Precious metals are having a great day, and gold is up more than 1.3%, flying above the psychological 1,800 USD level again.

If gold closes the day above 1,800 USD, it could be a short-term bullish impetus. Additionally, it looks like the recent smackdown has been quickly forgotten.

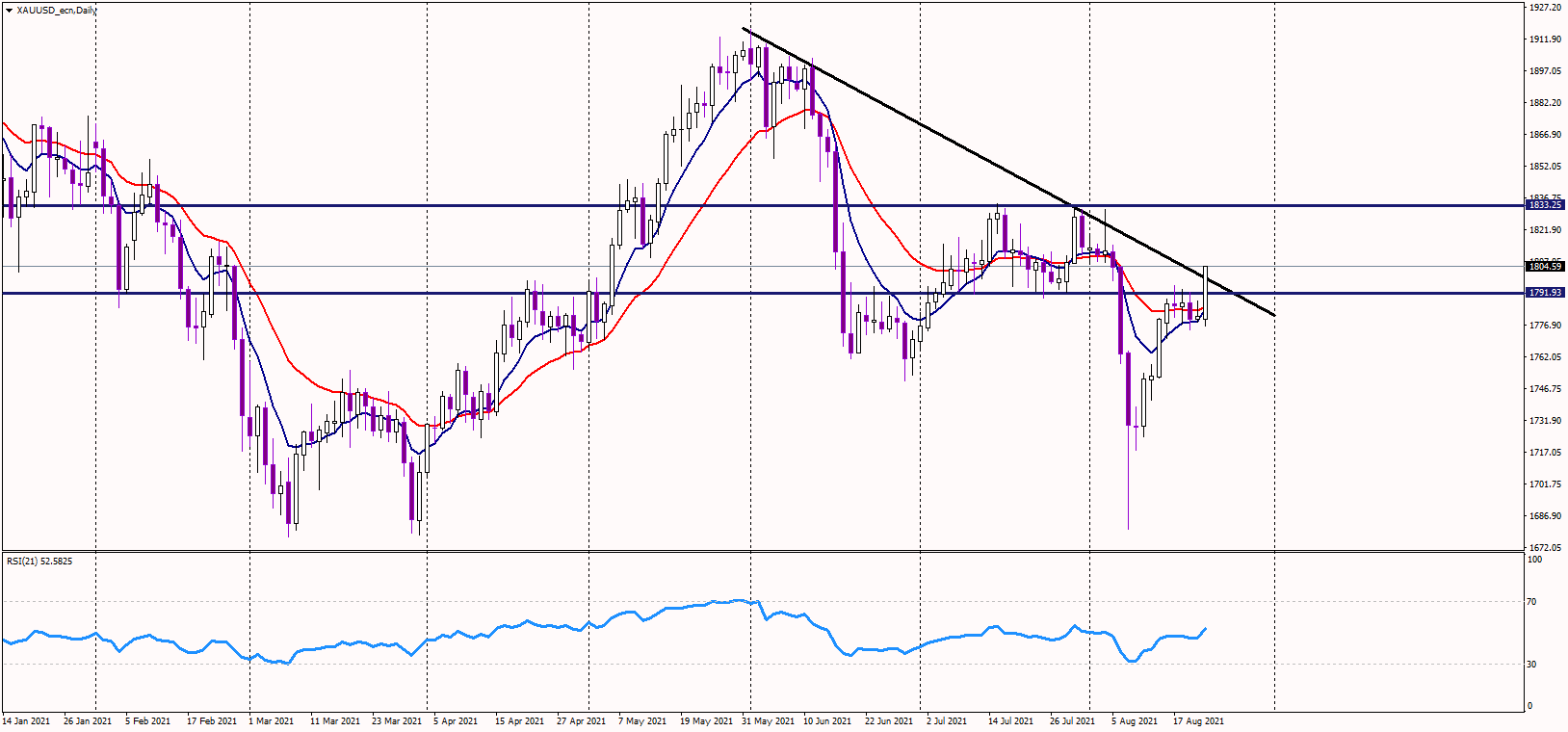

On the other hand, the medium and long-term trends remain neutral as the bullion has not moved anywhere since July 2020.

The next resistance could be found near 1,830 USD, where the previous double top formation is located, which recently sent gold 150 USD lower.

Alternatively, the short-term support is now at 1,800 USD, and the next demand zone could be near 1,790 USD.

The short-term outlook appears bullish, supported by the weakening USD, but Thursday's Jackson Hole Symposium might cause elevated volatility.