VIX Spikes as Indices Remain at ATHs - Fed Rate Cut Priced in Despite Data Blackbox

Introduction

Markets are preparing for the key FOMC Meeting, which sees the Fed having to make a decision between keeping inflation under control or letting the economy deteriorate, all while experiencing a lack of macroeconomic data due to the government shutdown.

Equity indices are showing a unique dynamic, with the VIX rising right at all-time highs. On the other end of the strong performers, Gold had one of its worst days ever, coinciding with massive retail interest.

Global Macro

The world of Global Macro experienced a relatively quiet week, with the sole exception being the release of U.S. CPI (Consumer Price Index) data on Friday afternoon. This reading represents the first significant economic data point since the U.S. government shutdown on October 1st. Given the current complexities surrounding economic policy, this specific CPI number carries heightened importance and could generate significant volatility upon its release.

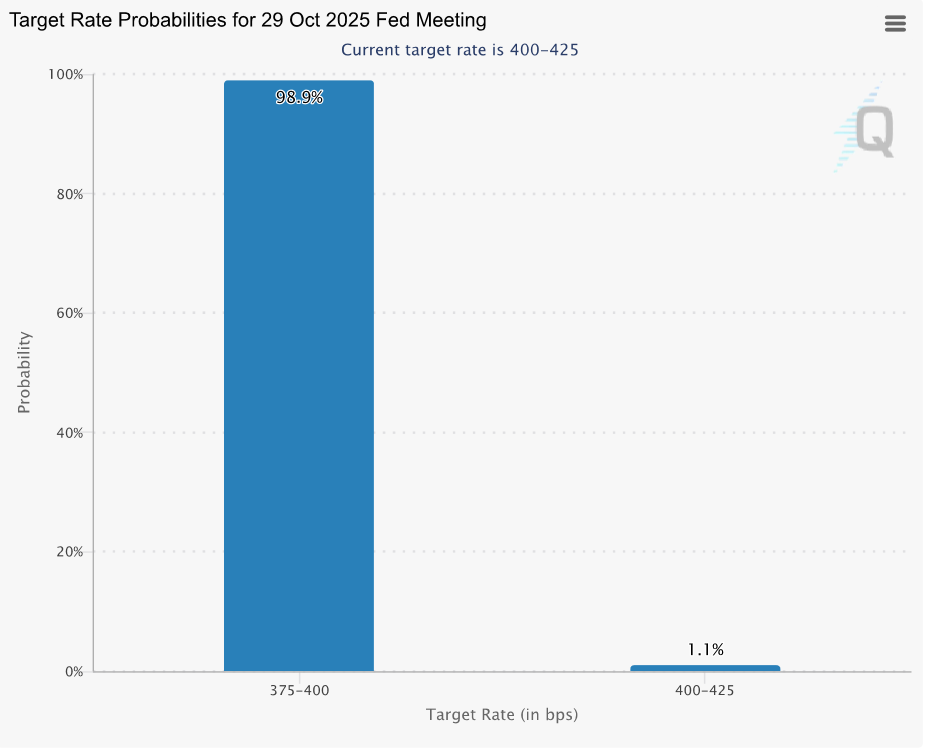

Looking ahead to next week’s FOMC Meeting (Federal Open Market Committee), expectations remain consistent with last week's analysis. A further 25 basis point rate cut is currently priced in with near-certainty (99% odds). However, these odds could shift drastically if the CPI data comes in higher than anticipated. While the Federal Reserve appears inclined toward easing policy, it remains data-dependent. A sudden flare-up in inflation, as indicated by CPI, might compel them to pause rate cuts for a period.

Equities

Major Indices across the U.S., Europe, and Japan have returned to their All-Time Highs following the brief period of tariff-related fears. Despite this upward movement, we are observing a unique divergence. The VIX, commonly referred to as the 'fear indicator,' is printing higher readings. Typically, the VIX only tends to rise during periods of market stress, with the last notable spike occurring during the April-May tariff concerns.

While the current levels are not nearly as elevated as they were earlier in the year, the combination of a rising VIX alongside rising asset prices is highly unusual. This market dynamic suggests that even as markets show strength, investors are actively buying put options (downside protection). This indicates that despite a strong bull run, investors are seeing more and more risk. This results in a unique market sentiment across risk-on assets, which is strong, yet cautious.

Forex

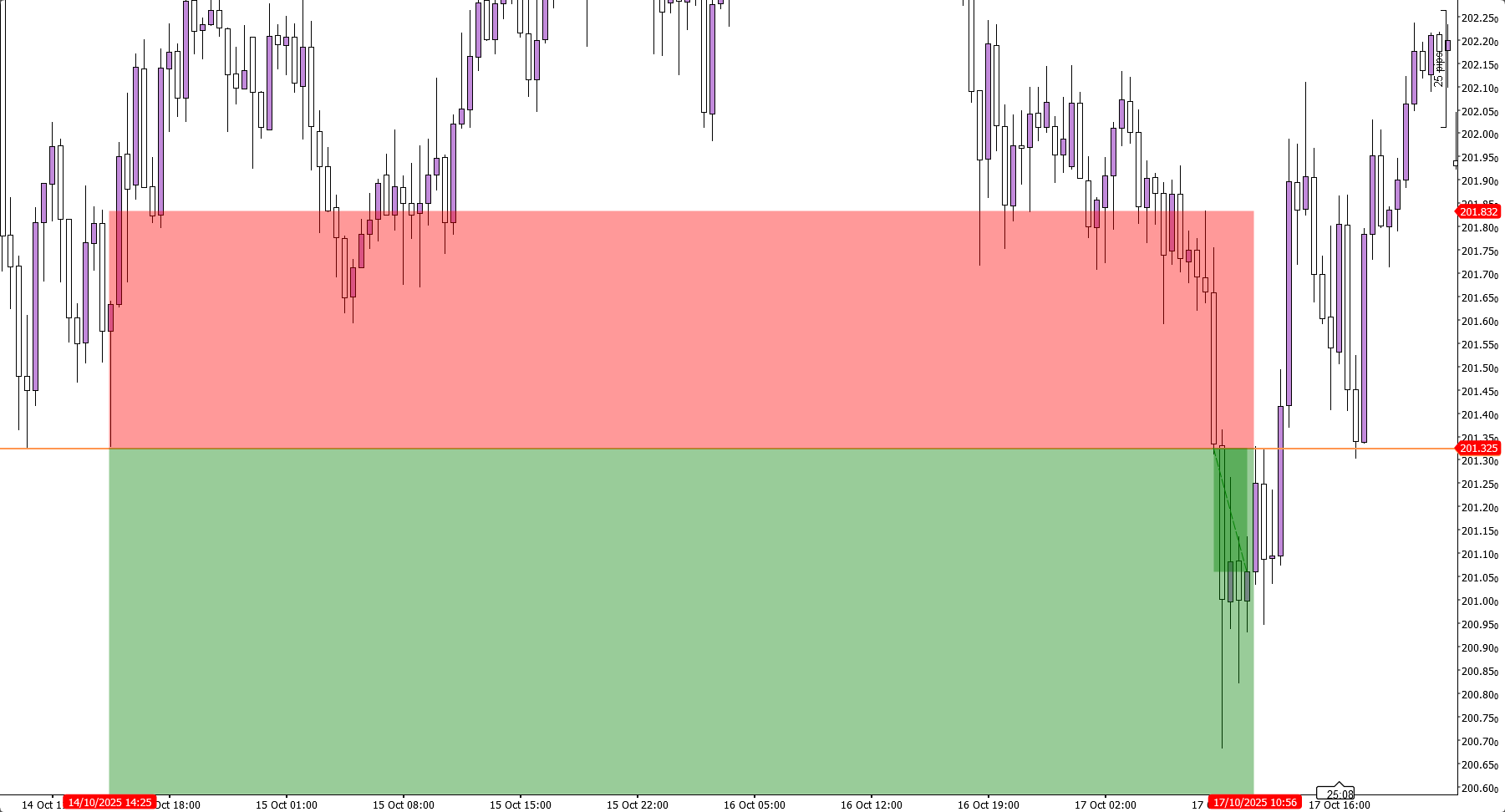

In Forex, most pairs were relatively flat. The eye-catcher was USDJPY, which put in a clean hammer candle (long downside wick, small body) on the Daily chart. Elsewhere, the GBPJPY setup we highlighted last week, targeting a gap close, ended up failing.

Price got a very precise initial reaction of the level, but ultimately failed to sustain downward price momentum. Afterward, price flipped this key level back into support, which ended up being the weekly low.

Commodities

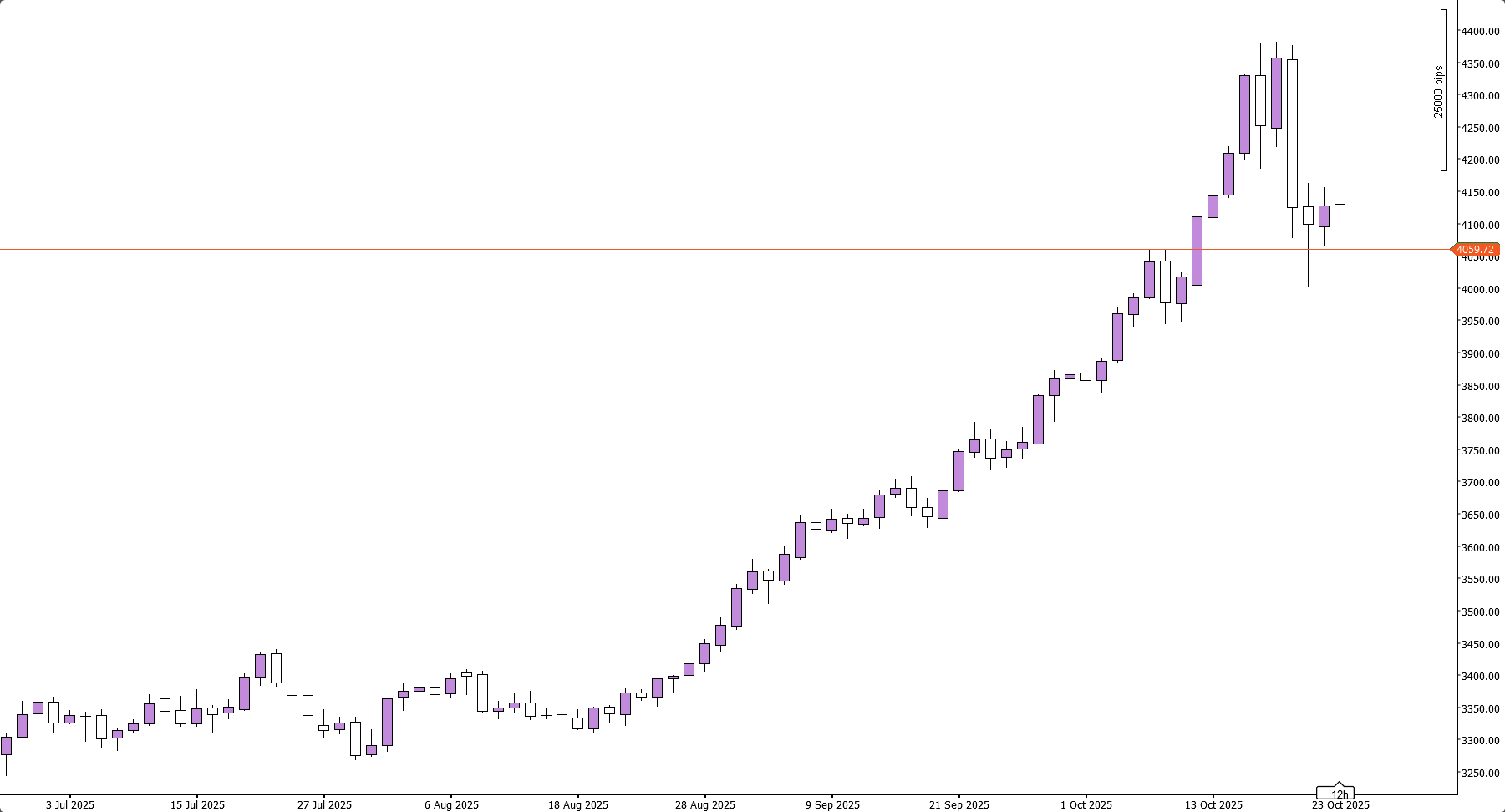

Gold experienced a historically steep down day, dropping sharply from $4,375 to $4,080 on Tuesday. Interestingly enough, the top coincided with news of retail investors lining up to buy physical gold across the world.

As we suggested just last week, Gold appeared overextended, so a modest retracement is a logical market movement. The fundamental bull thesis for Gold remains robust, supported by a weakening trust in Fiat currencies and central banks making massive Gold purchases as a macroeconomic hedge. In the shorter term, however, Gold was arguably overdue for a correction, which the recent chart action clearly demonstrates.

Conclusion

One-sentence summary of the week:

Risk-on market sentiment is cautiously optimistic, as Gold retail hype predicts a local top.