Soft commodities are a distinct asset class, fundamentally different from other investments. They are agricultural products that are cultivated or bred, such as wheat, corn, coffee beans, and livestock. This is in contrast to hard commodities such as oil, gas, and a plethora of metals, which are extracted.

The difference is not merely a theoretical classification but a difference in underlying fundamentals and price behavior. For example, a gold mine can operate year-round, whereas agricultural products are subject to harvesting cycles. This biological necessity introduces a seasonal element to price behavior, absent in hard commodities.

Trading these markets has its unique challenges but also unique benefits, thus providing a significant edge for those willing to dive deep into the factors that drive prices.

Because of that, we’ll be going deeper into the pros and cons of trading soft commodities, the fundamentals that drive price, and the market participants.

Trading Soft Commodities through Contracts for Difference

Before diving into the specifics of soft commodities, a solid understanding of how CFDs work and how they differ from buying futures contracts is required. These are some of the key features of trading through a CFD:

- A CFD is a cash-settled derivative. This means you never physically buy, sell, or take delivery of any goods. You are speculating on a contract that is made to track the prices of soft commodities futures in major markets. Using CFDs thus allows you to speculate on prices without ever having to worry about rolling over a futures contract or undertaking physical delivery.

- CFDs allow you to use leverage, enabling you to use your capital more effectively. Using leverage wisely allows you to hold multiple positions at a time without tying up all your capital in just one asset. It also allows you to size up positions and potentially make significant profit from intraday swings that would otherwise achieve only a small percentage gain. Leverage is a tool; when used wisely, it can amplify potential returns, but if used without understanding, it can also increase the size of losses.

- Unlike a physical investment, holding a CFD position past the daily market close typically incurs an overnight financing charge (or 'swap fee'). This cost makes holding positions for extended periods less profitable. Therefore, the strategies discussed below are suited more for short to medium-term trades instead of longer-term investments.

Should I trade soft commodities?

As we've established, this is a unique asset class with a different learning curve. Traders transitioning from Forex or equities, for example, will need to acquire new knowledge before they can successfully navigate these markets.

The Pros

One of the biggest advantages is the diversification they offer against other financial markets. The price behavior of soft commodities is largely uncorrelated with that of traditional investments, giving them a unique place in a portfolio. This can help to "smooth out your equity curve," meaning that using them wisely can lead to smaller drawdowns, allowing you to trade with more confidence and experience less psychological stress.

Beyond their low correlation to other asset classes, different soft commodities also often have a near-zero correlation with each other. In practice, this means you can have trades open in sugar, soybeans, and coffee at the same time without worrying about their prices being linked. This is a distinct advantage over, for example, equities, where the price behavior of indices like the S&P 500, DAX, and NIKKEI is often closely linked and tends to move together.

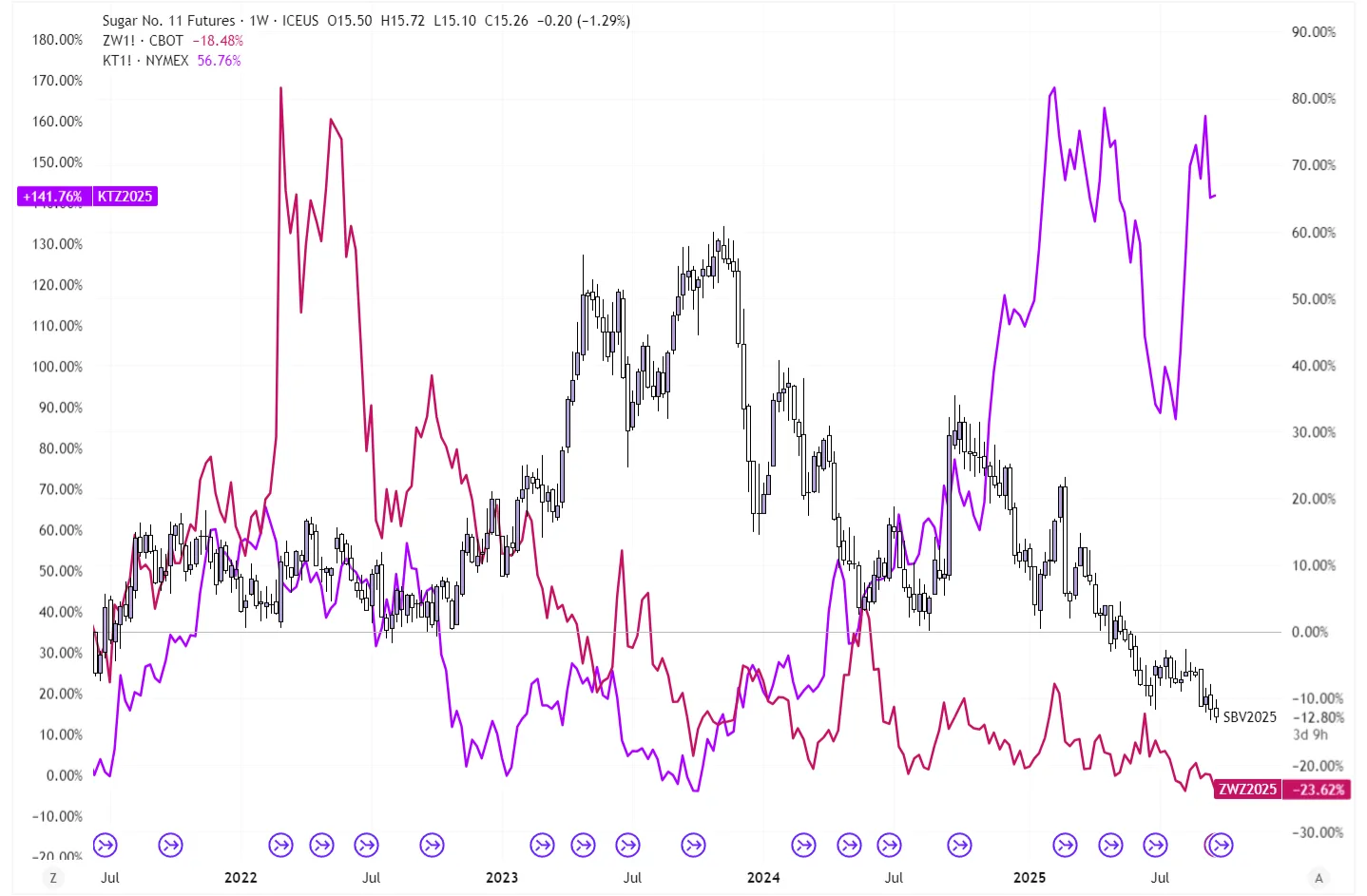

If you're unsure about the correlation between assets, a simple visual inspection of their charts can often tell you a lot. Consider this comparison between sugar, wheat, and coffee:

A portfolio of assets with low correlation is ideal for trading, as it allows you to manage each position independently without a high risk of one trade influencing another. This lack of correlation is a massive benefit of this asset class.

Other benefits of trading soft commodities are the following:

- Weather and seasonal patterns: Soft commodities reward traders who can generate insights from weather forecasts, planting and harvesting cycles, and global climate phenomena like El Niño/La Niña.

- Trend-following Opportunities: When a supply shock occurs, we can often see very explosive price movements. For example, coffee recently experienced a 50% increase in price over just two months. While this volatility comes with risks, it also provides an array of profit opportunities for those who can spot trends early and ride them with sound risk management.

The Cons

As is often the case, a benefit can also be a drawback. We'll start by addressing the risk of volatility. While we just mentioned that volatility is a great opportunity for traders who can spot trends, it's a huge risk for those who lack a solid risk management system and suddenly find their position has moved 10% against them in a matter of days. So, while volatility presents many opportunities, it comes with a big responsibility to have your risk management figured out.

Another potential downside is that commissions are typically higher for soft commodities. While many Forex pairs have spreads under 10 pips, spreads for soft commodities tend to be higher due to lower overall traded volume. This is partially compensated for by the generally higher volatility, which can lead to smaller absolute trade sizes and thus diminish the impact of higher commissions.

Ultimately, the takeaway from the pros and cons is that soft commodities can be a very lucrative asset class, provided you are willing to put in the time to master their unique nuances.

The Drivers of Price Behavior: A Unique Market

While traditional markets are driven mostly by the demand side (e.g., how many people believe a company will be profitable?), the demand for soft commodities is much more stable. People rarely change the amount of coffee they drink or the amount of pasta they eat.

These goods are what economists call inelastic goods. They are often basic food staples like bread, rice, and coffee. This means that even if prices were to rise sharply, demand would likely remain mostly the same.

Weather

As soft commodities are a supply-driven market, a trader's focus should be on factors influencing output, primarily the weather.

As a result, soft commodity traders closely monitor weather reports. One of the most important is the World Agricultural Supply and Demand Estimates (WASDE), released monthly by the U.S. government. This report includes worldwide forecasts for crops such as wheat, corn, and soybeans. For traders used to other financial markets, the WASDE report holds as much significance as an FOMC meeting would for Forex or equities. For example, a recent WASDE report noted that the total estimated U.S. soybean acreage would be 80.1 million acres instead of the previously expected 82.5 million. Although a relatively small difference, it led to the price consistently rising over the next several days.

Geopolitics

Another major factor driving soft commodity prices is international politics. Tariffs are particularly important here, as they can lead to huge price spikes or drops, sometimes overnight. For example, during the 2018 U.S.-China soybean trade war, China levied a 25% retaliatory tariff on U.S. soybean exports. This tariff created an immediate, overnight 25% price difference between American and Brazilian soybeans.

Cross-Asset influences

Earlier, we noted that soft commodities, as a group, show very little correlation against all other markets, and even against one another.

In some cases, however, there is a very interesting exception. For example, sugar exporters can choose to either export sugar or use it to create ethanol. Ethanol is a biofuel, making it a direct substitute for oil (both Brent and West Texas Intermediate) and natural gas. This means that when the prices of these energy goods go up, sugar exporters divert more of their sugar production into ethanol. This action lowers ethanol prices but causes sugar prices to rise due to the lower overall supply. This unique relationship creates a dynamic stabilizer between energy markets and sugar prices, both helping to limit the surge of energy commodities and holding up sugar prices during periods of very high supply. For a sugar trader, a sharply rising oil price can therefore serve as a leading indicator for the price of both sugar and corn (which is also used to create ethanol).

Market Participants: Who are you trading against?

Every trade has a counterparty, so it's wise to ask: who are the major participants in this market? What are their goals, strengths, and constraints? There are three broad groups:

- Hedgers: Companies that produce or consume commodities and want to limit the risk of adverse price movements.

- Institutional Speculators: Banks, hedge funds, asset managers, and similar firms seeking to make a profit in the market.

- Retail Traders: Individual speculators.

Terminology can vary, but the underlying roles are similar. For example, a corn producer worried about bumper crops next year and falling prices might open short hedges. Profits from those hedges can then offset lower cash-market revenue.

Each participant behaves differently, and anticipating their behavior can provide a significant edge. For example, understanding how hedgers execute large orders can present opportunities. One way to analyze their positioning is via the Commitment of Traders (COT) reports. These reports provide data on the positions held by different participant categories, offering insight into where capital is positioned and how conviction is shifting.

How to Trade Soft Commodities

Now that we've covered the key fundamentals, let's explore how to apply this knowledge to trading. A comprehensive approach that combines fundamental and technical analysis can help develop your own trading ideas.

One of the most effective strategies is to use fundamental analysis to establish a directional bias, and then use technical analysis to time your trades. For example, a fundamental analysis of a hot, dry summer in the U.S. Midwest could lead to a thesis of tightening soybean supplies, resulting in a long-term bullish bias. This bias could then be checked by analyzing how hedgers are positioning through the Commitment of Traders (CoT) report. A net increase in long positions would further support your view.

Technical analysis can then be used to identify optimal entry and exit points for the trade, such as looking for a support area to open your position. This integrated approach allows you to effectively marry the “why” (fundamental analysis) with the "when” **(technical analysis), giving you a well-rounded approach.

Conclusion

The soft commodity market rewards preparation and discipline. It offers unique opportunities to traders who master its drivers and respect its volatility. Success in this asset class favors a deep understanding of its supply dynamics and the behavior of its market participants.