Ask and bid prices in forex

Understanding the ask and bid prices and how they work in forex is essential for success. There are two types of orders: limit and market orders. Market orders that are placed by traders instruct brokers to purchase or sell assets at the current moment, at the current price. And limit orders enable traders to buy or sell at predetermined levels. The obvious downside of placing limit orders is that they may never get filled if price doesn't reach that level. What's interesting about these order types is that they are creating the bid and ask prices. Brokers get liquidity from various liquidity providers, and they offer the best possible prices to their clients. The difference between FX bid and ask prices is called the spread, and we'll expand on this later in this guide.

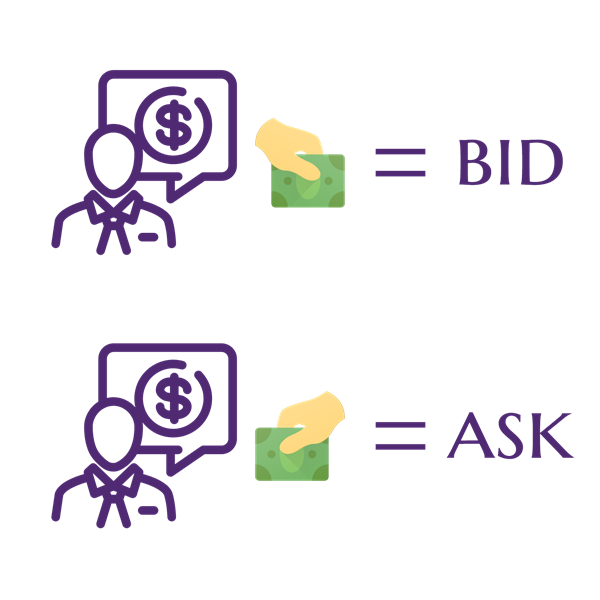

And to determine those prices, the two sides – buyers and sellers – engage in the negotiation process. That is where we encounter two of the most important elements of every trade – the bid price and ask price in forex. Here’s how they work:

- The bid price is picked as the best price by your broker out of a range of limit orders. It represents the price that you as a trader will pay to acquire the asset.

- The ask price is the best price out of a range of limit orders that you will be able to sell the asset that you hold.

Now, this might seem a bit difficult to understand. So, here is an example that shows the bid and ask rates in Forex in simpler terms:

The ask and bid quote example

Let’s assume there is a trader named Josh who wants to buy a USD/JPY currency pair for 100,000 Japanese yen. After he has bought the pair, he’ll wait some time until the bid-ask exchange rate increases to sell the pair and receive a payout. To do that, Josh finds a service provider – a broker, who has acceptable trading conditions for Josh.

Now, one would assume that the price for buying and selling the USD/JPY pair should be the same. So, if Josh buys about 911 dollars at the asking price of 109.69, he should be able to sell that same amount of yen and get 100,000 yen back, right?

However, that’s not how this system works, even though it might seem logical to many people. Instead of the bid and ask prices being the same, they are different from each other.

Therefore, if Josh buys 911 dollars with an asking price of 109.69, that will most probably be the maximum amount he will get as a result of the given trade with 100,000 yen. However, if Josh decides to sell the dollars and buy yen again, he’ll probably get a lower amount back.

For the sake of this example, let’s assume that the bidding price is 109.67. This means that the buyer will pay Josh 99,909 Yen back – assuming that the overall exchange rate remained the same at that time. From this bid and ask rate example in forex, we can see how spreads can influence profitability. A small spread might not seem significant, but if you're placing trades frequently, spreads can add up. It's important to trade liquid pairs such as major pairs and during the most active trading hours, such as during the London and New York sessions.

What does buying/selling a currency pair mean?

This bid and ask price foreign exchange example of Josh and his trading experience on the forex market demonstrates how the bid and ask prices work. Now, there is one more thing to clarify: when we are talking about the Forex bid-ask price, and also mention a certain currency pair like the above-mentioned USD/JPY, it means that we’re buying US dollars with Japanese yen. In general, buying a currency pair means just that: traders use the second currency – the base currency – to buy the first currency in the pair.

We can now discuss the price point which is acceptable for both sellers and buyers of these assets. As mentioned earlier, the bid price is the maximum amount the buyer is willing to pay for an instrument. Due to the fact that it is in the broker’s best interest to buy at the lowest possible price, they make sure to lower the price by negotiating with the seller

On the other hand, the asking price is the minimum amount the seller is willing to receive from the buyer for an asset. And when the asking price goes lower than a certain point, it’s just not worth selling at all. Therefore, the asking price is basically what the offer price means: a certain price offered to the seller of a pair

Forex ask and bid price difference – who benefits from it?

The difference between the bid and ask is called spread. Spreads are the highest when there is low liquidity on the market. Low liquidity means that there are low amounts of traders and not enough trading orders to enable orders to fill smoothly. Spreads in the markets are naturally occurring. Some brokers use spreads for charging their clients. They add spread markups to market spreads, which increases trading fees. This is how brokers generate revenue. You will come across two major trading fees: spread markups and commissions. Some offer spread-free accounts and charge traders commissions per traded lot instead. Some brokers use a hybrid system and use both fees at the same time.