The WTI benchmark has been up for five consecutive days, and it was trading at 78.50 on Tuesday, higher 1.5% on the day and rising to fresh seven-year highs.

Earlier today, OPEC+ decided to continue increasing output only gradually despite demand recovering as the Delta-variant Covid-19 wave eases. Global cases hit their lowest in nearly two months on Monday, according to Johns Hopkins data.

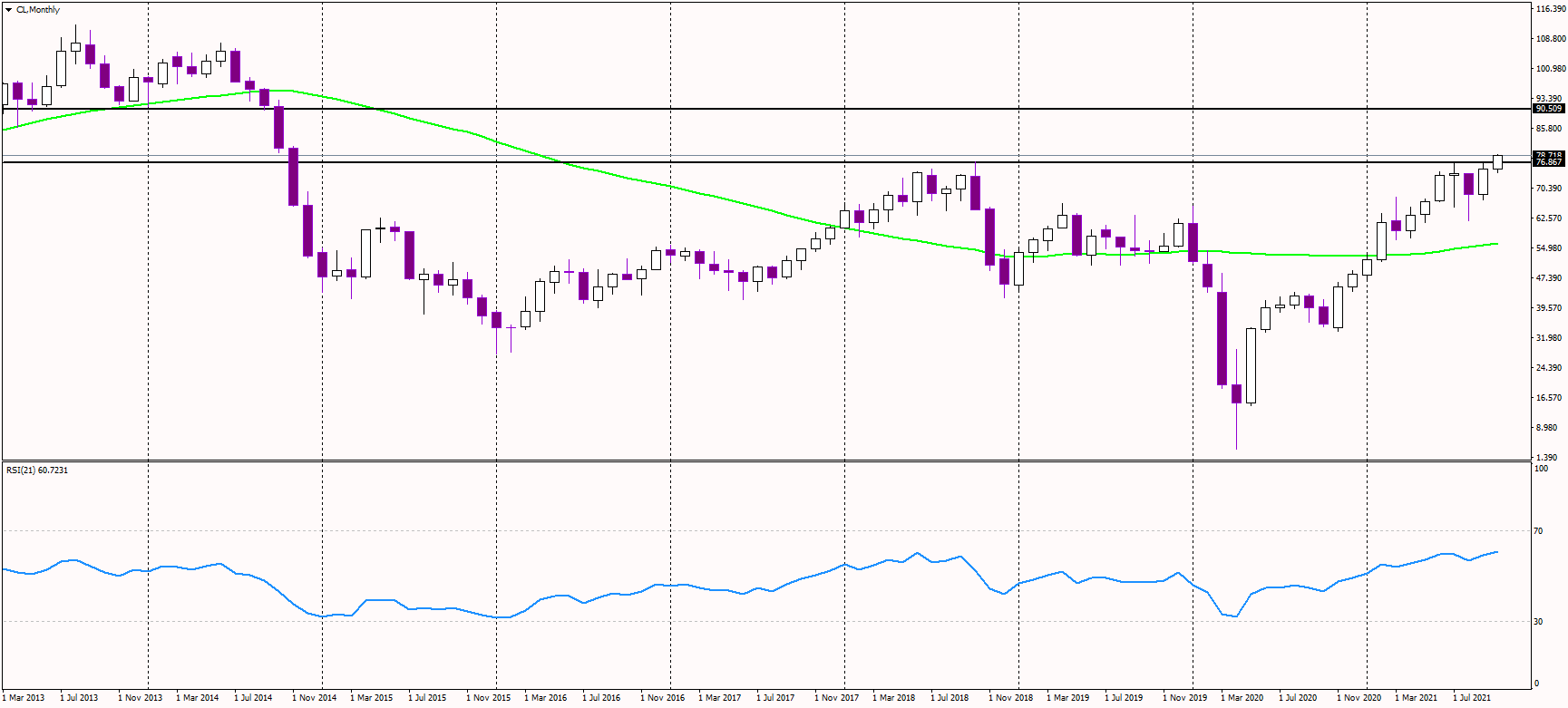

If we look at the monthly chart, we can see that the significant support now stands at 2018 highs, in the 75-77 USD territory. As long as oil trades above it, the outlook seems bullish. Any dips to this area are expected to be bought.

The next target for bulls could probably be in the 90 USD region. However, it is circa 15% higher than the current price. On the way there, the psychological level of 80 USD will pose as a strong selling zone.

Considering that oil has been rising without any more extensive correction, some traders could decide to take profits here, possibly dragging the commodity toward the mentioned 75 - 77 USD zone.

On the other hand, the energy crisis in the EU is not getting any better, and inflation is not getting any lower, support oil prices in their ascend.