Introduction

As always, we’re here to guide you through financial markets with this week’s Market Pulse. It was a hectic week, with plenty to cover across interest rate decisions, new ATHs for stocks, and a historic Soybean rally. Additionally, we’ll dive into a setup on GBPUSD and the Anchored VWAP as a dynamic Support and Resistance tool.

Global Macro

FOMC Meeting

The Fed delivered on the widespread expectations of a 25bps rate cut. However, the surprise was in setting expectations for the December FOMC meeting, stating that another December cut wasn’t nearly as likely as the market expected.

Powell seems to be leaning a lot more hawkish compared to the previous meetings, and with the government shutdown continuing, the Fed lacks reliable data to accurately consider the impact of its past rate cuts.

Finally, the Fed also stated that it will end Quantitative Tightening as of December 1st, which is a very strong bullish catalyst for risk-on assets. QT consists of the central bank reducing its balance sheet, which constricts the money supply and thus has a very similar effect to higher interest rates.

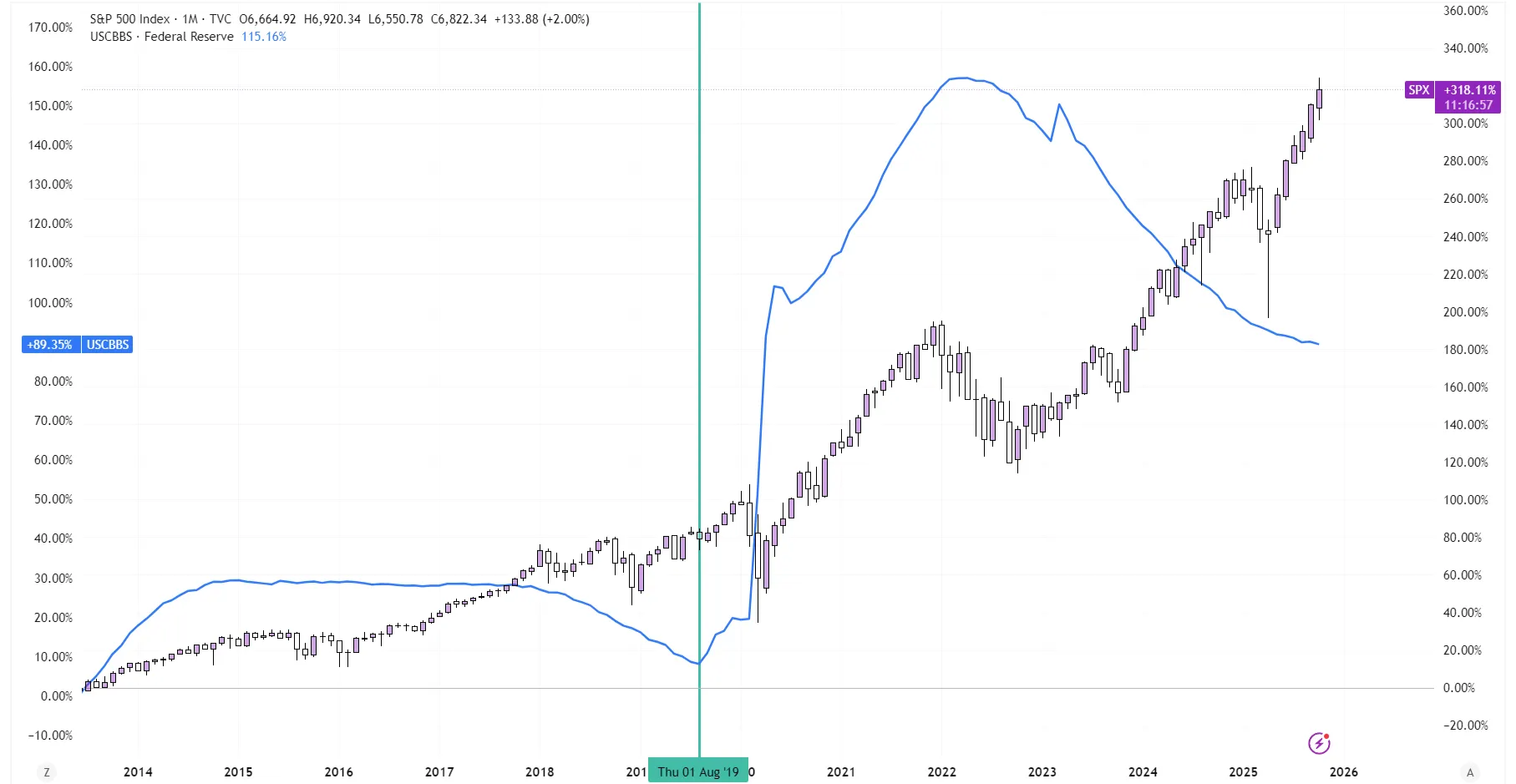

S&P Weekly Chart since 2014 overlayed with Fed Balance Sheet

The last time the Fed stopped QT in August of 2019, it quickly pivoted into Quantitative Easing, significantly picking up the pace in 2020, which then led to 2021 being one of the very best years for Equities in recent history. While we’re not anywhere near that kind of monetary stimulus, the overall monetary policy is turning from restrictive into neutral, which continues to support risk-on assets.

ECB Interest Rate Decision

On the other side of the Atlantic Ocean, the ECB had a much easier decision to make. While the U.S. continues to struggle with inflation, Europe has gotten things under control.

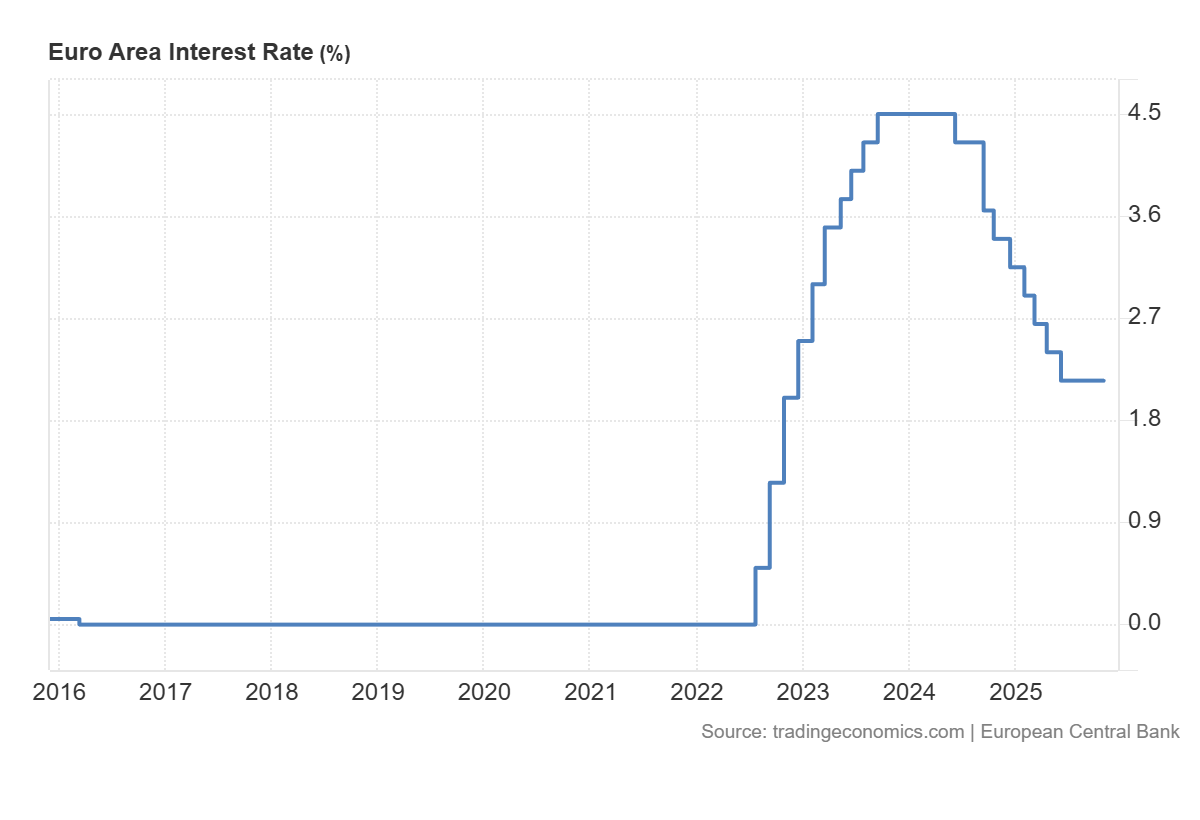

ECB Interest Rate since 2016

Since the economy is proving to remain strong, the ECB expects to keep rates at their current levels for the near future, as the interest rate has approached the neutral rate, i.e., the point at which monetary policy is neither restrictive nor accommodative.

Equities

Equities are continuing their upward trajectory, with more and more traders trying to call the macro-top. While that can be extremely profitable, it’s also extremely difficult. For every person who successfully called the top, there are dozens who lost money in a market that just continued to trend.

Therefore, it's perhaps wiser to follow the age-old adage:

“The Trend is your friend until the end, when it bends.”

S&P 500 on a Daily Timeframe since April 2025

A very useful tool to assess the trend is the Anchored VWAP (Volume Weighted Average Price). This tool will allow you to pin the VWAP to a certain price point (ideally, a major swing point) and serves as dynamic support and resistance. Looking at this chart of the S&P 500 since April 25’, we can see that the price has spent basically all its time above the first standard deviation band, signaling a very strong uptrend.

The upper band has been extremely accurate at plotting support areas. The Anchored VWAP is an invaluable tool precisely because it considers Volume and not just time. In the near future, it can serve as a very strong support area for price, preventing you from getting bearish right at the lows.

Forex

The US Dollar encountered a stronger week, backed by lower odds of additional interest rate cuts. This provided several opportunities across Dollar-denominated pairs, although perhaps most interestingly in GBPUSD.

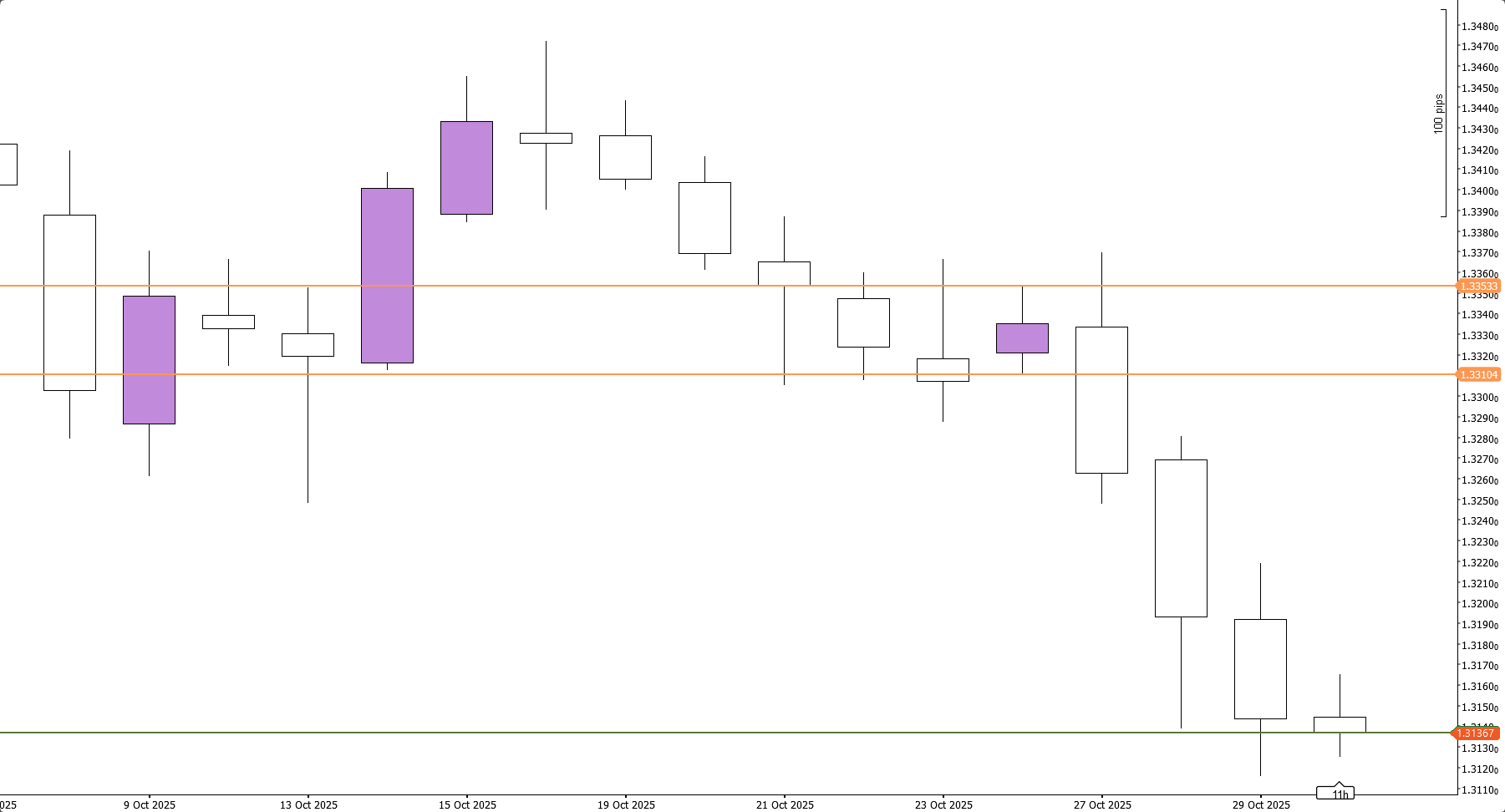

GBPUSD on the Daily Timeframe

On the Daily chart, Monday saw price put in an Inside Day (where price is contained within the previous day’s range), following Friday’s indecision candle. Inside Days are a pattern that we’ve talked about before, due to their nature of catching out breakout traders by probing one side of the range before quickly reversing.

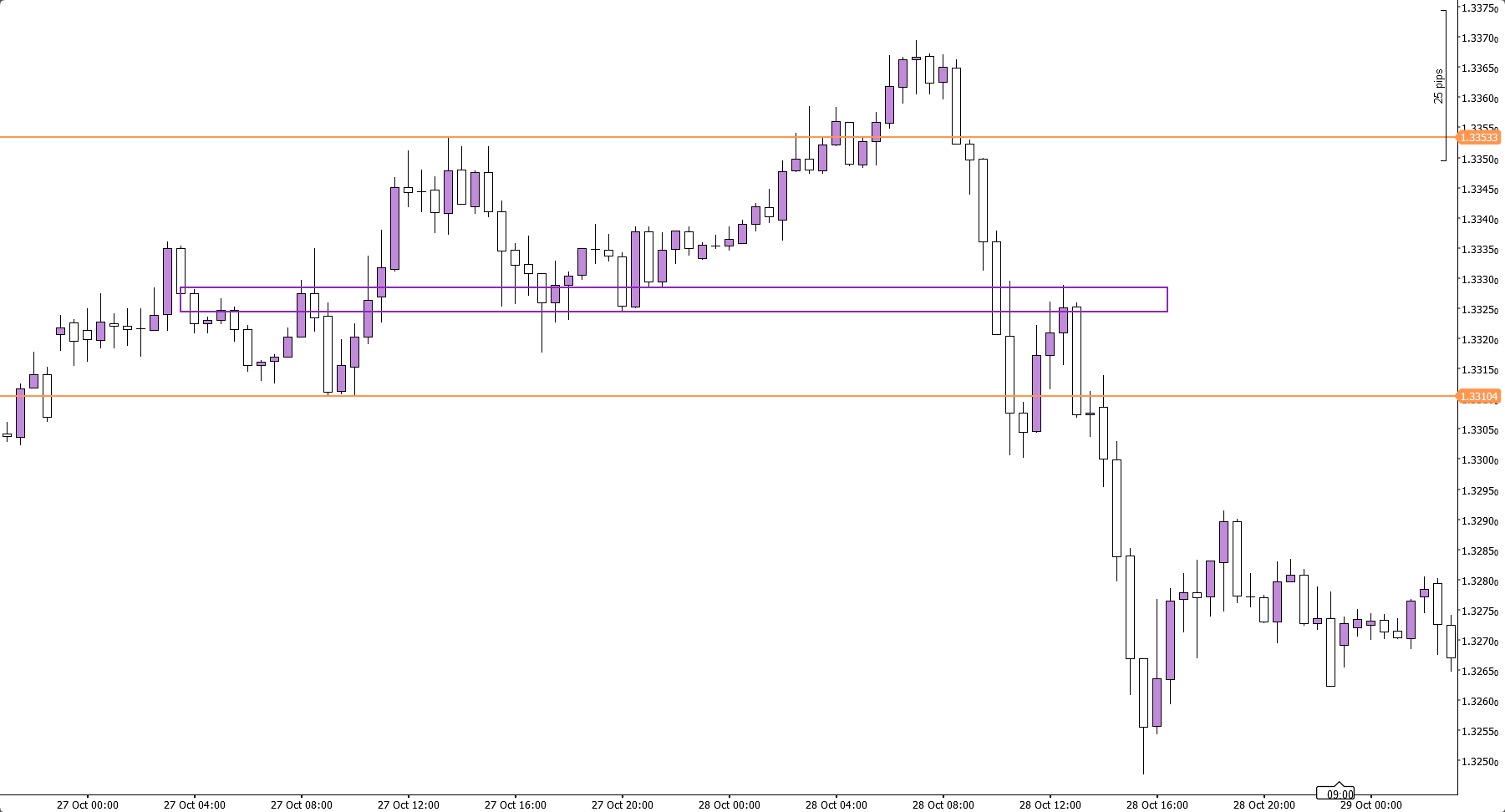

GBPUSD on the 30 Minute Timeframe

After completing the Inside Day Failure, price found resistance at a clear 30-minute S/R area, after which it continued going down and ended up closing the day as a Bearish Engulfing. This setup then allowed for more Lows throughout the rest of the week, providing several areas to enter short at.

Commodities

Following last week’s scare, Gold and Silver are currently in a healthy and unremarkable retracement, which allows us to focus on some other commodities. Soybean prices have seen a historically strong week, fueled by news that China is expected to make major soybean purchases in the American market.

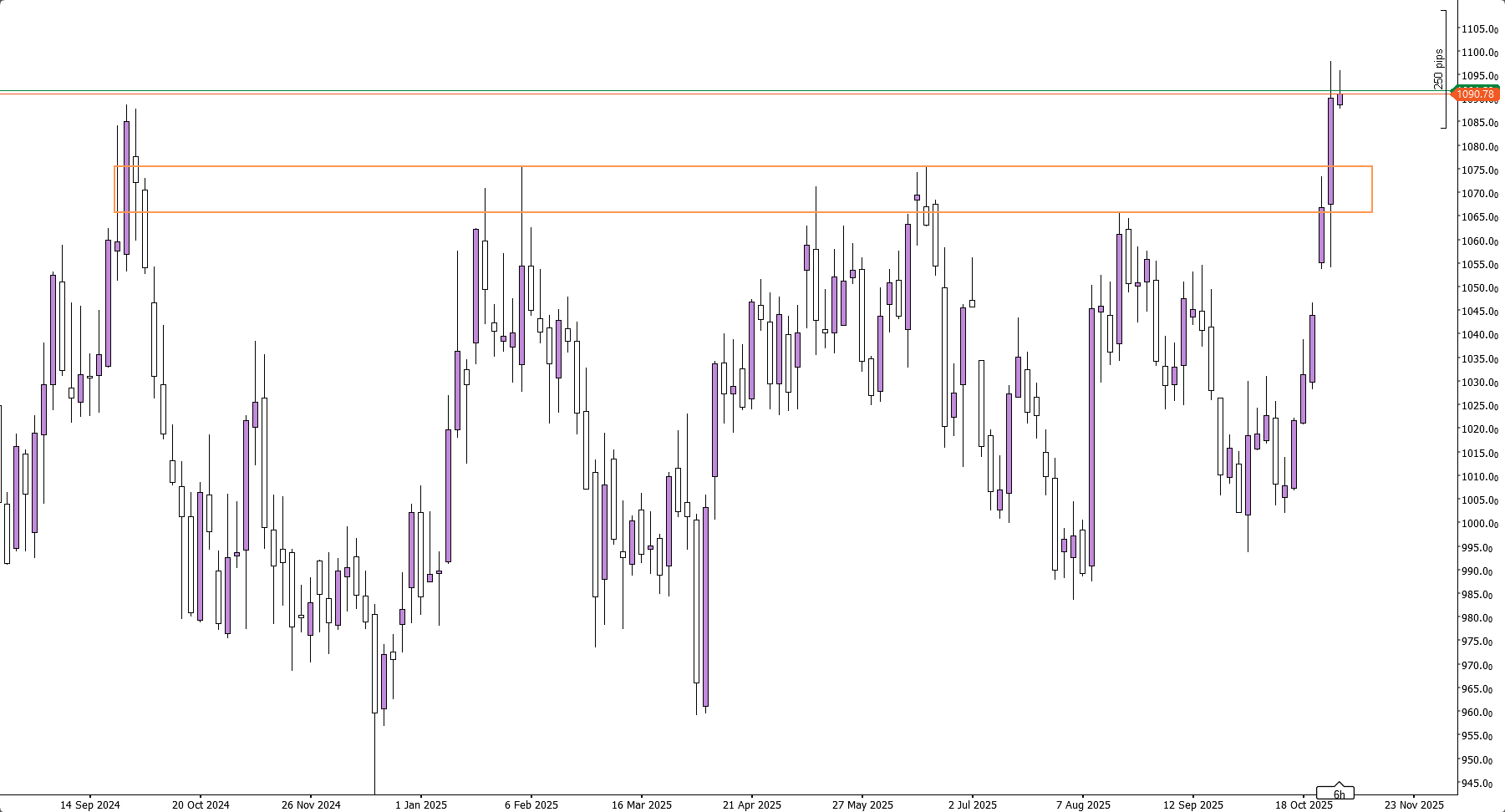

Soybeans on the three-Day Timeframe

Traders can now look towards the key liquidity pool between $1.065,50 and $1.075,00 to see if this zone can turn into support and potentially push the price up toward further highs.

Conclusion

One-sentence summary of the week

Stocks are king, the Fed is cautious, and Soybeans rally on Chinese purchases.