Introduction

Welcome to this week’s market pulse. The DOJ launched an investigation into Jerome Powell, U.S. inflation is going down, and Indices are at new All-Time-Highs.

Global Macro

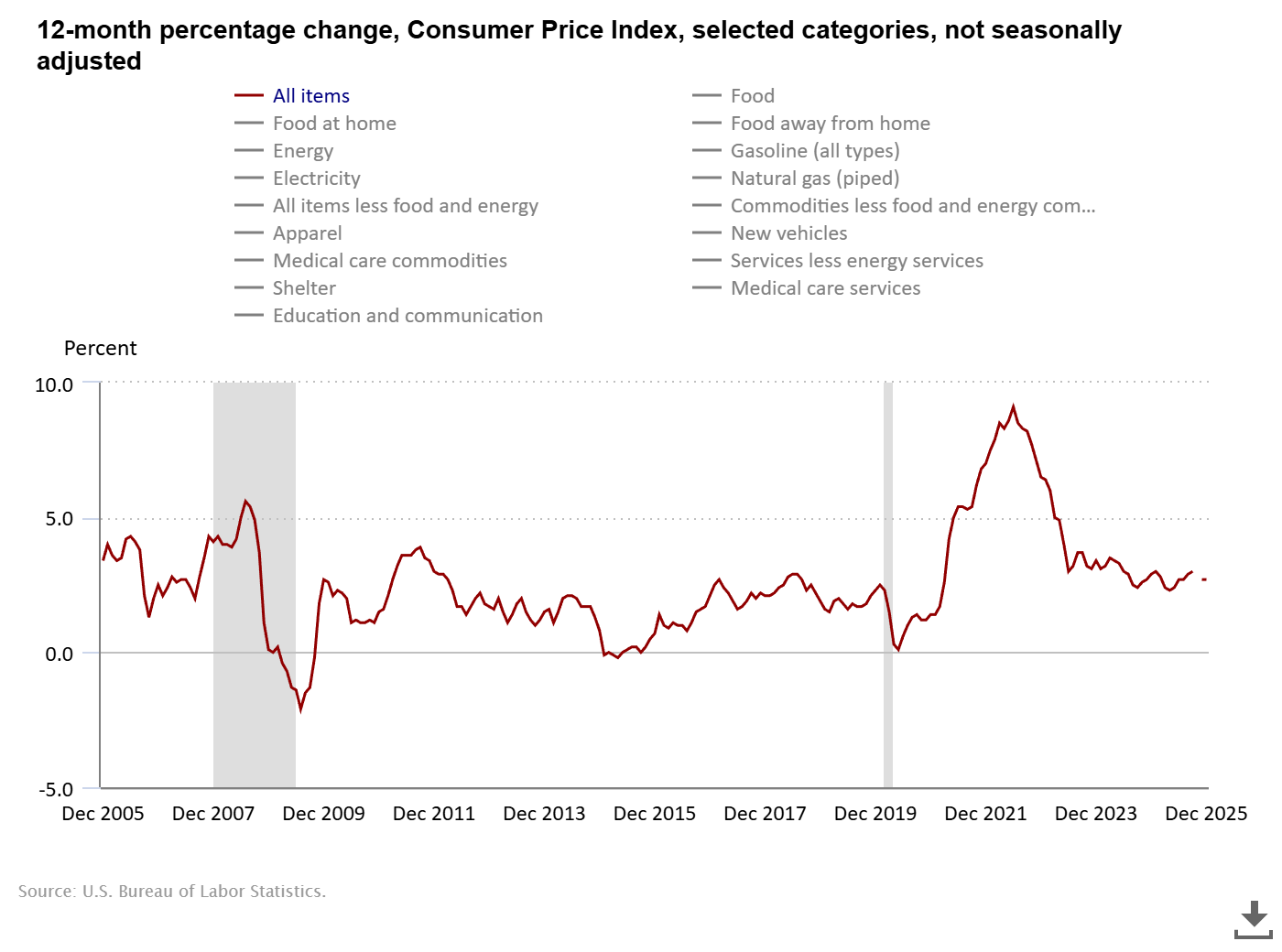

This week’s headline data was American inflation. Year-over-Year Consumer Price Index (CPI) came in at 2.7%, right on expectations. This continues our recent downticks in CPI, with last month’s data also coming in at 2.7% YoY.

The Fed remains extremely likely to hold rates at the January meeting, but this data nonetheless bodes well for future rate cuts, potentially further down the line.

The Struggle for Fed Independence

The U.S. Department of Justice reported that it’s investigating the Fed Chair Jerome Powell. The legal pretext involves the renovation of the Federal Reserve's headquarters. As the Fed chair, Powell is directly responsible. Allegations include "gross incompetence" and claims that Powell misled the Senate regarding the total costs of the project.

However, Powell came out stating the following:

The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.

This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions—or whether instead monetary policy will be directed by political pressure or intimidation.

While macroeconomic events don’t always have such a profound impact on financial markets, the independence of central banks is a cornerstone of trust in financial markets. If the U.S. Government continues to put pressure on Powell and the Fed, the Dollar might see strong losses, just like the Trade war in April 2025.

Equities

We’re seeing a geographical contrast in this week’s performance. While the S&P 500 and Nasdaq are down slightly, it’s the Nikkei, Euro Stoxx, and Dax that have consistently been putting in new All-Time-Highs and are maintaining their strength.

Nikkei on the 4-hour Timeframe

Especially the Nikkei looks technically set for more upside. 53,470 serves as the initial support level, with the 52,240-52,745 serving as the strongest support level. If the price were to fail both levels, it would likely mean a short-term return lower.

Forex

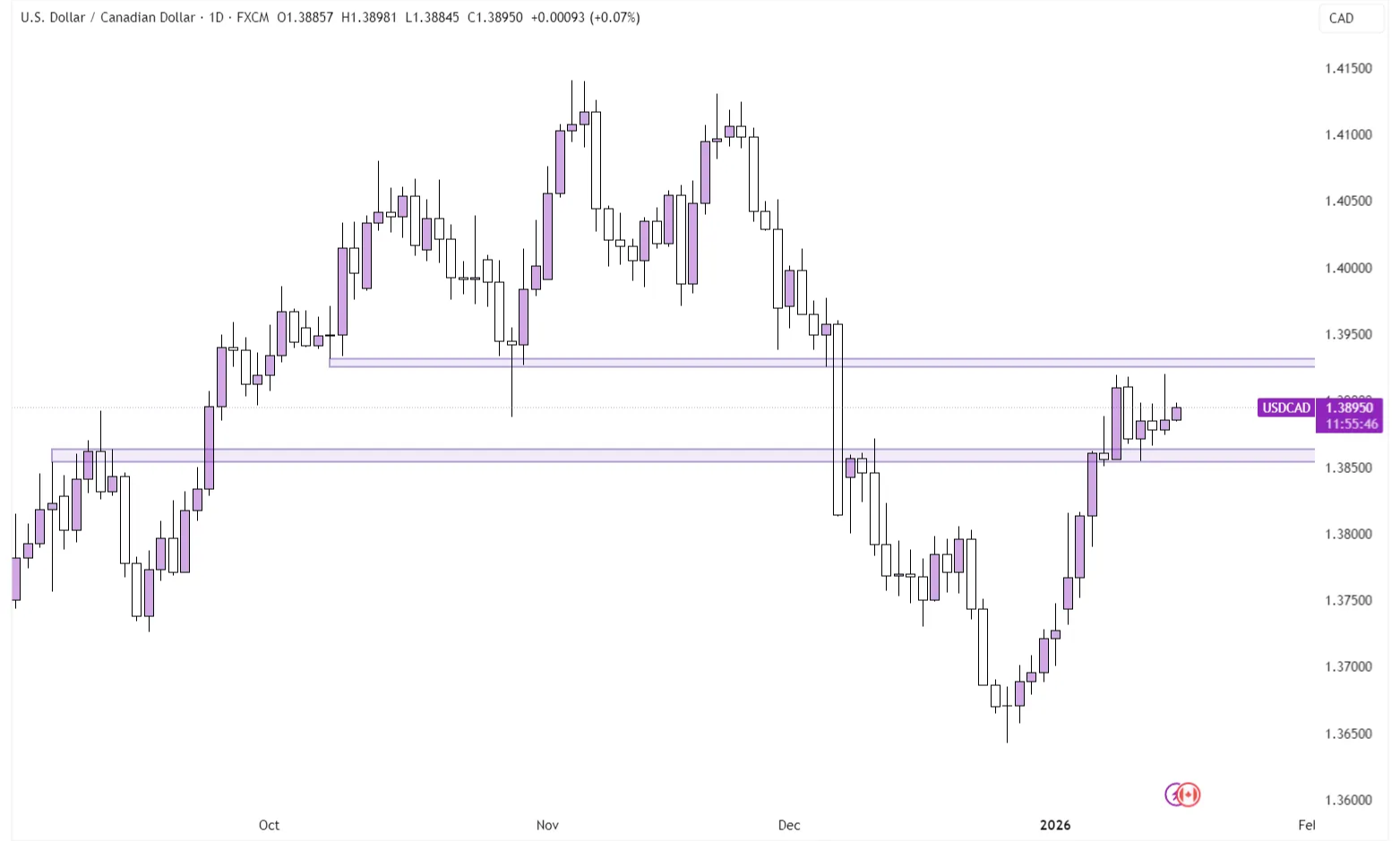

Due to the DOJ investigation into Jerome Powell, the Dollar did struggle slightly. However, USDCAD still provides some interesting S/R areas.

USDCAD on the Daily Timeframe

Price sits pinned within two very strong and clear S/R levels. To the downside, 1.385-1.386 consists of many local highs and lows, with this area having been tested plenty of times from both sides. However, since we already had a touch from above, the level is now slightly weaker than when it was during the first test of an S/R flip.

To the upside, 1.392-1.393, however, seems like an extremely strong level. Currently, it is also untested from the downside, which only strengthens the possible reaction. While a major pivot isn’t to be expected, this level is likely to give a solid reaction on the lower timeframes.

Commodities

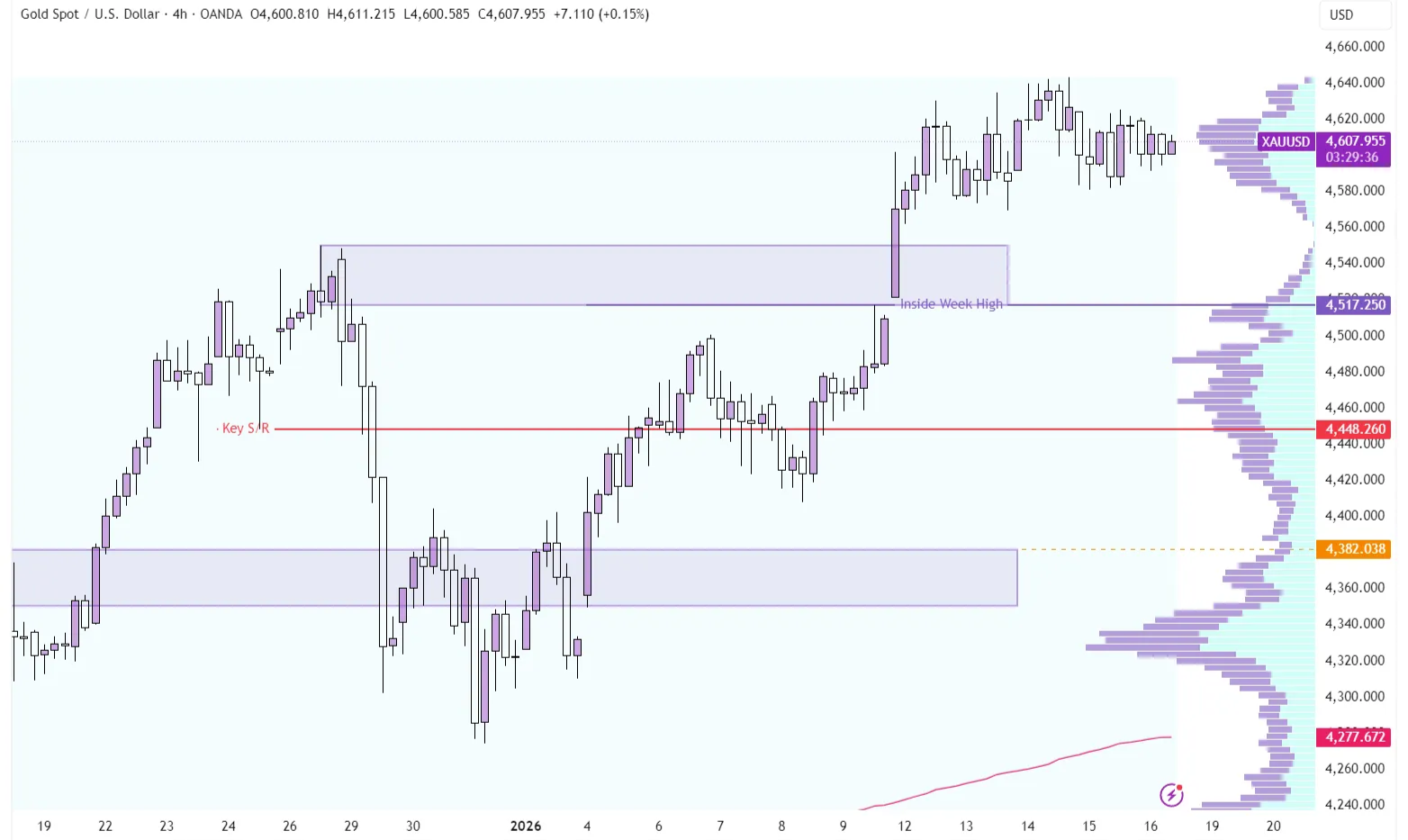

Last week, we discussed the Inside Week, which set up in both Gold and Silver. Noting that price likes to probe beyond an Inside Week extremum and then retreat within the Inside Week range, we were cautiously bearish.

Gold on the 4-hour Timeframe

However, the price completely disregarded this possibility. Instead, price swiftly broke out on the Weekly open and then spent the rest of the week in an incredibly tight range of just $70.

Instead, the Inside Week High at $4,517 is now a key Support level, with the level extending all the way up until the Christmas ATH at $4,550. This chart, from a technical perspective, now looks quite bullish, with such a strong downside level.

Conclusion

One-sentence summary of the week:

The Fed’s independence is under pressure, despite that Indices and Metals are at new ATHs across the board.