The global aluminum market is not a singular entity; it is a complex, fragmented ecosystem. It possesses unique behaviors that set it apart from other markets, even distinguishing it from other industrial metals. In this guide, we will walk through the mechanics of the aluminum market, the fundamental drivers you need to watch, and how to approach trading it.

Trading Aluminum through Contracts for Difference

Before diving into the specifics of aluminum, a solid understanding of how CFDs work and how they differ from buying futures contracts is required. These are some of the key features of trading through a CFD:

- A CFD is a cash-settled derivative. This means you never physically buy, sell, or take delivery of any goods. You are speculating on a contract that is made to track the prices of aluminum futures in major markets. Using a CFD thus allows you to speculate on prices without ever having to worry about rolling over a futures contract or undertaking physical delivery.

- CFDs allow you to use leverage, enabling you to use your capital more effectively. Using leverage wisely allows you to hold multiple positions at a time without tying up all your capital in just one asset. It also allows you to size up positions and potentially make significant profit from intraday swings that would otherwise achieve only a small percentage gain. Leverage is a tool; when used wisely, it can amplify potential returns, but if used without understanding, it can also increase the size of losses.

- Unlike a physical investment, holding a CFD position past the daily market close typically incurs an overnight financing charge (or 'swap fee'). This cost makes holding positions for extended periods less profitable. Therefore, the strategies discussed below are suited more for short to medium-term trades instead of longer-term investments.

Aluminum: A Fragmented Market

The LME and the Prompt Date Structure

The London Metal Exchange (LME) is the center of gravity for aluminum; it sets the reference price used in approximately 90% of global contracts. However, the LME differs fundamentally from standard futures exchanges like the CME or EUREX. While most commodity exchanges rely on standardized monthly expiry dates, the LME utilizes a daily prompt date structure designed to mirror the needs of the physical industry. This structure allows for daily prompt dates out to three months, weekly dates out to six months, and monthly dates extending up to 10 years into the future.

The third Wednesday of each month acts as the de facto standardized contract, which sees the majority of open interest. While physical hedgers will use daily prompts to match their specific production flow, speculators such as proprietary trading firms, hedge funds, or retail participants will concentrate their activity with expiration on this third Wednesday of the month, as it maximizes liquidity and minimizes slippage.

This structural division creates distinct liquidity nodes. The "3-Month" rolling contract is the benchmark for headline pricing, yet the Third Wednesday contracts hold the bulk of the open interest for carry trades and longer-term positioning. The disconnect between the 3-month rolling date (which changes every day) and the fixed monthly prompt dates necessitates complex adjusting trades. Traders looking to hold a position must constantly roll their exposure, dealing with the Cash-to-3-Month spread. This spread is the primary indicator of near-term physical tightness. A market in contango (future prices are higher than spot) is seen as the normal, and suggests ample immediate supply. Conversely, backwardation (spot prices are higher than futures) signals immediate physical scarcity.

To bridge the liquidity gap between the 3-month contract and the specific daily structure, the LME has introduced an additional functionality called “implied pricing”. This system uses the liquidity in the 3-month contract to create synthetic liquidity for the Third Wednesday dates by chaining orders together.

Luckily, CFDs simplify this concept and instead create one non-expiring contract, which is much simpler to use. However, there are still opportunities to be found by understanding this process, as arbitrage opportunities arise.

SHFE Arbitrage and the Import Window

While the LME is responsible for the global price, the Shanghai Futures Exchange dictates the internal price in China, which is the world’s largest producer and consumer of aluminum. Even after accounting for different contract sizes, VAT, and exchange rates, traders can observe different pricing between the LME and SHFE.

When the adjusted SHFE price rises significantly above the LME price, an arbitrage opportunity occurs. Chinese importers are financially incentivized to buy up aluminum from the LME and import it to China. It’s important to note that the LME has warehouses located throughout the world, so aluminum from the LME is not necessarily located in the United Kingdom.

This arbitrage provides opportunities for traders who can anticipate them. For example, if a certain premium consistently triggers Chinese imports, a trader could go long on an Aluminum CFD as the LME prices are used as the benchmark. However, the risk with this approach is that while the spread does converge, dollar-denominated prices drop, resulting in a loss despite a correct trade thesis.

Supply and Demand

The Supply Profile

China is by quite a large margin the largest producer of aluminum. However, its government has implemented production restrictions. Currently, there is a 45-million-ton annual ceiling, which was implemented to battle overproduction and maintain self-sufficiency.

These restrictions created a dual market. On the one side, there’s the Chinese market, which is mostly self-sufficient and keeps most of its production for internal use. On the other side is the global market, which has to rely on the rest of the global production. This is a major constraint on global supply, as Chinese production amounted to 66% of the global total in 2024.

One of the solutions for this lack of supply has been secondary or recycled aluminum. The supply coming from the recycling is now dominating the supply in other markets, as there are strong financial incentives to do so.

Remelting scrap aluminum requires a fraction of the energy, so as energy prices rise, the economic advantage of recycling continues to advance. This recycling serves as a viable substitute for production, as it can, in theory, be recycled infinitely without any loss of quality.

Demand Drivers

Aluminum has wide use cases; its characteristics make it applicable to a wide range of appliances. Aluminum is corrosion-resistant and a good conductor of heat and electricity. However, compared to copper, its thermal conductivity is about one-half that of copper, and its electrical conductivity about two-thirds.

A huge piece of the demand puzzle comes from the expected Green transition. Electric Vehicles require 60-80 kilos more aluminum per vehicle than their fossil-fuel counterparts. This sector alone is forecasted to drive 63% of demand growth by 2030.

Additionally, other green infrastructure, such as solar panels and wind mills, is also aluminum-intensive.

Finally, aluminum is often used inside packaging, which is a high-volume, recession-resistant market where aluminum is a viable solution for the move away from plastic packaging.

The Copper Substitution

Copper and Aluminum are highly correlated. They both share similar properties and are both heavily used in green energy due to their effectiveness as electrical conductors. However, copper is objectively the superior of the two metals and consistently demands a premium. At a certain point, however, aluminum becomes an economically viable substitution, where its lower prices warrant its diminished performance.

This link creates opportunities for traders, both through direct and relative value trading. As aluminum becomes too cheap, producers can cut costs by switching away from copper, which creates significant demand until prices of the two metals converge enough for the incentive to lessen or completely fall away.

Aluminum/Copper a Monthly Timeframe

We can visualise this relation by monitoring the prices of Aluminum measured in Copper prices. The following chart shows us that when comparing prices of the LME Aluminum contract with the COMEX Copper contract, the 500 level is a clear area of support.

Although prices went substantially lower during 2025, this area has served as strong support in the past, and thus might represent a price point where manufacturers are likely to start swapping out copper for aluminum. Traders can practically trade this relationship with two distinct approaches:

- As Aluminum prices become undervalued against Copper, open a direct long position on XALUSD

- As Aluminum prices become undervalued against Copper, open both a long position on XALUSD (Aluminum) and a short position on XCUUSD (Copper).

The benefits of the second approach are that you’re creating a delta-neutral (no direct market exposure) strategy, where you’re hedged against the risk of the Aluminum/Copper chart going up, while your actual XALUSD position is going down as Aluminum loses worth denominated in U.S. Dollars.

However, the second approach does involve a slightly higher complexity in managing and executing your trades, as well as double the transaction fees, as you’re holding two positions open simultaneously.

Macroeconomic Correlations and The Cost Paradigm

Commodity prices often revert to their marginal cost of production, and for Aluminum, the most significant cost is by far energy prices.

Power accounts for 30-40% of aluminum's production costs, which has earned it the nickname of “congealed electricity.” However, the specific energy source that is used differs based on the geographical location where it is being produced.

In China, the majority of smelting is coal-powered, and the price of thermal coal serves as a leading indicator for Chinese aluminum prices. Spikes in coal prices compress smelter margins, forcing lower production, which restricts supply and eventually supports aluminum prices.

However, more interesting for those who trade Aluminum CFDs is the gas correlation. European smelters rely heavily on natural gas.

This was reflected during 2022, when the European energy prices, including natural gas, shot up, and traders saw Aluminum prices rise 55% over a timespan of four months.

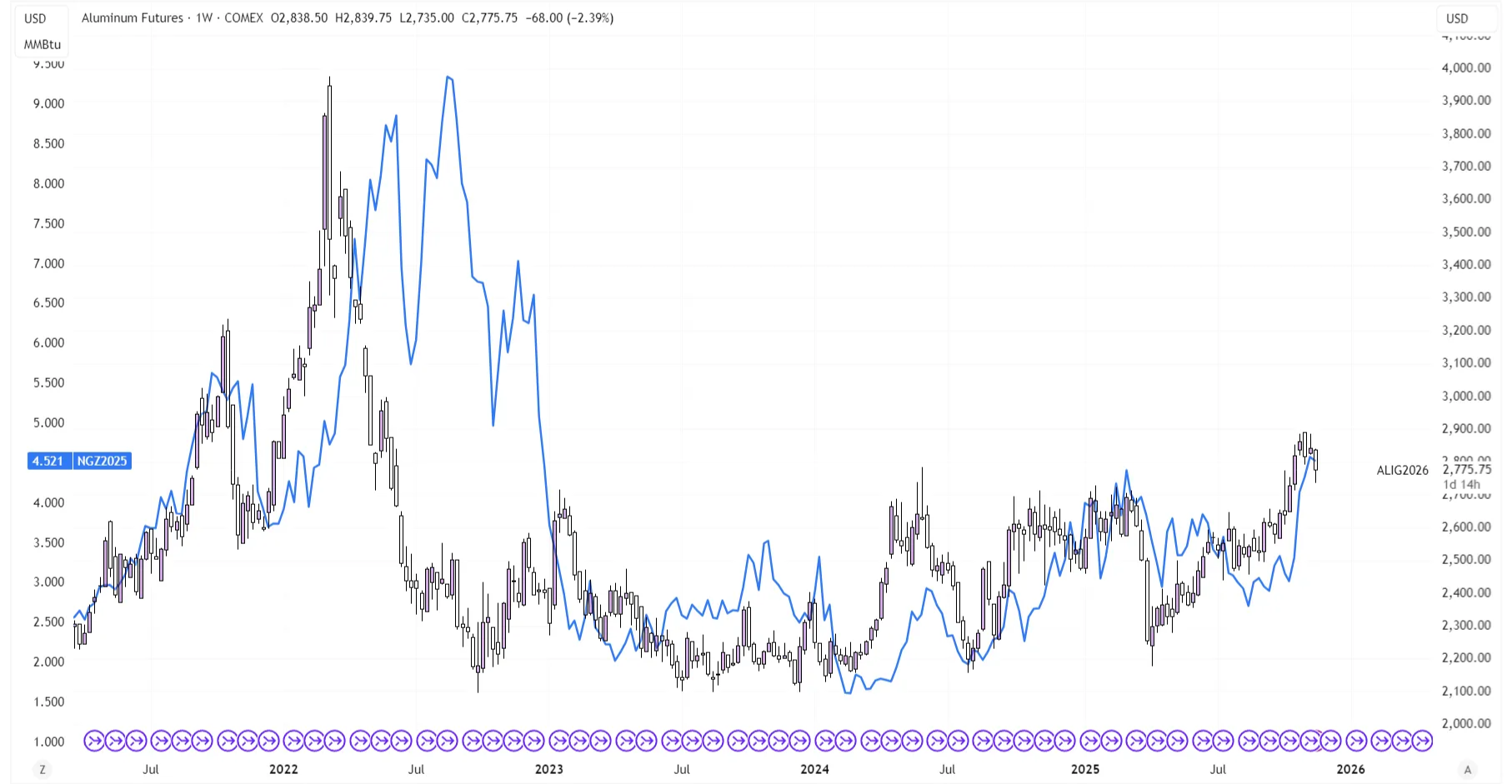

Natural Gas prices can thus serve as a leading indicator for Aluminum prices, although the relationship isn’t as clear as one might hope:

Aluminum on the Weekly timeframe overlaid with Natural Gas Prices

Common advice is that Natural gas leads Aluminum prices; however, this chart paints a different picture. Aluminum prices at first seem to lead Natural gas prices instead of the other way around; however, that’s not the case either.

In reality, the best conclusion to be made from this chart is that correlations depend on the specific underlying dynamics. In theory, both assets should be directly correlated, but each asset has multiple different factors influencing its prices, which makes this relationship harder to predict. However, for traders who can synthesize all of the underlying factors that drive prices, it creates opportunities.

We can observe this dynamic between energy prices and Aluminum prices much more clearly when looking at the Aluminum/Copper correlation. Since Aluminum is much more energy-intensive than Copper, Natural gas prices show a very strong correlation.

Aluminum/Copper overlayed with Natural Gas prices on a Weekly Timeframe

The drop in natural gas prices in 2023 provided a financial incentive for producers to maximize their aluminum production as their margins widened due to lower production costs. However, this subsequently led to lower Aluminum prices, especially when priced against copper.

News Reports

Aluminum sees a wide range of news reports that are both unique to the market and essential to monitor. Let’s go through each of them quickly and discuss what they are and why they’re important:

LME Daily Stocks

Every day, with a two-day delay, the LME publishes its physical inventory, known as the ‘Stocks breakdown report’. As this report includes all the metals on the LME, make sure to look at ‘Primary Aluminum’.

| |

Primary Aluminum |

|

|

|

|

|

|

| Country/Region |

Location |

Opening Stock |

Delivered In |

Delivered Out |

Closing Stock |

Open Tonnage |

Cancelled Tonnage |

| Belgium |

Antwerp |

0 |

0 |

0 |

0 |

0 |

0 |

| Germany |

Hamburg |

0 |

0 |

0 |

0 |

0 |

0 |

| Hong Kong SAR |

Hong Kong SAR |

0 |

0 |

0 |

0 |

0 |

0 |

| Italy |

Genoa |

0 |

0 |

0 |

0 |

0 |

0 |

| Italy |

Leghorn |

0 |

0 |

0 |

0 |

0 |

0 |

| Italy |

Trieste |

50 |

0 |

0 |

50 |

0 |

50 |

| Japan |

Nagoya |

0 |

0 |

0 |

0 |

0 |

0 |

| Japan |

Yokohama |

0 |

0 |

0 |

0 |

0 |

0 |

| Korea (South) |

Busan |

0 |

0 |

0 |

0 |

0 |

0 |

| Korea (South) |

Gwangyang |

140.775 |

0 |

0 |

140.775 |

140.775 |

0 |

| Korea (South) |

Incheon |

0 |

0 |

0 |

0 |

0 |

0 |

| Malaysia |

Johor |

1.225 |

0 |

0 |

1.225 |

1.225 |

0 |

| Malaysia |

Port Klang |

357.000 |

0 |

2.000 |

355.000 |

300.750 |

54.250 |

| Netherlands |

Amsterdam |

0 |

0 |

0 |

0 |

0 |

0 |

| Netherlands |

Moerdijk |

0 |

0 |

0 |

0 |

0 |

0 |

| Netherlands |

Rotterdam |

3.450 |

0 |

0 |

3.450 |

2.450 |

1.000 |

| Netherlands |

Vlissingen |

0 |

0 |

0 |

0 |

0 |

0 |

| Singapore |

Singapore |

275 |

0 |

0 |

275 |

275 |

0 |

| Spain |

Barcelona |

0 |

0 |

0 |

0 |

0 |

0 |

| Spain |

Bilbao |

0 |

0 |

0 |

0 |

0 |

0 |

| Sweden |

Helsingborg |

0 |

0 |

0 |

0 |

0 |

0 |

| Taiwan |

Kaohsiung |

45.300 |

0 |

0 |

45.300 |

45.300 |

0 |

| UK |

Hull |

0 |

0 |

0 |

0 |

0 |

0 |

| UK |

Liverpool |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

Baltimore |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

Chicago |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

Detroit |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

Los Angeles |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

Mobile |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

New Orleans |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

Owensboro |

0 |

0 |

0 |

0 |

0 |

0 |

| USA |

Toledo |

0 |

0 |

0 |

0 |

0 |

0 |

| |

|

|

|

|

|

|

|

| Total |

|

548.075 |

0 |

2.000 |

546.075 |

490.775 |

55.300 |

| Change |

|

-2.125 |

|

|

-2.000 |

|

|

LME Daily Report for Primary Aluminum dated 18 November 2025

In this report, the field that’s of most use to use is the total change, which shows us the difference between the opening and closing stock. But in and of itself, even this number is relatively meaningless. To interpret these numbers, we need to compare them to long-term averages of the physical inventory.

This will allow us to see when physical inventories are historically low or high, and thus integrate this data into our analysis.

Additionally, an advanced technique revolves around analysing inventory in specific geographical areas. For example, analysing the physical inventory of the LME in Chinese ports allows traders to more correctly assess when Chinese importers will start buying LME Aluminum, as the geographical distance is lower and, with it, the import costs are lower.

Caixin China Purchasing Manager’s Index

This is a leading indicator of Chinese factory activity, which is thus indicative of base metal production and sentiment. Even though CFD prices track LME prices, monitoring the Chinese Caixin PMI still allows us to understand whether the biggest consumer and producer of aluminum is in an expanding or contracting cycle.

Readings above 50 signify that the economy is expected to grow, whereas readings under 50 signify economic contraction. On top of looking at the raw numbers and interpreting them that way, it also makes sense to compare the actual results to what the expected values are, as this creates short-term price volatility upon release. This report is released every month on the first day of the month.

IAI Production

IAI Production is a report by a private company called the International Aluminium Institute. Their report is the definitive source for global production trends and is released on the 20th of every month. It allows us to see the total production per month and is generally seen as very accurate.

The Commitment of Traders Report

The LME releases a weekly report called the Commitment of Traders (CoT), which allows us to take a direct look at the position for futures contracts. We’ll be applying it here for aluminum, but the CoT Report can be used across all assets that have futures contracts and are released by the LME (London), CME Group (U.S.), and Eurex (Germany).

| |

Notation of the position quantity |

LOTS |

Investment Firms or credit institutions |

|

Investment Funds |

|

Other Financial Institutions |

|

Commercial Undertakings |

|

Operators with compliance obligations under Directive 2003/87/EC |

|

| |

|

|

Long |

Short |

Long |

Short |

Long |

Short |

Long |

Short |

Long |

Short |

| Number of Positions |

|

Risk reducting directly related to commercial activities |

68961,96 |

59441,85 |

314 |

6 |

4635 |

10647,15 |

93201,49 |

223677,66 |

0 |

0 |

| |

|

Other |

509471,48 |

483970,64 |

193464,29 |

61589,47 |

42524,75 |

10305,3 |

128312,32 |

191799,56 |

0 |

0 |

| |

|

Total |

578433,44 |

543412,49 |

193778,29 |

61595,47 |

47159,75 |

20952,45 |

221513,81 |

415477,22 |

0 |

0 |

| Change since the previous report (+/-) |

|

Risk Reducing directly related to commercial activities |

4908,78 |

4810,43 |

0 |

0 |

232 |

-219,12 |

3869,04 |

5669,5 |

0 |

0 |

| |

|

Other |

11692,39 |

-7971,52 |

-1790,43 |

-8335,45 |

1598,46 |

667,99 |

-28087,32 |

-2578,07 |

0 |

0 |

| |

|

Total |

16601,17 |

-3161,09 |

-1790,43 |

-8335,45 |

1830,46 |

448,87 |

-24218,28 |

3091,43 |

0 |

0 |

| Percentage of the total open interest |

|

Risk Reducing directly related to commercial activities |

6,63% |

5,71% |

0,03% |

0,00% |

0,45% |

1,02% |

8,95% |

21,48% |

0,00% |

0,00% |

| |

Other |

|

48,95% |

46,47% |

18,59% |

5,91% |

4,09% |

0,99% |

12,33% |

18,42% |

0,00% |

0,00% |

| |

Total |

|

55,58% |

52,18% |

18,62% |

5,91% |

4,54% |

2,01% |

21,28% |

39,90% |

0,00% |

0,00% |

| Number of people holding a position in each category |

|

|

Combined |

|

Combined |

|

Combined |

|

Combined |

|

Combined |

|

| |

Total |

|

40 |

|

315 |

|

19 |

|

51 |

|

. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Aluminum Commitment of Traders Report

The following table is an example of a CoT report for aluminum. Crucial to watch is the change since the previous report row, as it allows us to monitor how different types of participants are positioning as prices evolve.

The CoT report has the following categories:

- Investment Firms or Credit Institutions: Intermediaries and banks that mostly facilitate trading for clients. These firms aren’t taking directional positions, but are either market makers or investment banks/brokers trading for their clients.

- Investment Funds: Institutional speculators like hedge funds and, to a lesser degree, also mutual funds, are speculating on prices.

- Other Financial Institutions: Financial entities that don’t fit in the previous categories. Main examples here are insurance companies and pension funds. We can expect this category to be speculating, but on a longer time horizon, being more concerned with an investing style approach rather than trading.

- Commercial Undertakers: These are the traditional hedgers; they’re companies that are in some way involved in either producing aluminum or using it to create a more refined product, and want to hedge their exposure. Their bets are non-directional; they are concerned with limiting risk, not making outright profit.

Using these categories, we can understand the intention of each category of participants and understand how positioning evolves throughout time, and as prices evolve with it. While there is no ‘correct’ way to do this, the CoT report is just another piece of the puzzle and gives more confluence to trading ideas. For example, you might find that a certain category of participants is a good predictor of price and use its positioning as a confluence to your own setups.

Geopolitics

On top of the already discussed fundamentals, there are even more factors to consider. While these aren’t necessary to master the Aluminum markets, they can give you a leg up on the competition.

Russian Sanctions

Russia is the third-largest aluminum producer, and yet the EU has a direct import ban on Russian aluminum, while the U.S. levies a 200% tariff, which makes it impossible for Russian prices to compete with those of other countries.

This creates an increasingly fractured supply chain for Europe and the United States. On top of China, which is already limiting its exports, they are now also effectively pricing out Russian aluminum, which diminishes the available supply even more.

As the LME Aluminum futures are the benchmark price, which CFDs base their pricing on, this can create significant spikes in prices. Shanghai-noted contracts might be priced significantly lower than their London counterparts, due to geopolitical risks. This creates risk for upward volatility in Aluminum.

CBAM: The Border Tax

The European Union has implemented a policy to incentivize Aluminum producers to minimize their carbon emissions and level the playing field between imports and European production, as Chinese or Indian producers have much looser regulations about how they can produce aluminum. The Carbon Border Adjustment Mechanism (CBAM) is essentially a tariff on high-carbon imports (most often those coming from China & India).

This policy is set to be implemented by 2026 and will increase the carbon emission cost of aluminum in the European region by $20-50 (0.6-1.5% at prices of 2500GBP). This policy has the goal of making low-carbon emission producers more competitive, such as the Norwegian producer Norsk Hydro, which uses renewable energy to produce Aluminum. This policy will become more aggressive over time as the European Union wants to leave enough time for this transition to low-carbon production to be made successfully. From 2026-2033, the taxation is expected to stay constant, whereas after 2034, taxation will be ramped up.

This policy is likely to drive a bigger premium between regular and low-carbon aluminum, potentially driving up LME prices compared to Shanghai.

Conclusion

Successfully trading aluminum in the coming years will depend on traders being able to abandon the single-price mindset and instead learn to separate prices in London and Shanghai.

There’s an edge here for specialized traders to exploit the arbitrage opportunities between the two venues and to use the governmental policy in combination with standard technical analysis to correctly predict London prices, which CFDs are based on. It’s necessary to understand the role of recycled aluminum and energy prices as leading indicators for prices.

Additionally, price behaviour around the Third Wednesday of the month, when most contracts expire, might show certain patterns. In some cases, this could create situations where traders attempt to anticipate the moves of participants who need to adjust their positions, potentially at less favourable prices.

Gain access to global base metals and trade the trends shifting the Aluminum market with Axiory.