Introduction

The past week served up another flurry of geopolitical headlines, yet markets remained remarkably unfazed. Despite the external noise, it was largely business as usual across most asset classes as traders kept their cool and stayed focused on the underlying data.

Global Macro

Bank of Japan Interest Rate Decision

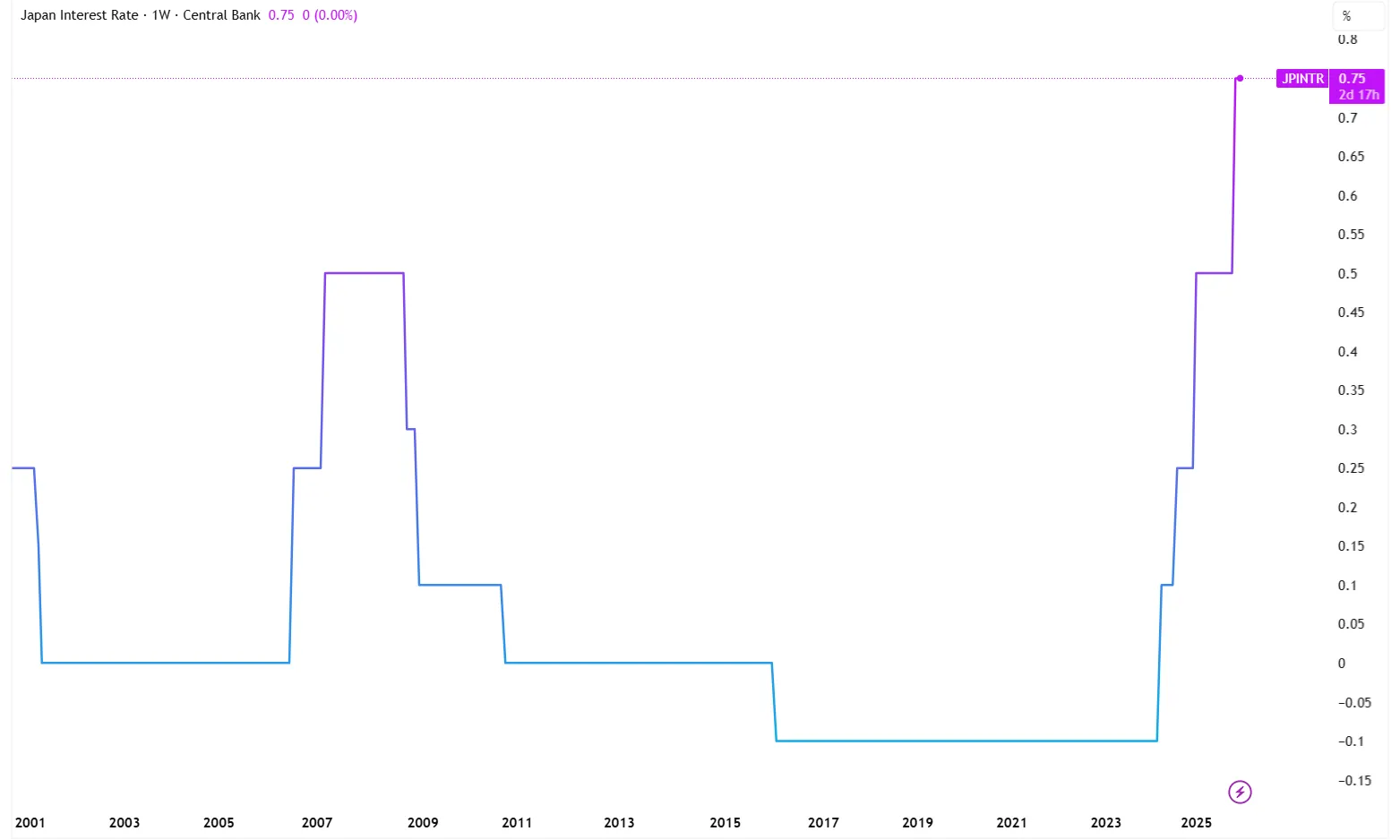

The Bank of Japan (BoJ) continues to find itself in a difficult position. The central bank is currently tasked with fighting off Yen bears through hawkish reasoning, all while trying to avoid a surge in bond yields amid expectations of heavy government spending. Historically, the BoJ has pursued ultra-loose monetary policy, maintaining rates at 0.00% for years to stimulate growth. However, they’ve been forced to pivot. With rates at 0.75%, they might seem low from a global context, but are high to Japanese standards.

Bank of Japan Interest Rate since 2000

As expected, the BoJ kept rates steady. However, this meeting did show hints of more hawkishness in the future. Notably, board member Takata dissented from the majority, voting for an additional 25bps hike. Additionally, the Board raised both its growth and inflation expectations for the coming year, ultimately creating the case for future rate hikes later this year.

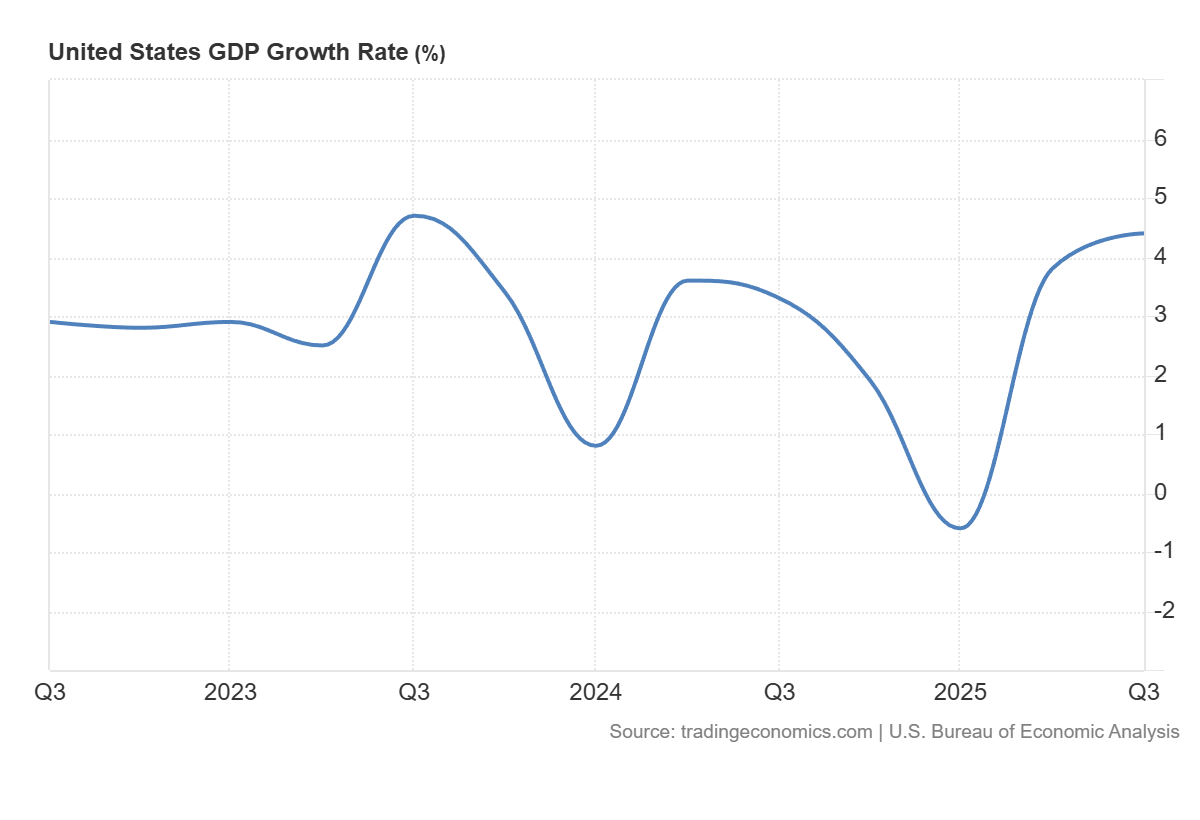

U.S. GDP

Despite rocky politics, U.S. economic exceptionalism continues. Year-over-Year GDP growth came in at 4.4% for the third quarter of 2025, beating the expectations at 4.3%.

Equities

All major indices, ranging from the Nasdaq to the Nikkei to the Euro Stoxx, had a surprisingly similar week: drop 1-3% at the start of the week over geopolitical fears, to then reverse course as Trump TACO’d again. The VIX (Volatility Index) showed this dynamic perfectly:

VIX on 1-hour Timeframe

On Tuesday (Monday was an American bank holiday), price immediately gapped up 4 points; however, price created a nice Head and Shoulders pattern on the 1-hour chart and quickly closed the Weekly gap as economic policy was reversed.

It’s interesting to note how stock markets have grown accustomed to extremely volatile U.S. policy. In April of 2025, the VIX spiked 43 points over two weeks, over trade war fears. However, this week’s temporary suspension of the U.S. - EU trade deal barely pushed up the VIX.

Forex

The Yen lost another 2% this week against the Euro, continuing last year’s trend of Yen weakness. From a technical standpoint, however, EURUSD is creating the most interesting setup this week, with Thursday closing as a true Bullish engulfing.

EURUSD on the 1-hour timeframe

A Bullish engulfing on Thursday gave us a strong bullish bias coming into Friday. The most interesting way to play these engulfings is to look to get in around the high of the day prior (i.e., the high of the day that got ‘engulfed’). However, as prices have already tested this level, focus shifts a bit lower.

The key level seems to sit at 1.1725-1.1729. This level is especially crucial as it’s a level that’s right underneath the Prior Day High and has gotten plenty of touches from both sides. From this level, we might then target new highs, which is in this case either the high of the day of the engulfing at 1.1759 or the current weekly high at 1.1768.

Commodities

Metals have had another stellar week. The resurgence of geopolitical risk saw even more capital flow into both Gold and Silver. Both assets are now trading right underneath absolutely key psychological levels.

Gold and Silver on a Daily Timeframe

Gold is sitting right below the $5,000 mark, while Silver is just inches away from reaching $100/ounce. Both levels carry extremely high amounts of psychological importance and should be tested relatively soon.

Conclusion

One-sentence summary of the week:

Hawkish BoJ keeps rate constant - Geopolitical fears push Gold and Silver to just under $5,000 and $100, respectively.