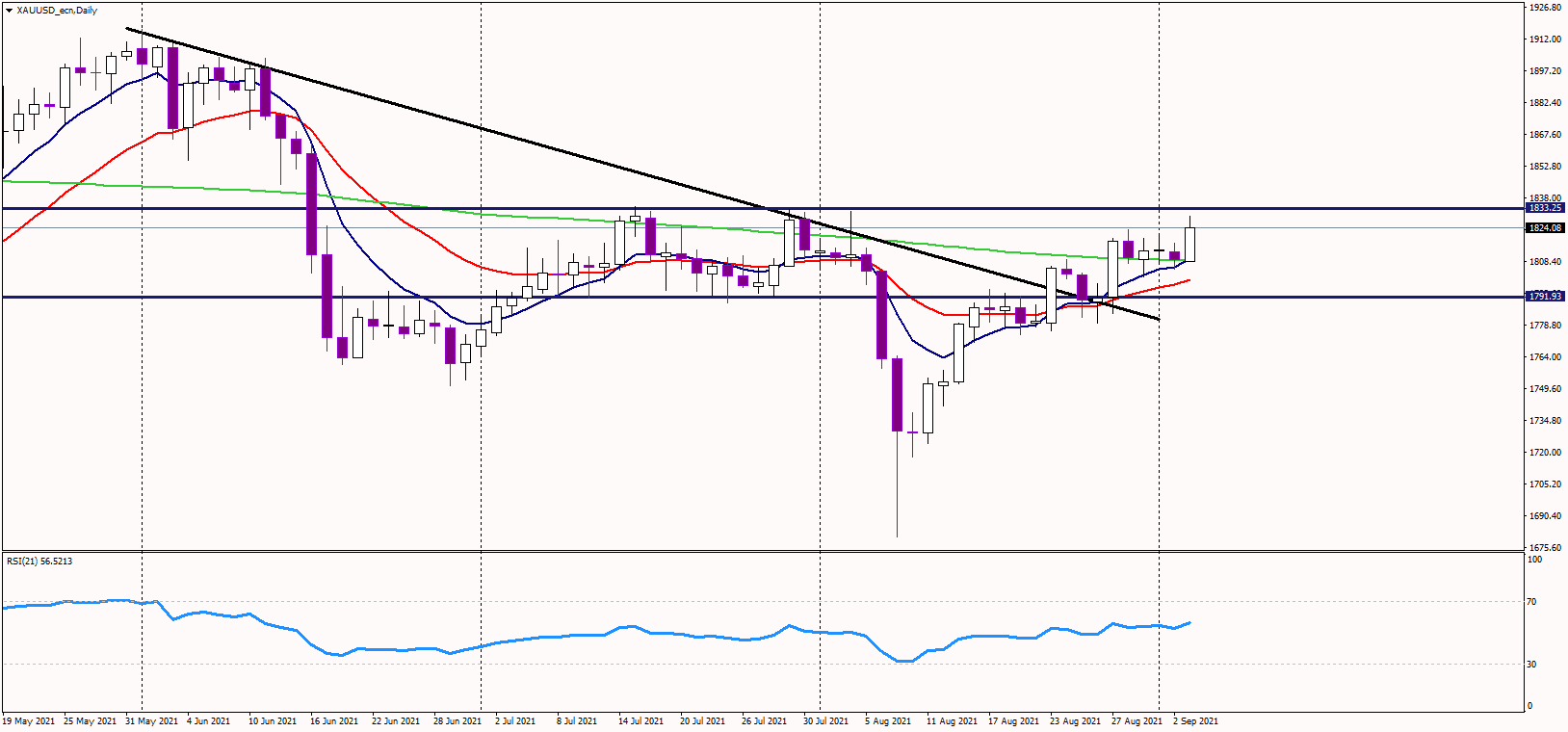

Gold managed to push above the 200-day moving average, currently near 1,808 USD (the green line). As long as it trades above it, the medium and short-term outlooks seem bullish.

The next resistance is in the 1,835 USD zone, where gold has failed many times during the summer. However, judging by the current bullish momentum, it looks like this resistance won't hold the bulls for long. Therefore, the second target in the current leg higher is expected near 1,850 USD.

Alternatively, if gold starts to decline, the support is at the mentioned 200-SMA at 1,808 USD and afterward at the psychological level of 1,800 USD.

The USD has been dropping nonstop since last Friday's Powell speech; precious metals might continue in their upward movement as weaker greenback usually supports commodities.