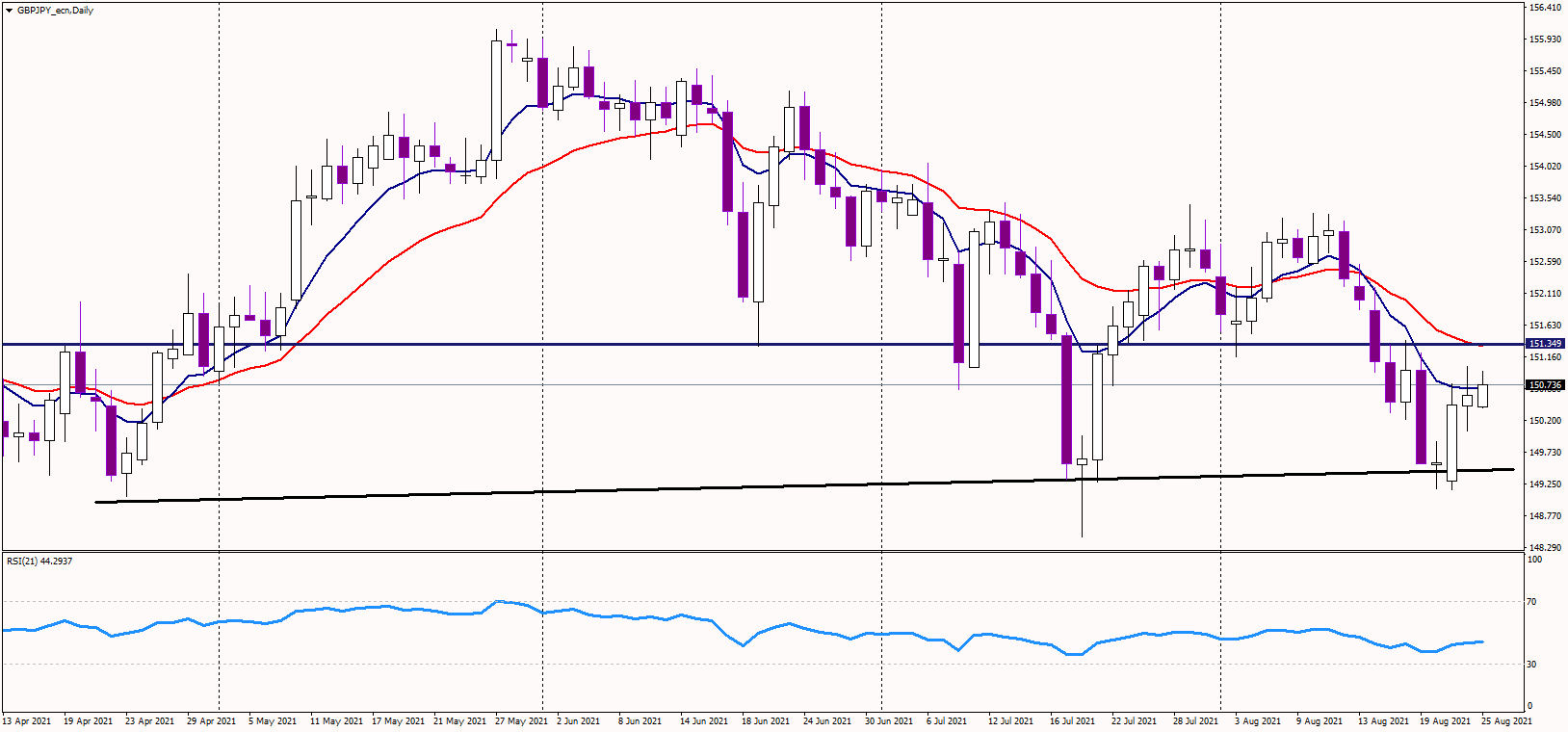

All risk assets continued to rebound on Wednesday, and the GBPJPY cross was no exception, last seen 0.2% higher during the US session, trading near 150.70.

During last week's decline, the price dropped to the 149 area, where the strong uptrend line is located. In July, an impressive bullish pin bar formed here, sending the price sharply higher in the following days.

This time, the price did for any clear bullish reversal sign, but a similar bounce occurred, confirming the strength of the trend line. Therefore, as long as the cross remains above 149, the medium-term uptrend appears cautiously bullish. Additionally, the 150 zone is important from the short-term perspective, and bulls should keep the Pound above it.

The current bullish momentum might drive the price toward 151.35, where previous lows are converged with the 21-day exponential moving average. That could be the key resistance for the near future.

Alternatively, should sentiment worsen again and the selling pressure returns, The mentioned two supports at 150 and 149 must be defended, or a risk of a larger correction becomes real.

Most volatility is expected on Friday, when Jerome Powell announces his plans for monetary policy, with investors expecting a taper announcement.