The Center of Gravity indicator newbie guide

When trading Forex, stocks, or other securities, locating support and resistance areas is one of the main objectives. Support and resistance points and areas work as price stoppers. When price reaches a significant level, it either retraces back or breaks the level, and the probability of price making sharp moves in the breakaway direction increases. When trading levels, traders get an amazing risk to reward ratios as Stop Loss orders are usually placed behind significant levels. Prices move from levels to levels like a pinball. To make money trading, the universal rule is to buy low and sell high (Or vice versa in the case of CFDs). Support and resistance levels help traders buy from low points, place the smallest Stop Loss possible, and give ideas about where to insert Take Profit targets.

In Forex, as well as other

trading markets, a price is always moving up and down. Security prices do not move in straight lines. The movements are often chaotic and traders need an environment where they can make logical predictions. The Forex trading Center Of Gravity indicator is very useful in this regard, as it helps increase the sense of clarity. These are some major benefits of using COG:

- It’s a leading indicator

- It’s comprehensive

- It’s freely available

- Works best in ranging markets

The Center of Gravity indicator, also known as the COD indicator in short, is a useful feature that enables traders to look into the concurrent price fluctuations and try to predict the upcoming ones. Developed by John Ehlers, the COD indicator is one of the more recent technical indicators in the field.

According to the main function of the Center of Gravity indicator explained by John Ehlers himself, traders who use it will be able to closely speculate the upcoming price change of the asset. Ehlers noted that not only is the COG a leading indicator, but it also has virtually no lag, which helps COG produce signals with no delay.

The difference between leading and lagging indicators

What we are interested in is the difference between leading and lagging indicators. As already mentioned earlier, the COG is a leading indicator, meaning it can help traders make some predictions about future price movements. Usually, COG indicators are plotted as oscillators in the chart, which means the indicator moves within a certain scale in order to give a buy or sell signal.

Unlike leading indicators, lagging indicators only assess the price movements that have already occurred. Therefore, traders use them in order to confirm a certain trend, which is also a very important factor in trading. Lagging indicators help improve market visualization and make chart information more easily digestible.

How to use Center of Gravity indicator in real life?

Now that we have the COG indicator explained, let’s say what it actually does. To put it shortly, this indicator measures the support and resistance levels in price movements. As for the support and resistance levels themselves, here’s what they mean:

- Support occurs when the downtrend starts to slow down and even pause. That’s because traders tend to have a high demand for an asset when its price is very low, therefore generating a support level at the lowest point of a downtrend.

- Resistance occurs when the uptrend starts to pause or slow down. As the price has reached its peak, many traders want to start selling their assets, thus forming a resistance level to the uptrend.

By using the COG indicator, traders can identify those support and resistance levels and have a more or less clear idea when the price starts moving in a different direction. In order to do so, the platform, whether it is MT4, cTrader, or anything else, uses a complex Center of Gravity indicator formula that finally plots a COG line in the chart. Alongside it, the indicator also uses a simple moving average line that is called a signal line or a COG Trigger.

By looking at the way these two lines intersect each other, traders can get the idea of when the buyers’ or sellers’ interests are strengthening. For example, when the COG line crosses above the signal line, it means that the actual price has received support and started on an upward trend. Therefore, it may be a good idea to buy an asset.

Conversely, if the COG line crosses below the signal line, it means that the asset price has met resistance and started declining. Therefore, selling an asset could be a good idea. One thing to keep in mind when using these COD indicator settings is that it works only if the market has no defined trend and the support and resistance levels interchange between each other. That’s because, during a trend, the price will likely continue in the same direction for a while, whereas the COD indicator is applied to quickly change prices.

Center of Gravity indicator download and install on your platform

When downloading

MetaTrader trading software, it usually doesn’t come with the pre-installed Center of Gravity indicator. That’s why traders need to find a certain version of the COG on the internet and install it on the platform. A quick disclaimer: the internet is full of both Forex Center of Gravity indicator MT4 and the Center of Gravity indicator MT5 installation files.

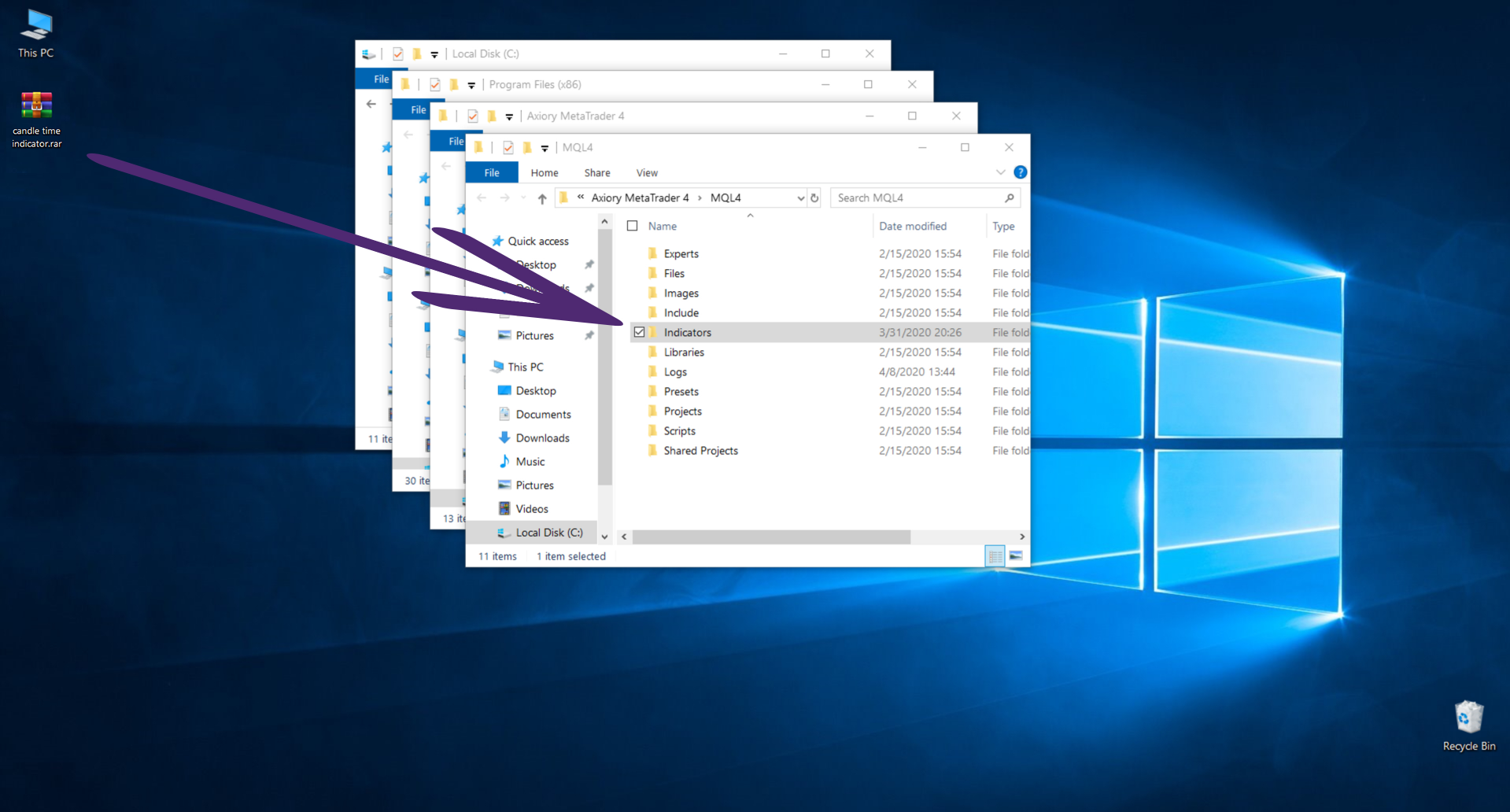

When you find a specific version of the free Center of Gravity indicator that you are happy with, you need to download the file on your computer. If the file is in the archive, you first need to extract it and then go ahead and paste it in the appropriate folder, which is located in the original installation partition. In the MetaTrader 4/5 folder, you will find the MQL4/5; after you open it, you’ll find another folder called Indicators. That’s where you need to copy the COG indicator file.

After the installation is complete, you will have to restart your trading platform. And that’s it: you will find your new Center of Gravity indicator in the Navigation panel under the Indicators list.