Stock Support And Resistance Explained - With Examples

The price of a stock seldom goes in a straight line; instead, it varies up and down over time. However, when it repeatedly reaches a certain value then reverses direction, it creates price levels called support and resistance. These levels are just one tool in technical analysis that you can use to gain more skills as well as knowledge while trading in the stock market.

To explain simply

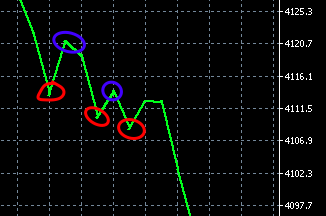

support and resistance indicators in the stock market, it should be noted that they are price levels that act as boundaries that a stock has bounced off more than once. Support is the level a stock tends to stay above. On the other hand, resistance is the level a stock hits and comes back from.

Let’s take a look at the real-life example in order to better understand what support and resistance levels mean in the stock market. Let’s say we are trading with the stocks of Apple. If we take a look at the last 5 day data, we can immediately identify support and resistance levels. At the time of writing this guide, the resistance level for Apple sits at $128, because it failed to break through that price twice on May 14th.

On the other hand, in terms of support levels we can see that the price tried to drop below $125.25 on 3 separate occasions, but could not. This means that the support level for Apple is currently at $125.55. With this information, a trader can determine where the best entry and exit points are for Apple in the short term. Traders should remember that this is a 5-day chart meaning that it’s not designed for the long term.

A lot of traders will see $125 as the perfect entry point for their positions in the short term, and also see $128 as the perfect exit point unless they are willing to risk waiting for a breakout.

While having

stock support and resistance explained it should also be mentioned that Support and resistance levels are not necessarily good tools for long-term trades simply because there is more time for something to happen with the company which has nothing to do with the technicality of the chart, but due to something external affecting its stock price. This is when the “logic” of support and resistance kind of breaks down.

Stock Market Support and Resistance Risks

While talking about

stock support and resistance levels it should be noted that these indicators are not 100% guaranteed and have some risks associated with them which should be taken into account by every trader. So some of the risks related to these levels include psychological indicators and outside factors. We will talk about them briefly down below.

Psychological Indicators

The first important factor that should be mentioned here is psychological indicators. If the chart does not necessarily showcase very clear support and resistance levels, then traders start to psychologically determine the ones that are the most appropriate for best. They tend to round these levels almost all the time. For example, we also did the same with Apple’s resistance level in the example above. We rounded from $127.8 to $128 to make it easier to see or easier to plan for.

A lot of traders do this as well because they do not think the remaining $0.2 bears any significance. In the case of “expensive” stocks like Apple, yes they truly do not bear much significance, on the other hand, when we are talking about cheaper stocks or even penny stocks, they are very important to be taken into consideration. All of this means that the first risk related to stock

support and resistance indicator is when traders think they know where these levels are when in fact, they are totally wrong.

Outside Factors

We already noted earlier that support and resistance are usually used for short-term trades. Maybe a maximum of 5 days at best. Anything more than this, for example for a 1-month chart, support and resistance becomes much less reliable. Why? Because then there is much more time for something external to affect the stock price.

For example, Apple just launched a new iPhone, while you were still looking at support and resistance levels. Naturally, the “logic” of these indicators is going to break down as something that important will definitely affect the stock price. This is why it is extremely important for the traders to be alerted about the essential events or the economic news releases because it always affects the market performance a great deal. While these types of outside factors occur in the stock market, it usually causes the level of volatility to grow significantly which, on the other hand, causes the prices of various stocks to change.