MT4 vs MT5 vs cTrader - overview

When starting out trading, one of the most important decisions you need to make is to select the trading platform correctly. Your trading platform should suit your trading needs. For instance, if you are an algorithmic trader, your platform needs to have extensive capabilities for creating and adding trading robots, you require access to various trading algorithms that are developed in the market, etc. Technical traders require platforms that have a vast collection of tools for analyzing the markets and are user-friendly at the same time. Fundamental traders are less picky about technical tools, however, ideally they want integrated economic calendars. What's more, there are platforms that are limited to offering certain types of asset classes only. Let's take a look at the most popular trading software today: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. All three of them have their strengths and weaknesses.

A brief backstory behind these programs

Before we jump into the comparison of these programs, let’s see how they were created and what the idea behind creating them was.

- MetaTrader is a trading software developed by a company called MetaQuotes. The company released MT4 in 2005, and it brought a significant change in trading. It replaced the existing MetaTrader programs, improved stability of the server, etc. MetaTrader 4 for beginners remains one of the best trading software programs due to its simplicity. The platform may look outdated, but its reliability is unchallenged, which can explain the platform's popularity.

- Five years later, in 2010, MetaQuotes released MetaTrader - MT5. While the design was pretty much the same, the new version introduced new additions to the software: the ability to trade more instruments such as stocks and commodities, the new programming language, and more;

- cTrader, was released in 2011 by Spotware Systems LTD. Like MT5, cTrader also included different securities and had more tools available. However, you cannot trade stocks or stocks as CFDs using this platform. Unlike MetaTrader programs, cTrader had a different, more modern and comfy design. In addition, the software uses a common C# programming language for trading automation. It's worth mentioning that the cTrader platform is going through updates and a team of professionals are trying to improve it regularly, while MetaTrader platforms haven't changed much since their creation.

It's worth mentioning that when traders are planning on trading different asset classes, MT5 alternatives are limited. MT5 is a great multi-asset platform. MT4 is a super reliable, popular Forex platform and cTrader is highly user-friendly with modern features and excellent execution.

Design differences

Since MT4 and MT5 were released by the same company, they have pretty much the same design.

The interface difference between MT4 and MT5 is pretty much non-existent and has more of a Windows 98 look to it with blank white and light gray windows. Even the layout of charts, market watch, and other elements have the same position in the programs. The majority of the screen accommodates four live charts for the most popular Forex pairs, while the various tools and indicators are placed on the left and the bottom part of the screen.

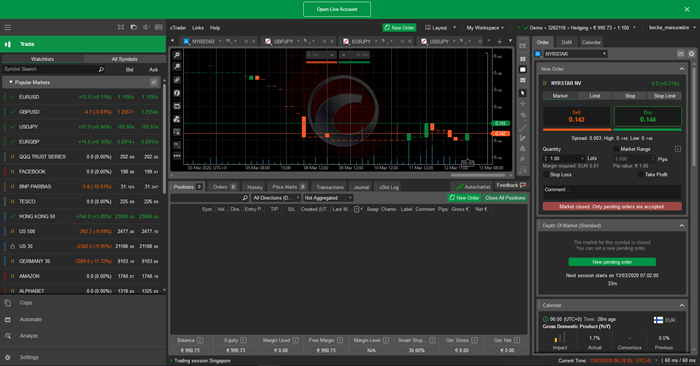

cTrader vs MetaTrader offers a more modern-looking interface. One of the main advantages of this program is the ability to change the theme of the interface: there are both light and dark themes available. Both looks are slick and user-friendly. Novice traders love using cTrader as it offers intuitive design.

Comparing MT4 to cTrader, or even MT5, the chart layout is a bit different: in cTrader, there is only one chart – now supporting four charts – which is located in the center of the interface. This way, the trading instruments on the left, as well as the position details (or other selectable components) at the bottom, have a much bigger space than in MT4 or 5.

Programming languages – MQL4, MQL5, C#

As we have already mentioned, MT4, MT5, and cTrader use different programming languages: MT4 uses MQL4 (MetaQuotes Language 4), MT5 uses MQL5, and cTrader uses C#.

Even though the MetaTrader software programs were developed by the same company and have the same design, their programming languages are still very different from each other.

While there are many complicated terms that explain the difference between the two languages, the main difference between them is that MQL5 is more efficient to use and traders themselves can create, as well as change, the scripts. Not only that, the programs developed for MT4 cannot function on MT5. Which is a big disadvantage of the latter one because there are a lot more programs for MT4 – traders and brokers have been using this program for almost 15 years.

Now, unlike MetaTrader programs that use their own specific language, cTrader is based on a commonly-used C# language. Because of its popularity, programmers from all backgrounds – and not just those who specialize in trading – can create new tools, scripts, and features for this program. Therefore, there are more possibilities for cTrader than MT4 or MT5.

New platform features of MT4, MT5 and cTrader

Trading platforms undergo frequent updates, introducing new features and resolving issues to stay abreast of the ever-changing landscape. Let's delve into a detailed discussion of these ongoing transformations.

MetaTrader 4 (MT4)

In the 2023 latest upgrade, MetaTrader 4 introduced significant enhancements: The changes are made on MetaMarket security, and the platform’s interface.

Market security improved: to operate the product, users and now required to be authorized on the platform using the same MQL5 account through which the product was purchased. The account must be specified under the tools/Options/Community section. Failure to specify a valid account will prevent the product from starting.

Improved user interface translations: The user interface translations have been updated to ensure a more seamless and user-friendly experience.

The platform stability has improved in 2023 updates.

MetaTrader 5 (MT5)

MT5 had major design improvements in 2023 for trading reports. The added display of monthly funds growth can be accessed in new trading reports. To view the report go to Summary report and click on the Balance mode.

In addition, deposit and withdrawal pages got improved. And optimized recalculations of financial operations throughout the entire platform, including strategy tester. As a result, profit, margins, and many other platforms are now calculated faster.

Moreover, the web terminal also got various improvements. In 2023, developers added a section “Contact Broker” that traders can use to directly communicate with the customer support.

Traders now can use the platforms to deposit and withdraw funds directly from their trading platforms.

cTrader

cTrader experiences more frequent upgrades than MetaTrader platforms. The latest build introduced Overlay Indicators, Integrated IDEs for Algo Developers, and Backtesting and Market Replay Reports. Thanks to the upgrades, traders have the flexibility to determine the placement of indicators within the trading window. Furthermore, different indicators can be combined.

Another important upgrade is Markey Replay Reports and Backtesting Export capabilities. Traders now have the capability to seamlessly export, open and share their backtesting or market replay reports with fellow traders.

Furthermore, for enhanced PC RAM optimization, you have the option to run cBots in a distinct external process, separately from the cTrader desktop app. Simply right-click on a cBit and select “Start in external process”. As a result, you can close the cTrader app while your cBot seamlessly operates independently. Additionally, running a cBot in an external process is achievable via the CLI without the necessity of launching the cTrader Desktop, providing a teamlined and resource-efficient alternative.

Trading with MT4/MT5/cTrader tutorial

Now that we have reviewed the basic features like design and the foundation of these trading programs, let’s turn our attention to how they compare to one another in the actual trading. We’ll take a look at the

chart types and available time frames, trading instruments, and automatic trading features.

Chart types and timeframes

Charts are among the most important features of any trading software, as they represent the historical data of price movements and enable traders to conduct technical analysis. For that reason, a large space of the interface in MetaTrader and cTrader programs is allocated for this feature.

In MT4 and MT5, as we already mentioned, we have four individual charts for different assets, but traders can also maximize one chart if they want to. As for the charting types, both programs support line, bar, and candlestick charts. Changing one chart type to another is also similar: traders can either right-click the actual chart and choose the preferred type, or go to the chart menu in the top-right corner and do the same.

When it comes to the timeframes, the difference between MetaTrader 4 vs 5 becomes more apparent. MT4 has 9 timeframes: 4 minute-frames, 2 hour-frames, daily, weekly, and monthly frames. Meanwhile, MT5 offers 12 timeframes more – 21 in total: 11 minute-frames, 7 hour-frames, daily, weekly, and monthly frames.

Then there's a cTrader that only shows one chart in the middle of the screen. Unlike its counterparts, cTrader features three previous and one additional chart type – dots chart. Like MT software, however, a right-click on the mouse can change the chart types pretty easily. As for the timeframes, cTrader offers 26 timeframes: 14 minute-frames, 7 hour-frames, 3 day-frames, weekly, and monthly frames.

When comparing MT5 vs cTrader in terms of simplicity, beginner traders will find cTrader more comfortable. cTrader enables traders to easily calculate trade sizes and use various trading orders.

Available trading instruments

When comparing MetaTrader 5 vs cTrader in terms of trading instruments, it's worth mentioning that MT5 was created for trading various asset classes, while cTrader is mainly for trading forex. Some cTrader brokers even offer CFDs on some cryptos, indices, and commodities.

Originally, when MT4 was created, it was dedicated to Forex trading. And still, in modern times, the platform remains highly dedicated to trading Forex pairs. As for other instruments, the number is not as great as in the case of MT5 and cTrader, however, traders can easily download the desired trading robot or indicator from MetaTrader marketplace.

In MT5, the limitation is still present, but it allows for more instruments than its predecessor. This way, traders can use even more stocks, futures, commodities for their new orders. In both MT4 and MT5, traders can select new instruments in the Market Watch window on the left side of the screen. In MT4, one has to double-click the mouse in the blank space, while MT5 has a dedicated Plus button for it.

When comparing cTrader vs MT4 or MT5, the former allows a more straightforward method of selecting new instruments: on the left side of the screen, there is a Trade window with Watch list and All Symbols sub-menus. In the All Symbols Sub-menu, traders can see the Popular Markets category, as well as 10 individual asset categories, including Metals, Energies, Forex, and more.

Automatic trading

The next important feature in our discussion is automatic trading. In MetaTrader applications, both MT4 and MT5, traders use

Expert Advisors – manually coded programs – for various automated tasks, including technical analysis of price data and, of course, opening/closing positions on given instruments.

If we compare MT4 to MT5, the main difference between their Expert Advisors would still come down to the programming language they use. Since MQL4 has been around for longer than MQL5, there are more pre-written scripts and codes that traders can use for creating their personal Expert advisors, even if they don’t have knowledge in programming. However, MQL5 is a simpler programming language and therefore, creating new scripts themselves is easier with it.

As for cTrader, it also offers similar programs to the Expert Advisors – they are called the cBots. As we have mentioned earlier, cTrader uses a well-known C# programming language which, in theory, means that out of all three languages – MQL4, MQL5, and C# – it is the most universal one with a large consumer base.

However, in reality, cBots are less popular than Expert Advisors (EAs) and here’s why: the online trading community behind EAs is larger than that of cBots which translates into more pre-existing templates for MT4/MT5 vs cTrader.