Best Forex Robots 2020 According to Traders’ Ratings

Here is the list of top Forex robots, currently available on the MetaTrader 4 platform:

- Safe Trend Scalp

- Trend Me, Leave Me

- Cluster Expert Advisor

- The Correct Order

- Fundamental Trader DailyFX

Now, before moving on to the descriptions of each of these Forex robots, we need to address the one question many traders might have at this stage: How can one

find and download the expert advisors mentioned above?

Well, actually the entire process is quite simple. Firstly, traders need to open the terminal. They can do this in 3 ways. Traders can click to ‘view’ bottom on the main menu of the MetaTrader 4 platform and then click on the ‘terminal’. Alternatively, they can click on the ‘terminal’ icon, which is located just below the ‘charts’ at the bottom of the upper left corner of the platform.

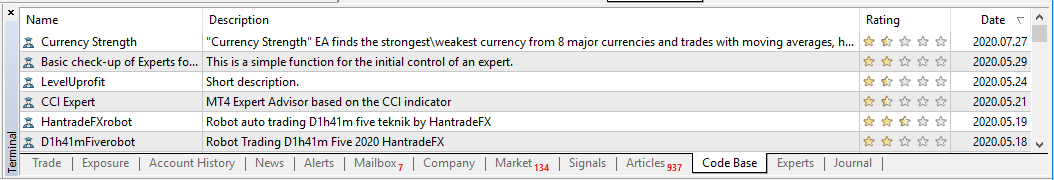

Finally, the easiest way to do this is simply to use the Ctrl+T keys, after which the terminal should open up immediately. Once the trader does one of those three things, the following bar will become visible:

Traders need to click on the ‘code base’ window in order to access dozens of different expert advisors. Here, the market participants can see the name of the program, its description, star rating, and the date of its publication.

In order to do Forex trading robots download, traders should right click on the given expert advisor and then click on the ‘download’ option. Once this process is complete, it should appear on the ‘navigation’ bar under the ‘expert advisors’ and then ‘downloads’ section. So for traders who are looking for Forex robots, free download is available at the ‘code base’ window on the ‘terminal’ bar.

Now that we have discussed the simple process of downloading EAs, let us go through the detailed characteristics of the best EA Forex robot 2020 according to the trader’s ratings.

Safe Trend Scalp

The first item on our list is the expert advisor called the ‘Safe Trend Scalp’. This EA relies on several indicators. Firstly, as the naming suggests, this tool is mostly focused on identifying and following trends. It was first published in January 2020, but already gained some popularity with traders, by receiving a 4 star rating.

Also, by the extensive use of the ZigZag indicator, the program identifies the most important support and resistance levels. After analyzing this data, the robot draws a trend line. Consequently, if the price touches this line, then the expert advisor will either buy or sell the given currency pair, depending on the current market circumstances.

Another interesting thing with this EA is that its official description pages advise traders not to use this tool for real trading accounts, not before testing them on a demo account for at least 4 working weeks.

This means that simply picking a currency pair and running a backtest for a period of 4 weeks might not be enough to get a full picture of the accuracy of the expert advisor. Instead, it tells traders to use this tool for their daily trading for at least 4 weeks and judge its effectiveness according to the results.

Actually, this approach might be quite useful not only with this particular expert advisor, but all other trading robots as well. It can be considered as a necessary precautionary step to ensure that traders choose one of the best Forex trading robot available on the market.

Trend Me, Leave Me

The ‘Trend Me, Leave Me’ is one of the oldest Forex robots currently available on the market. It was introduced back in 2007 and achieved a 5 star rating reviews by the Forex traders.

This expert advisor might be very useful for those types of market participants who do not really like the totally ‘hands-off’ approach to using EAs and instead want to retain some degree of participation in trading.

This expert advisor allows traders to analyze the chart and draw trendlines with a given currency pair. The EA will then execute trades according to those trendlines. The robot also gives the market participants an opportunity to set their own rules for placing stop-loss and take profit orders.

Some traders do shy away from using Forex robots because they do not want to entrust 100% of the decision making power to artificial intelligence. Instead, they want to remain a part of the process. Consequently, this tool helps traders to address this concern.

Here, essentially, traders can start their day by analyzing charts of several currency pairs, and draw a couple of trendlines with those securities where the trend seems obvious. They can also draw the lines for stop-loss and take profit orders. Once they are done with this process, they can go about their daily business and leave the expert advisor to its own devices.

So this EA can be a very handy and attractive tool for many traders. However, one thing to keep in mind is that using this expert advisor does require at least some basic chart reading skills from the market participants. Consequently, it might not be the best option for those beginners who are not yet skilled in this aspect of trading.

Cluster Expert Advisor

The next item on our list is the ‘Cluster expert advisor’. It was designed and published back in 2009 and still has the average 4 star rating from the trader community. So it is one of the Forex robots 2020 traders can still make use of.

The ‘Cluster expert advisor’ can be very attractive for those traders who like using the Forex hedging strategies. The basic methodology of this EA is as follows: It identifies the weakest and strongest currencies from the 8 major ones at any given time. Those 8 major currencies are the US dollar (USD), the Euro (EUR), the British pound (GBP), the Japanese yen (JPY), the Canadian dollar (CAD), the Australian dollar (AUD), the New Zealand dollar (NZD) and the Swiss franc (CHF).

So how does the Forex hedging strategy work with this expert advisor? Well, in order to make it simple to understand, let us take an example. Let us suppose that this EA has analyzed the latest developments in the Forex market and determined that the strongest currency during this period is the British pound (GBP) and the weakest one is the Swiss franc (CHF).

The expert advisor will open two positions; it will buy both GBP/USD and USD/CHF pairs. So essentially, at any point in time, the EA takes one long position with the strongest performing currency and also opens one short position with the weakest one.

So, as we can see here, this allows the market participants to potentially benefit from the latest trends in the Forex market. In addition to that, it does have the element of hedging. This is because, if for example, the strongest performing currency suddenly starts weakening, traders can offset those potential losses by the short position with the weakest currency.

Now it goes without saying that even the best EA forex robot can not guarantee a 100% success rate to any trader. However, this particular expert advisor might be relatively less risky compared to some other options. The fact of the matter is that the chances of the strongest currency dropping sharply and the weakest performing currency rising considerably, is relatively small. Consequently, this EA might be more appealing for risk averse market participants.

The Correct Order

The ‘Correct order’ expert advisor was designed and published back in 2016. During the following years, it gained the confidence of some traders and currently holds the 4 star rating.

This expert advisor makes extensive use of the moving average indicators. In fact, it uses 10, 20, 50, 100, and 200-period simple moving averages in its analysis and the decision-making process. Now the main idea here is that the correct order for the uptrend is that the 10-day simple moving average should be higher than 20-day SMA, which in turn should be higher than 50-day SMA and so on.

The opposite is also true with the downward trend. In this type of environment, the 10-day simple moving average should be lower than 20-day SMA, which in turn should be lower than 50-day SMA and so on.

After the correct order forms with five candles, the artificial intelligence will open the position. At the same time, the expert advisor exits the trade when this correct order is violated.

The official description of the EA also features the strategy tester report. According to this document, the expert advisor tested for approximately a 9-month period during 2008-2009. As a result, the trading capital has risen from the initial deposit of $10,000 to $11,327.99. This represents the 13.33% growth for this period. Consequently, the annualized growth rate might be close to 17.8%.

This can be an attractive rate of return for many traders, especially in times of the near-zero interest rate policies across the world’s major banks. So some traders can consider utilizing this Forex autopilot trading robot to earn some consistent payouts.

However, it might not be the best idea to always take numbers published in the individual strategy tester report at the face value. One thing to keep in mind here is that traders can certainly reduce risks and get more clarity by completing several backtests themselves, before using the given expert advisor in the Forex trading.

The fact of the matter is that the EA might perform quite well with one particular currency pair in a specific period of time. However, this does not guarantee that it will deliver the same results with other currency pairs or with different time periods. Hence the importance of traders conducting their own backtest to verify the usefulness of the given expert advisor.

Fundamental Trader DailyFX

One of the major downsides of the majority of expert advisors is the fact that they are entirely based on one or several technical indicators, however, they typically do not take the fundamental variables into account. The ‘Fundamental trader DailyFX’ was created to address this major imperfection of even some of the top Forex robots.

It was created way back in 2008 and considering its maintained 5 star rating for so long, it can be the best Forex robot 2020 for fundamental trading, according to the trader reviews. Besides the very positive Forex robot review, this EA has additional advantages. It is connected to the economic calendar and actually makes trading decisions based on the latest news releases.

The basic principle behind this expert advisor is as follows: artificial intelligence makes the comparison between the actual number from the economic announcement, to the analyst forecast, as well as the previous release. If the latest releases show much better economic results than the forecast and previous numbers, then the artificial intelligence executes large sized traders in favor of the currency in question. On the other hand, if the difference is small, then it opens up relatively smaller sized positions.

The opposite is also true. If the latest economic release is far worse than the analyst’s expectations and previous release, then the expert advisor opens the large short position for the currency in question. However, if the latest numbers only slightly miss the expectations and previous reports, then artificial intelligence will decide to open a small sized position.

Another interesting feature of this expert advisor is the fact that its risk/reward ratio is automatically set at 1:3. This means that if the EA is risking 10 pips, then it expects to gain 30 pips.

It goes without saying that this can improve the odds in favor of the trader. In fact, in this case, the market participant can still end up with an overall gain if he or she just has 26% of the winning trades. For those traders who want to utilize this Forex robot, the free download option is available on the MetaTrader 4 platforms. Once installed, it does not require any additional software to run successfully since it imports the latest data from the Forex economic calendar automatically.

Despite the obvious strengths and benefits of this expert advisor, it does have some imperfections. The fact of the matter is that this software entirely relies on the predictability of the market reaction on the fundamental news releases. Now, this might work in some cases, but any experienced trader can notice that sometimes the price reaction to some announcements can be highly unpredictable.

Just to bring one example, there were several cases where it was widely expected that the European Central Bank (ECB), the US Federal Reserve, or some other major central bank would cut its key interest rate. The obvious conclusion here was that the currency in question should have depreciated substantially against other major currencies.

The main reason for this is the fact that when the given central bank cuts rates, the savers and investors earn lower returns on the savings accounts, the money market accounts, from the certificates of deposit (CDs) or other fixed income instruments. At the same time, the Forex traders earn lower returns from carry trades. Consequently, when the policymakers reduce their rates, it tends to make their currency much less attractive for investors and traders. This leads to the depreciation of the currency.

However, in many cases when the actual rate cut announcement came out, the currency in question stayed flat or even made some notable gains instead of falling further. So how can we explain this? Well, it can be that the actual rate cut was already priced in by the market before the announcement came out.

Yet, guessing whether or not the actual economic release is priced in the exchange rate can indeed be a very difficult task. Even some of the most experienced professional traders have a hard time making accurate distinctions, so it is not surprising that artificial intelligence might fail at this task as well, from time to time.

Alternative Option

Before moving on to the concluding remarks, it is important to recognize that there are still some traders who do the Forex robots download and find them quite useful. However, they might not feel comfortable with giving artificial intelligence all of the decision-making power.

One solution with this concern is to only activate the signals and do not check the box which allows live trading to robots. Consequently, the Forex robot will only give traders the trading signals and let them have a final word on the execution of future trades. In this case, the market participants will get an alert such as this:

As we can see from the above image, the alert will specify the exact time of detecting the signal, the trading recommendation, buy or sell, the currency pair, and the timeframe of

the chart. So in this case, the traders will receive an alert, take a look at these details, and then can decide whether or not to open the recommended position.