Silver was down more than 1% on Tuesday as investors took profits after Friday's rally, and it was seen trading around 24.40 USD during the US session.

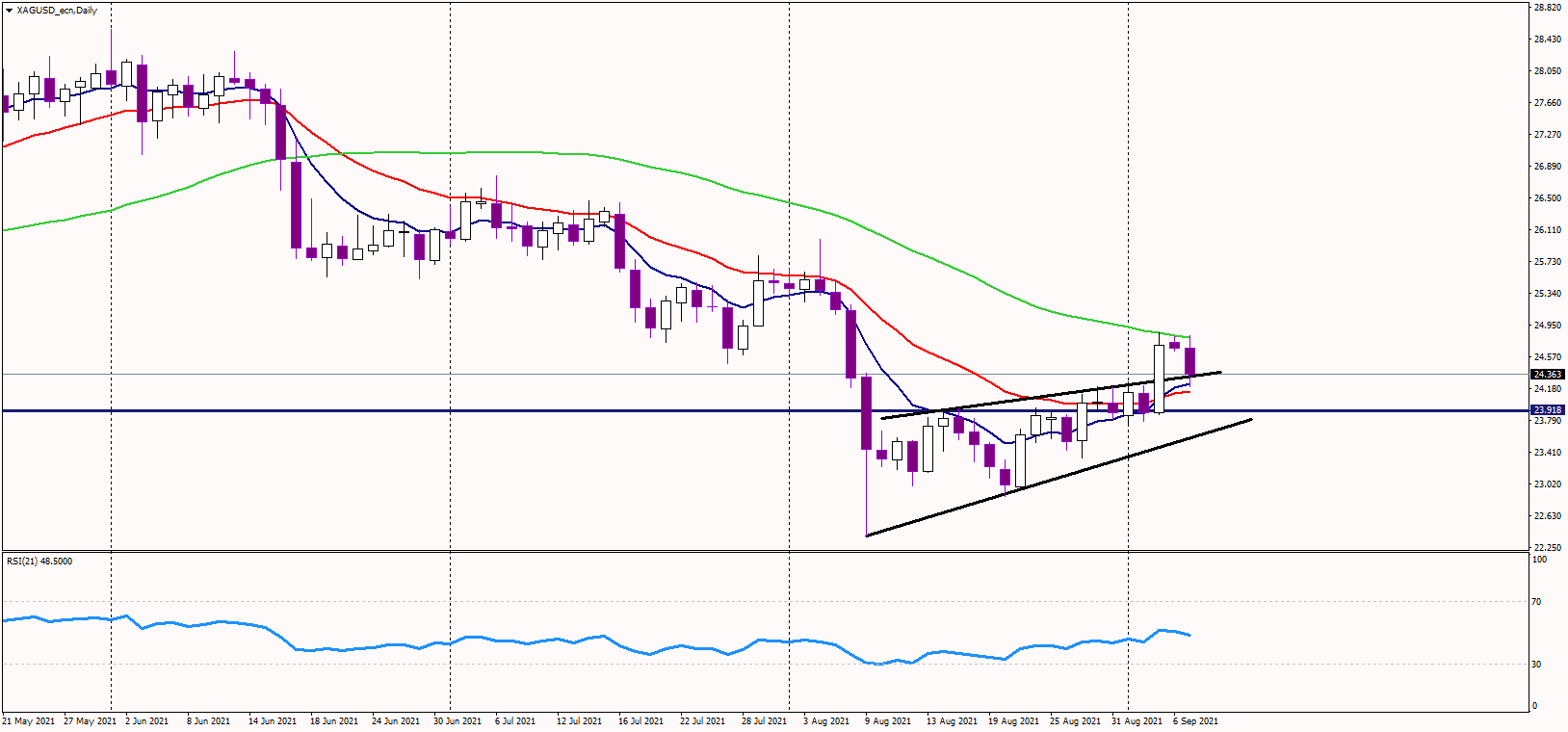

The price is now retesting the upper line of the previous consolidation triangle, which is near 24.35 USD. However, it needs to hold for the short-term outlook to remain bullish. The previous bullish breakout could become a false one if the support is broken, implying a bullish trap.

The next demand zone will most likely be in the 23.90 USD regions, where previous highs are seen. Additionally, the lower line of the triangle now stands at 23.70 USD and could offer some demand as well.

On the other hand, if bulls buy the dip and silver starts rallying again, the major resistance is still located at 24.85 USD, where the 50-day moving average is. Should the price jump above it and close beyond it on a daily basis, the medium-term outlook could change to bullish.

The next target would most likely be in the 25.50 USD region, where summer lows are.

Traders bought the US dollar today, and the EURUSD pair dripped below pre-NFP highs, suggesting the bad data failed to make any meaningful impact on the dollar. Strengthening USD tends to be negative for precious metals.