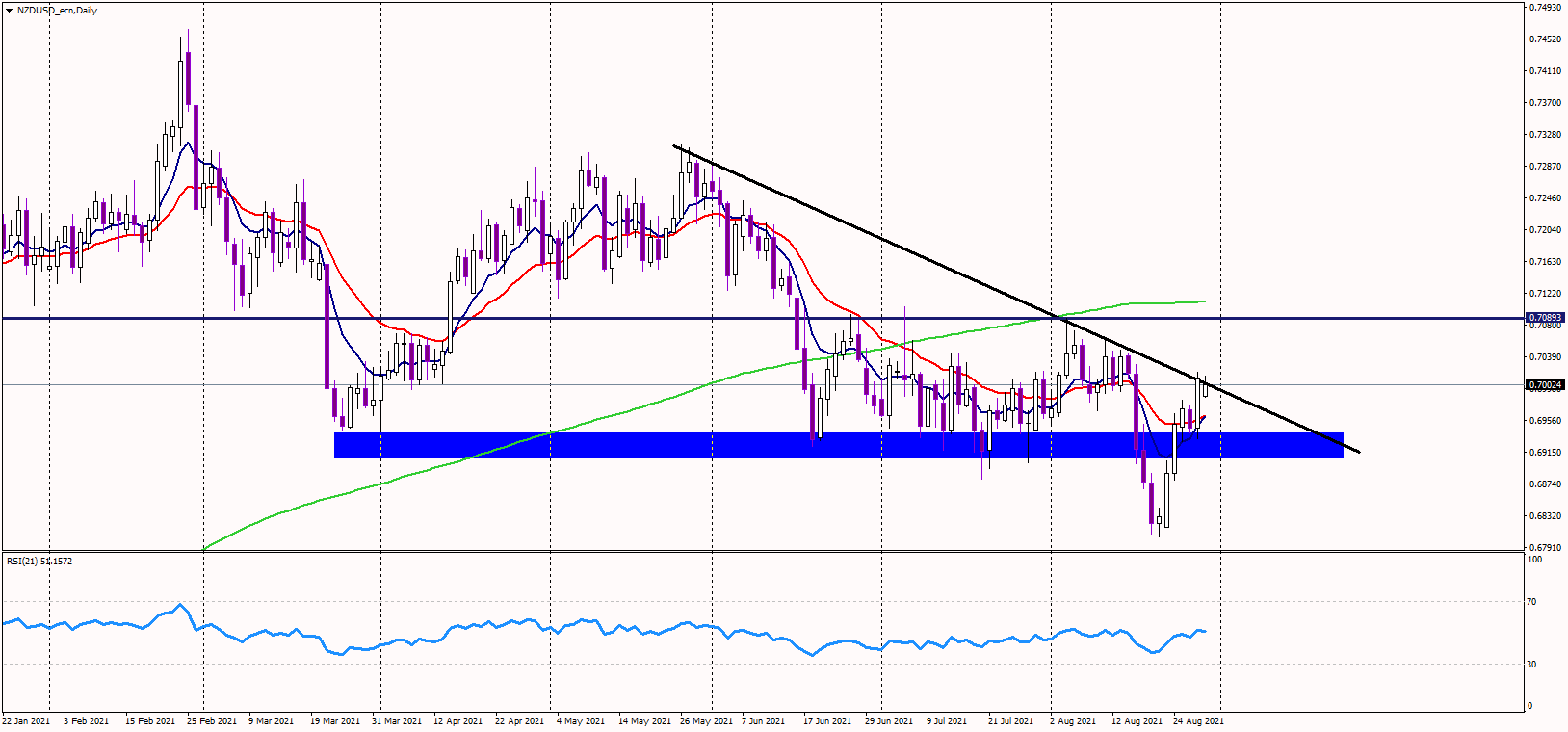

The NZDUSD pair, also known as the Kiwi-dollar, was down marginally on Monday, trying to settle above the important psychological level of 0.70.

Friday's dovish Powell led to a sharp and broad decline of the greenback, sending the NZDUSD pair to the 0.70 resistance zone. However, the medium-term bearish trend line is located here, and should the pair jump above it, the medium-term outlook could improve to bullish.

The next target for bulls will most likely be at June's highs near 0.7090, where the Kiwi has failed several times.

Another selling level is observed at the 200-day moving average, currently near 0.7115.

Thus, should the NZDUSD pair squeeze above those resistances, the bullish momentum could accelerate further higher.

Alternatively, the major support zone is still seen at previous lows at 0.69, and as long as the NZD remains above it, dips are expected to be bought.

There is a large bullish divergence between the MACD indicator and the price on the daily chart, supporting the current bounce.

Sentiment against the greenback remains negative, and the uptrend in the NZDUSD pair is likely to continue.