What is donchian channel?

As already mentioned, the primary purpose of the donchian channel is to help us see through the volatility. For example, when we look at a regular chart, it may get a bit hectic with all of the green and red candlesticks. With this indicator enabled we are able to see where an instrument has reached its maximum potential, and how long it took for that maximum potential to be bested.

For example. Let’s say that the USD/JPY exchange rate reached its maximum potential at 100, but then started to fall in the coming days. The donchian channel would help us see this failure to overcome a

resistance level with a flat line. But this wouldn’t be a donchian channel indicator tutorial if we didn’t visualize the tool.

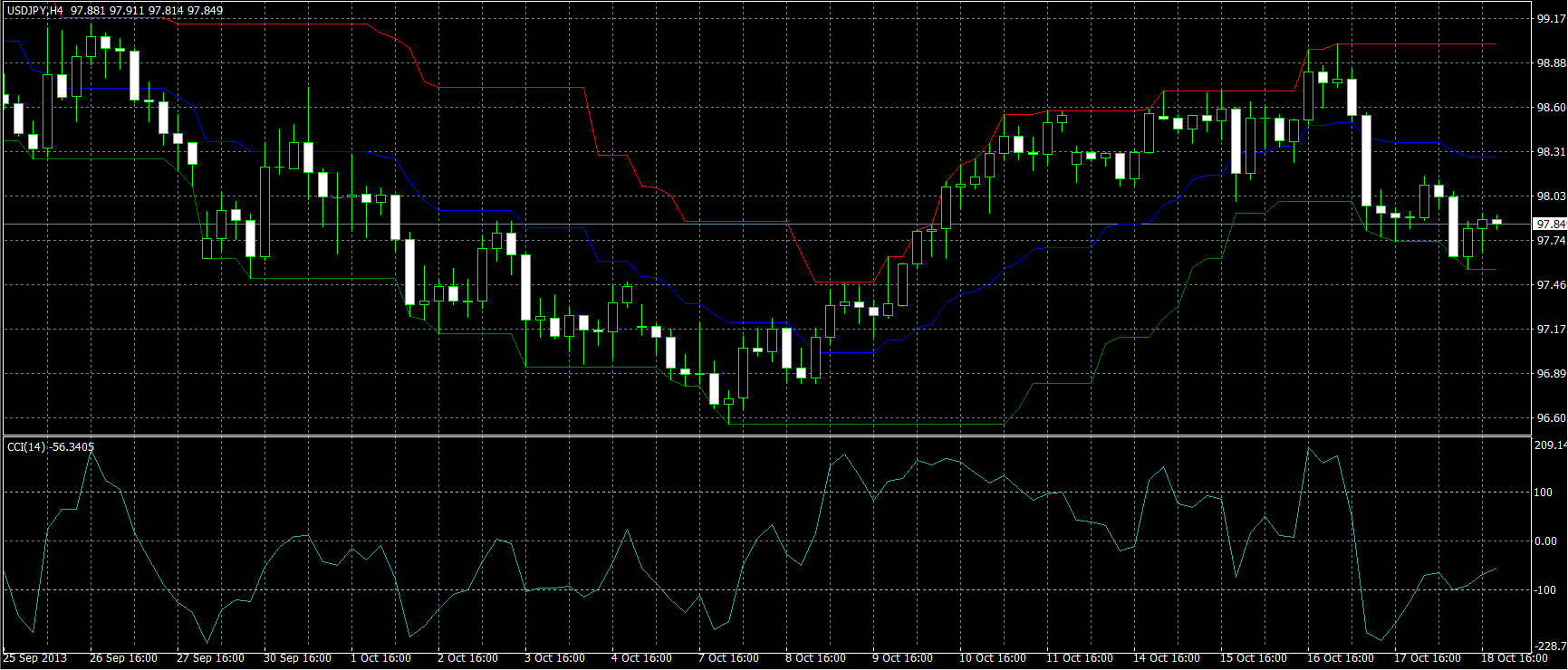

As you can see from the chart there are three lines that you can follow. In our guide, we need to focus only on red and green. First, let’s focus on the red. The timeframe chosen for this specific chart was H4 so it helps us see the comparison of each highest mark in the 4-hour segments.

As you can see it starts off strong, but slowly declines and grows again. The red line helps us see when there was no challenge to the previous segment’s “high point” by displaying a flat line while everything else is pretty easy to understand.

The donchian channel Forex indicator helps us look through the volatility of the FX market and see a much bigger picture, but that’s only from the top line. The top line shows the potential growth for the asset. Let’s focus on the lower green line which shows us the actual growth.

The main difference here is that the green line shows the lowest points of each 4-hour segment. This helps us see the actual growth of the instrument that it had from point A to point B. In this chart’s case, there is no growth, there’s a loss.

By taking all of these 3 lines that we see on the chart, the top, the low and the middle traders can judge where it’s best to place their pivot points or where their next TP or SL points would be.

The most important things the donchian channel highlights:

- The real growth of a financial instrument

- The volatility of the asset

- Highest and lowest points in a timeframe to avoid

How to use donchian channel indicator

The donchian indicator may look quite easy to use, and it is most definitely the case with experienced traders. But when it comes to beginners it may be a bit hard to use it effectively.

There are numerous mistakes that have been observed with the donchian indicator that beginners tend to make, so let’s make a list where they are all explained and highlighted. This will help you avoid them as well as see the donchian channel as something much more than previously described.

Mistake 1: not using other tools with the donchian channel

The first mistake is not something only donchian users make unfortunately, it’s present with other tool users as well. The real answer to the question “how to use the donchian indicator” is that you need to pair it up with other tools as well.

Once the indicator highlights the market performance for you, it is time to add in other information such as the volume indicators and pivot points. Pairing up these tools will most definitely assist in making the most educated guess.

Mistake 2: Choosing small timeframes

Another mistake that we see beginners make is going for smaller timeframes. This strategy is completely fine on its own, but when combined with the donchian channel, it may get a bit tricky. You see, the most optimal way that has been tested for trading the donchian channel is going for longer timeframes simply because you get to see the actual growth much better. Smaller timeframes only show potential growth, which can be deceiving when trying to place the most accurate guess.

Mistake 3: Trusting donchian too much

The donchian channel is not something that takes data, calculates it and gives you some kind of analysis. It’s a completely visual tool that helps you better understand the market rather than having the tool understand the market for you.

Because of this, it may not be the best idea to trust donchian too much. If it shows that there is potential for the growth to be 10 times what it is now, it may not necessarily be the case.