Silver was down 1% percent during the US session on Thursday, and it looks like the recent short-term bounce might be over. At the time of writing, it was changing hands near 23.50 USD.

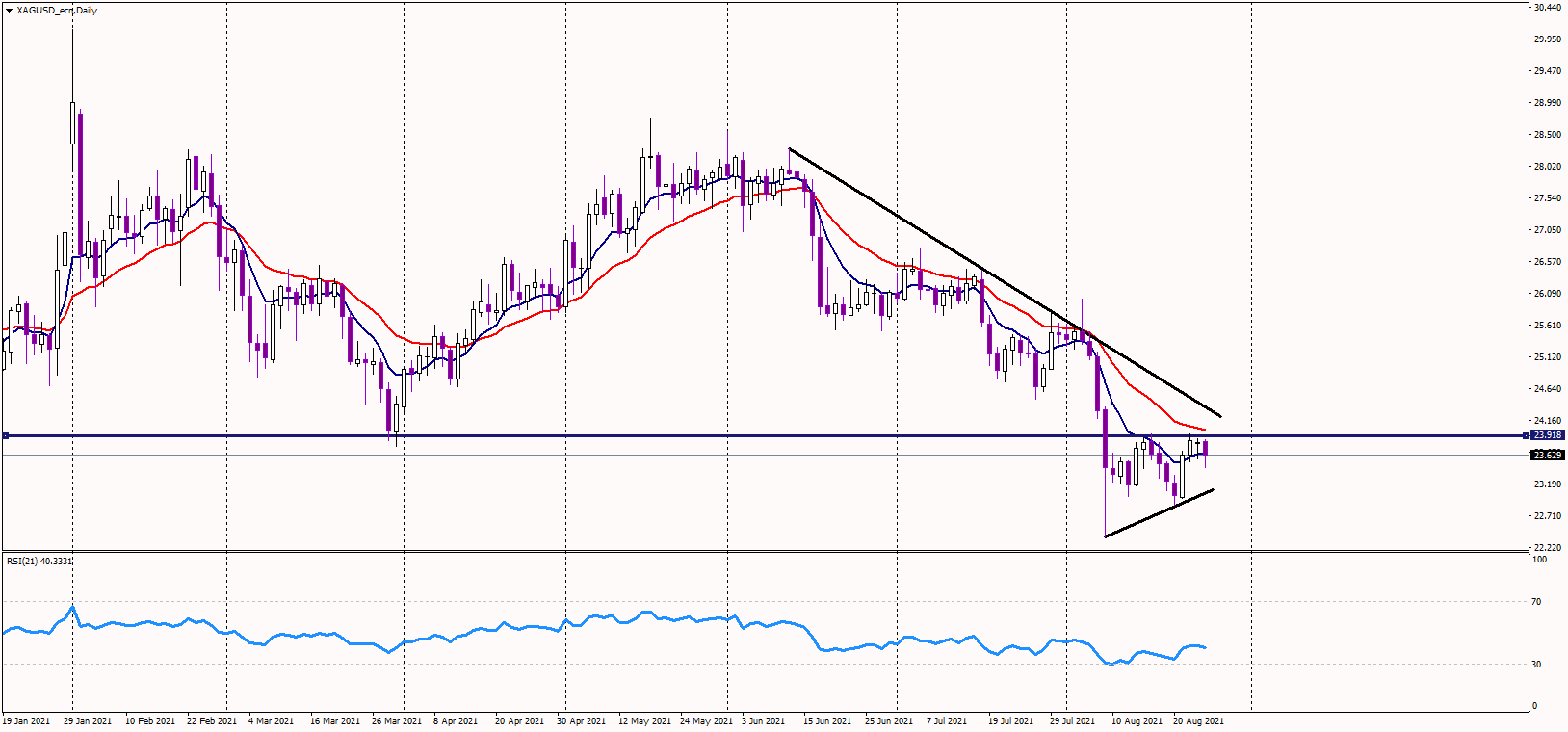

Bulls tried to buy the dip, but the bounce has been weak, and silver failed to push above previous strong support at 24 USD. Additionally, it looks like a short-term double top pattern has been formed there.

The potential of that pattern is circa 1.15 USD, and the support of the formation is at 22.85 USD. Therefore, if the price drops below 22.85 USD, it could go another 1.15 USD lower, targeting the 21.70 USD zone.

The metal is also trading below the medium-term downtrend line, implying bears are in control. However, tomorrow's Jerome Powell's Jackson Hole speech will surely move precious metals, and we might see a bullish surprise, for all we know.

Bears will be defending the mentioned 24 USD zone, and silver must close above it on the daily chart to improve the short-term bias to bullish. However, volatility is expected to be elevated today and tomorrow, so we advise caution when trading.