The NZDUSD pair, also known as the Kiwi dollar, has been under pressure in the previous two weeks, but it managed to book some gains on Wednesday in anticipation of a dovish FOMC meeting.

At the time of writing, the pair was up 0.25%, changing hands at around 0.7020.

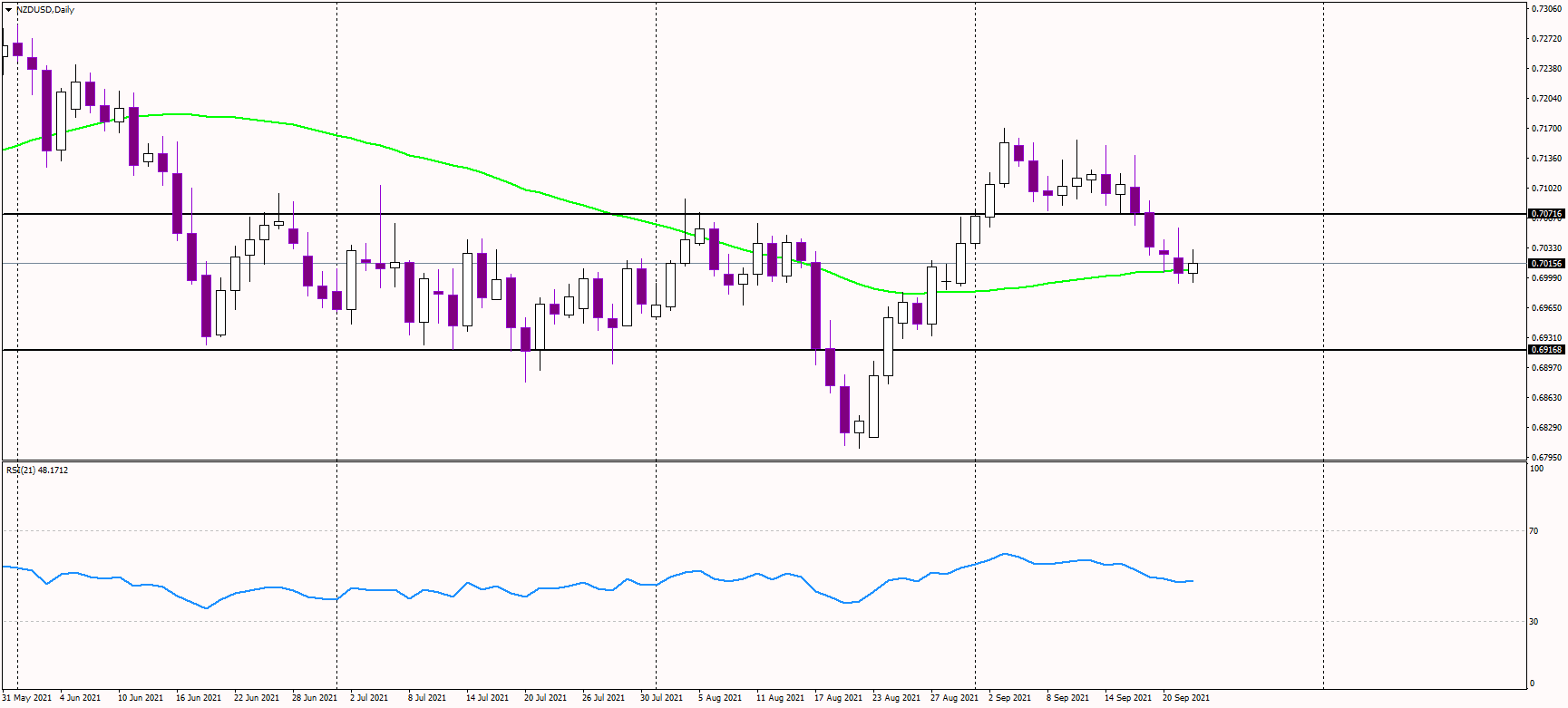

The pair is now testing a confluence of supports - the psychological level of 0.70 and the 50-day moving average, located some pips above it. It needs to defend this support to remain in a medium-term uptrend.

In such scenario, the resistance seems to be in the 0.7070 zone, where previous swing highs are located. If another leg higher begins from the current support, the recent cycle highs at 0.7150 will also pose some difficulty for bulls.

Alternatively, should the kiwi break below the 0.70 support, stop-losses of long positions will be hit, possibly pushing the pair further lower. The next medium-term target for bears would be in the 0.6920 area.

The RSI indicator is in the middle of its zone, not helping either bulls or bears.

The immense volatility should come tonight after the FOMC decision, which might sound a little dovish, considering the recent sell-off in stocks. Should that happen, the NZDUSD pair might shoot higher, testing the mentioned resistance near 0.7070.