Forex spread types - How many are there?

Although every spread type has one purpose of earning the broker some income, they still come in different shapes and sizes. There are way too many to mention here, but the ones that are most important to know about are the following:

Bid/ask spread

Yield spread

Option adjusted spread

Negative spread

Z spread

However, we will still only talk about Bid/ask spreads, yield spreads and negative spreads as the others are a bit more advanced.

Let’s get to know all of them one by one

What is bid ask spread

When asking for what is the spread in Forex, people usually mean bid-ask spreads, as they are the most common ones to find with Forex brokers because they are such an easy way to get payouts for them.

The difference between the bid and the ask price is pretty much what you are paying the broker to receive their service. Although 1 pip may sound small for making a good income for a company, remember that spreads are calculated according to the size of the lot you are trading.

For a standard lot, 1 pip would be equal to $10, for a mini lot it would be $1, etc. The more you trade, the more the broker makes through spreads.

The perfect way to calculate how much you are spending on spreads is to use the following formula:

(ask-bid) x lot size = payment size.

Yield spread

Yield spreads are also pretty much the same as bid and ask spreads, but they are usually calculated for different assets. For example, the most popular asset that yield spreads are associated with bonds, and here’s how they calculate them.

If there are two bonds of equal size and value, the difference between their yields will result in a yield spread.

So, if one bond has a yield of 10% and another has a yield of 5%, this would mean that the yield spread is only 5%.

This can be used for Forex as well. For example, a high-yield spread would be something like this. Imagine that EUR/USD has a yield curve of 20%, and EUR/GBP has 5%. Both of these currency pairs are considered major ones, so calculating the yield spread on them is available.

The yield spread here would be 15%, indicating that more people will start transferring to the EUR/USD pair to find more payouts

Negative spreads

Negative spreads are only negative for the brokers themselves. Basically what a negative spread means is that you can trade without having to “pay” the broker anything from your trade orders.

The broker guarantees that you immediately get a payout if the spread is negative. But this is possible only when you make the correct call. If the currency pair starts falling, then no amount of negative spread will be there to save you.

The negative spread in Forex usually happens with high-interest rate currencies. The broker can profit so much from the government for holding or trading their currency, that they are ready to pay their customers to use this currency pair as much as possible

Fixed and floating spreads

This is not necessarily a “type” of spread for Forex trading, simply because every single spread can be either fixed or floating. They’re like the types of the types of Forex spreads.

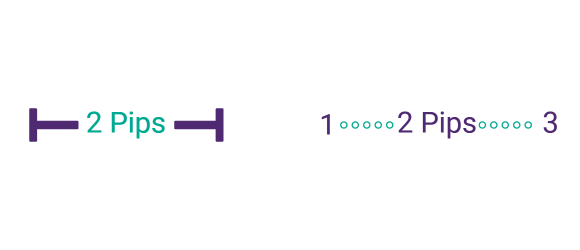

A fixed spread is when the broker guarantees that no matter what happens in the market, the spread will remain the same. So, if the spread on EUR/USD was 1 pip, it would stay that way no matter what.

A floating spread is based on market demand. Similar to the price and exchange rate of the currencies, the spread can change by growing or lowering. The market then adjusts it based on how many people continue to trade that currency pair.

Spreads vs Commission

The spread in Forex is considered one of the best options for both brokers and traders, but it doesn’t mean that there is no alternative method for it. That alternative method is the commission. It’s usually very different depending on the broker you are trading with, but it doesn’t mean spreads and commissions can’t be compared.

The main factor is probably the guarantee of spreads and the unpredictability of commissions. You see, when the spread is fixed, you as a trader are already aware of how much you will pay for the broker’s services. But when you are on commissions, they could change dramatically. For example, your trade can grow overnight making you pay a commission, it could reach a deadline making you pay a commission, or you could accidentally close the trade too early and again pay a commission.

The logic is quite clear, bid-ask spreads may be slightly more expensive when we first look at them, but in the long run, commissions are much more likely to cost you more.

Scalpers, who make a few pips from each trade, prefer low spreads and will pay commissions, while swing traders and day traders prefer lower commissions and are ready to pay a bit higher spreads. This is because swing traders sometimes may have positions overnight and commission can quickly add up to huge fees

How can spreads change?

Fixed spreads change very rarely, but floating ones are guaranteed to do so. The most common case when a spread changes is when there’s a shift in the market.

Imagine a news piece where the government of the United States says that they are increasing interest rates significantly. It’s likely for Forex brokers to react to this news and lower the spreads on their USD currency pairs.

Why? Because they want to increase their volume of USD trades so that the interest rate bonuses are applied to them.

Other reasons for changing the definition of what is a good spread in Forex include market trends and recessions. If the market decides that a specific currency pair is a lot more important to trade, it’s likely for a Forex broker to increase the spreads on it. Why? Because a lot of people are trading it, it might as well increase their income due to the demand. This corrects the market and people diversify into different currency pairs eventually.

And in terms of recessions, Forex brokers could simply choose one major currency pair and offer the best spreads possible on it.