How to use the Pivot Points indicator

There are several steps that need to be taken when using Pivot Points for your trading strategy. This is mostly broken down into 4 steps on the most basic level, but advanced levels can have sometimes a dozen steps of preparation before you can even think of placing a trade. Let’s focus on the basic one for now.

- Finding the Pivot Point (with external or internal software)

- Highlighting resistance and support levels

- Placing TP and SL points

- Analyzing market sentiment

Let’s go through each of these steps.

Finding the Pivot Point

The essence of how to trade Pivot Points is in the skill of finding them first. In most cases, traders use external software that they download and

install on their MT4 platforms. This software does the calculations for the trader and determines not only the Pivot Point but also the resistance and support levels.

There are ways to do this manually, such as calculating the average for exchange rates on the closing hours of markets in the previous days, but considering that the FX market doesn’t stop until Friday midnight, this may be a bit difficult. Generally, automating the process is much easier.

Highlighting resistance and support levels

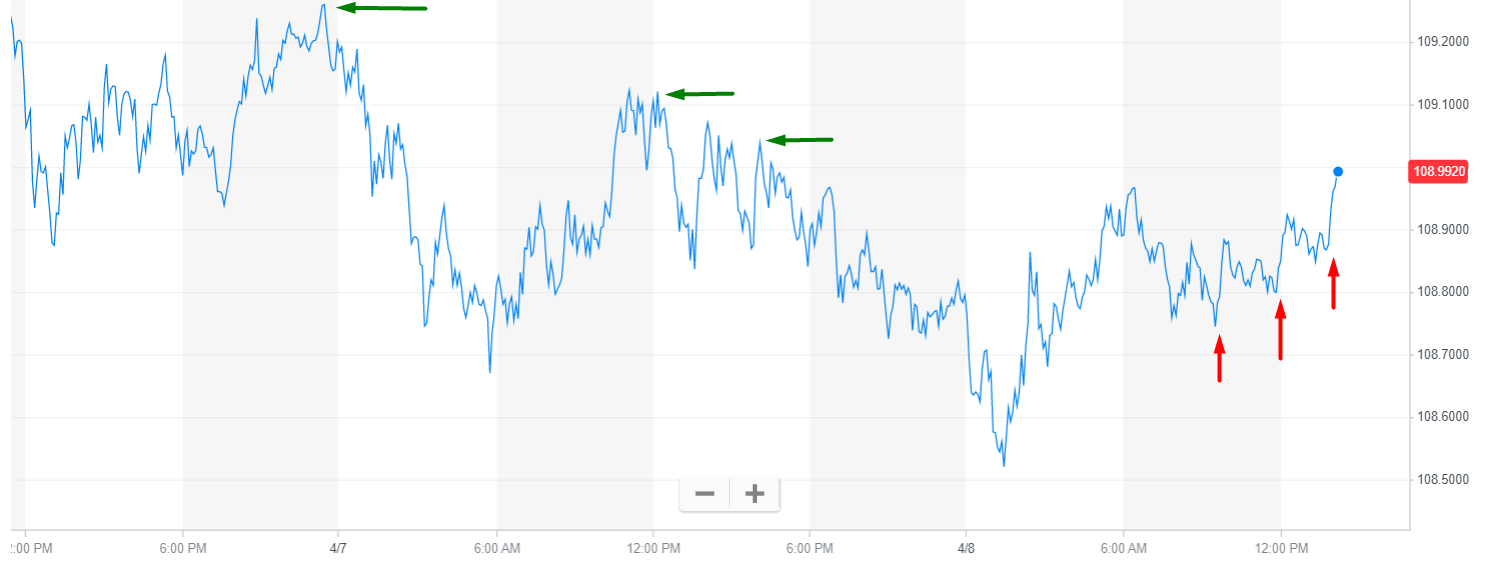

Again, there is software that helps you do this automatically, but manually finding these price points is also not too difficult. Let’s look at the most recent USD/JPY chart.

As you can see we have 3 resistance levels (green) and 3 support levels (red) illustrated on the chart. The Pivot Points trading strategy revolves around finding these levels, and here’s how it is usually done.

Every price point where a downtrend stopped but has not fully recovered is technically a support level. In this chart’s case, we have 3 price points that managed to recover and the market is in an uptrend, therefore it’s an exception that we have the support levels where we have them.

Every price point where an uptrend stopped but has not fully recovered is technically a resistance level. As you can see on the chart we highlighted 3 price points which the currency pair managed to reach, but could not achieve more.

Placing TP and SL orders

TP stands for “Take Profit” and SL stands for “Stop Loss”. These are orders that help you passively close trades on indicated prices. Why are these so important in your Pivot Point trading strategy?

Because they help prevent any unnecessary loss when you’re not next to your device. You see, when traders have determined the support and resistance levels, it’s quite common to use them as TP and SL order price points. For example, it’s quite common for a downtrend to continue if one support level is broken. So, traders tend to place an SL order on the first support level.

Also, it’s quite common for uptrends to continue beyond the first resistance levels. Therefore, traders tend to place a TP order on either the second resistance level or somewhere between the first and second. This is believed to be the safest approach.

Analyzing market sentiment

Although the Pivot Points trading software may be very useful for finding these price points, it’s not always a 100% guarantee that you will be profitable. It’s a simple “background” analysis that most expert traders do before they evaluate the entire

market sentiment.

Let’s go back to the same chart shown above. The highest resistance level we have there is somewhere around 109.3, but that does not mean it can’t go any higher, right? Therefore what expert traders tend to do is look at the current set of events that may affect their currency pair of choice. If they find a downtrend coming, then they will opt for short-selling below the Pivot Point indicator or above it if they see an uptrend.

In these cases, the most common strategy is to increase the timeframe for your Pivot Point software. If it was on 5 days, upping it to maybe a month or 6 would give a better picture.