Forex Robots Explained

At this point, some people might be wondering why some traders are using Forex trading robots instead of making decisions themselves. Well, the fact of the matter is that using free Forex robots that work can bring certain benefits to traders, such as:

- Forex trading robots can execute a higher number of trades than it might be possible by humans. This can potentially increase the size of one’s earnings.

- Using Forex robots allows traders to take a disciplined and consistent approach to trading, which in turn can raise the chances of improving one’s long term trading performance.

- Forex robots can be helpful for those individuals who struggle with controlling their emotions during trading. This tool allows those traders to take emotions out of the decision-making process and potentially avoid making many mistakes.

- By using this tool, traders do not have to constantly keep an eye on the risk and money management rules. Instead, artificial intelligence takes care of those.

- When using Forex robots, traders do not have to spend so much time on technical analysis. Therefore, they can use this spare time for other activities in their lives.

So as we can see from the above list, the use of artificial intelligence in trading can be beneficial for traders. However, it goes without saying that this is only the case if the given

expert advisor or another type of trading robot is successful in trading. Consequently, it is not surprising that many traders still wonder whether there is a Forex robot that works, which is something we will discuss in greater detail below.

Are Forex Robots Profitable?

The advantages listed above seems quite helpful for traders, however, the reality of the matter is that none of them will be true if the given artificial intelligence fails to produce positive results. So the obvious question here is: do Forex trading robots really work?

Well, the simplest way to answer this question is to simply run some tests. Traders can do backtesting by going to the ‘view’ bottom of the main menu in the MetaTrader 4 platform and select the ‘strategy tester’ option. Alternatively, traders can use the Ctrl+R key which will give the same result.

This in turn will open up the ‘tester’ bar, where traders can identify the individual expert advisor they wish to test, as well as such important items as currency pair, model, period and spreads. After filling out all of these details, the trader can click on the ‘start’ button and the backtesting will begin.

So in this case, let us run the test for the ‘moving average’ expert advisor. This is actually one of two EAs that traders get when they download MetaTrader 4 platform. As the name suggests, this represents the simple expert advisor, which makes trading decisions based on the moving averages of individual currency pairs.

For the experiment, we will use the GBP/USD pair with a 1-hour chart. The testing period will cover 3 months, which can be sufficient to get some idea about the relative effectiveness of the given EA. After finishing with the backtesting, the computer has displayed the following results:

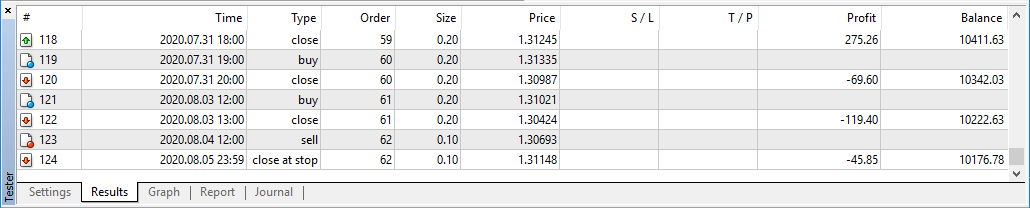

So as we can see from the above image, the expert advisor has executed 62 trades during this period, opening or closing positions 124 times in total. The size of each position was 0.1 to 0.2 standard lots. The original balance of the trading account was $10,000. By the end of the testing period, the trading capital stands at $10,176.78.

This means that overall, the expert advisor did manage to make some gains during this period. In fact, this represented a 1.77% rise in one’s trading capital. So if the expert advisor manages to maintain the same pace for the rest of 3 quarters of the year, then the annual return for the trading account will be approximately 7.1%.

Now, this might not be that impressive for some traders, who are looking to earn higher returns. However, it does show the fact that in some cases, the Forex robots can trade successfully over extended periods of time.

One important thing to note here is that traders can actually access more details about their backtesting results by clicking the ‘report’ window at the lower part of the ‘tester’ section. This page for our GBP/USD pair experiment looks like this:

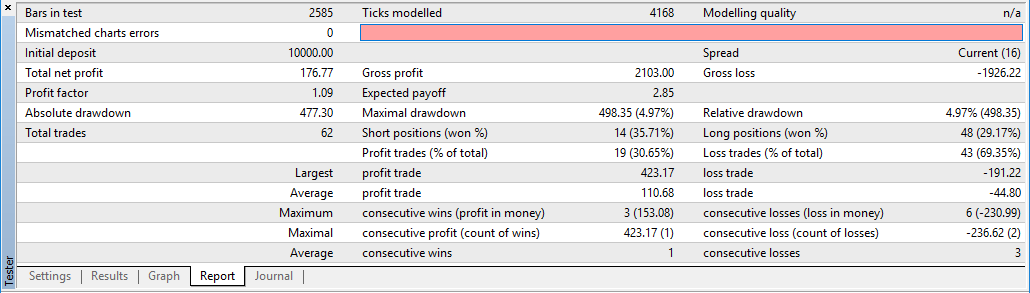

As we can see from here, the ‘report’ window displays several measurements. Here, traders can see the total number of bars in the test, the initial deposit, and total net earnings, which in our case equals $176.77, as well as the total number of trades, which is 62 in our example.

At the center and right side of the bar, traders can see items such as gross gains and losses, percentage of winning and losing trades. Actually, when it comes to the last subject here, we have an interesting scenario. Here we can see the overall percentage of winning trades is 30.65%, while the losing trades are at 69.35%. This means that more than 2/3 of executed trades ended up with a loss.

It seems that the artificial intelligence here has used very sound money management principles and decent risk/reward ratio, otherwise the expert advisor most likely would have ended up with a sizable net loss.

This section also shows the largest and average size of winnings and losses. Finally, the report also displays information about the largest consecutive wins and losses for the trader during this period. So as we can see here, the ‘report’ section might be quite informative.

Risks of Using Forex Robots

So far we have seen that there are indeed Forex robots that really work under certain conditions. However, this does not imply that the traders will always succeed by using this tool. In fact, there can be cases when a given Forex robot might earn some decent payouts with one currency pair or period and suffer some losses with another.

Returning to our previous example of the moving average expert advisor, let us now run the same test on a 1-hour chart. However, this time, instead of GBP/USD, let us use the EUR/USD pair. After running this backtest, the computer has displayed the following results:

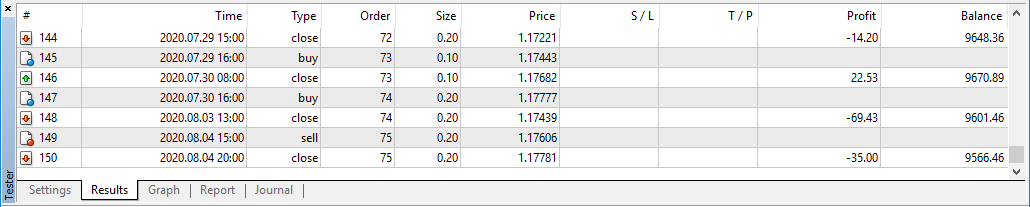

As we can see from the above screenshot, this time, artificial intelligence has performed quite poorly. The overall trading balance was reduced to $9,566.46, which represents more than 4.43% loss. We can also notice that with some trades, the expert advisor has lost more than $69, which is 0.69% of the trading capital.

So as we can observe from this example, we have the case of the free Forex robot that works under certain conditions, but it also suffers considerable losses with some currency pairs during specific periods of time.

Therefore, it goes without saying that using Forex trading robots does have certain risks. One of the reasons for their occasional failure is that all of the expert advisors are based on specific economic indicators.

Obviously, there are many people working to improve the latest versions of Forex robots. However, the fact of the matter is that nobody can design the expert advisor, which can take all of the technical and fundamental indicators simultaneously into account. There are simply too many technical patterns and economic variables to include in one single trading robot.

However, there are some trading robots which can perform quite well in the majority of cases. In order to identify those, traders can take several steps. Firstly, it is always a good idea to take a look at the Forex robots review, which includes the star rating given to them by the ordinary traders and even the opinions of some market participants.

By going through the Forex robot trading reviews, traders can identify those trading robots which possibly earned at least a certain degree of confidence from other market participants.

As we have discussed before, it is also helpful to test the given expert advisor with several currency pairs and different timeframes. Here traders can choose those EAs which had the best overall performance.

However, the minimum requirement for an expert advisor is that it should be able to produce net gains consistently. If the EA is showing a net loss on a regular basis, then it might not be useful for trading. In fact, in some cases, a trader might have better luck by

making decisions by a coin toss, rather than by relying on such an expert advisor.

Finally, traders also have an option to test some of the best performing EAs on the trading account. By activating automatic trading, artificial intelligence will be able to open and close positions on their own. This gives traders an opportunity to measure the performance of the EA under the live trading conditions.