The New Zealand dollar slid Friday, losing half a percent during the US session and trading near 0.7160.

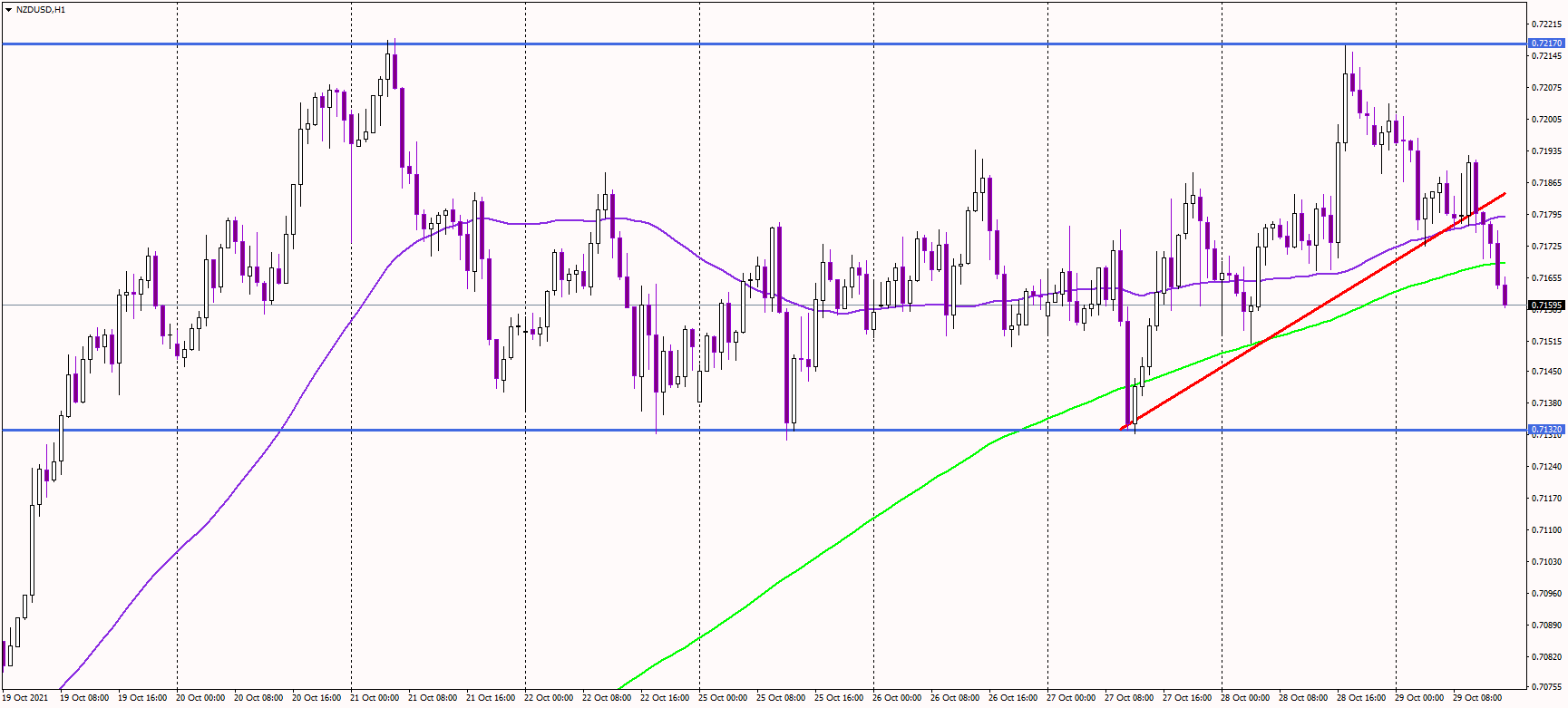

The pair has topped again near 0.7215, posting a perfect double top pattern, a bearish reversal formation. This formation's neckline (or support) is seen at 0.7130, and if the NZD drops below it, the pattern could become valid. It has the potential of 90 pips, thus targeting 0.7050 as the entire target for bears.

But on the longer time frame (such as four-hour or daily charts), the formation only looks like a consolidation shape in the current medium-term uptrend. It is usually broken in the direction of the primary trend, in this case, to the upside.

Therefore, traders should wait for a break from the current range. If it happens to the upside, the next target could be at 0.73, while the downside target was set at 0.7050.

It looks like the USD has lost ground, despite rising yields and rate-hike expectations, possibly keeping the uptrend in the NZDUSD pair intact. However, the short-term direction will likely be set once a break from the range occurs.

NZDUSD hourly chart 2 PM CET