Forex Arbitrage Explained

There are plenty of

Forex strategies, however, traders always look for those methods where they can reduce their risks as much as possible, while still being able to earn decent payouts.

One approach which might satisfy the above-mentioned two criteria is the triangular arbitration strategy. As the name suggests, it involves the use of three currency pairs. In order to explain this in more detail, and see how arbitrage trading works, let's return to the forex arbitrage trading sample.

The entire process is completed in 4 stages:

- An individual opens a long EUR/USD position by buying €10,000 and selling $11,000.

- The trader then opens a short EUR/GBP position, purchasing £8,800 in exchange for the sale of €10,000.

- After that, the individual opens a short GBP/USD position by buying $11,044 and selling £8,800.

- The trader closes all three positions and earns a $44 payout in the process.

As we can see from this example, the triangular Forex arbitrage strategy can be quite straightforward, however, there are some considerations.

Firstly, for simplification, there are round numbers used in this example. Also, 50 pip arbitrage opportunities were used for demonstrating purposes, and in real life trading, this is a very rare occurrence, especially when it comes to the major currency pairs.

Secondly, when those kinds of opportunities do appear, it is not only visible to one trader, but to thousands of market participants. Trades can also use the Forex arbitrage calculator, which can be much faster compared to making those calculations manually.

Keep in mind that the triangular Forex arbitrage opportunities are usually very short-lived, and the market is quick to correct those pricing inefficiencies. Therefore, it is essential for a trader to act quickly on those possibilities before they disappear because of the inevitable adjustments.

Is Forex arbitrage possible with the interest rate differentials?

When discussing how to use an arbitrage strategy in Forex, it's worth mentioning that there are many arbitrage strategies available for traders to use. Trading long short arbitrage Forex positions can be challenging for novice traders as it requires a good understanding of financial markets.

Covered interest arbitrage is another possible option. This approach aims to exploit the interest rate differentials between the two currencies. For example, nowadays, the Federal Funds rate is confined within the 0 to 0.25% range. Consequently, putting money in the Bank Certificate of deposit might not be the most attractive option for many people. Therefore, investors are looking for other ways to earn a decent return on their savings.

One alternative can be the use of covered interest arbitrage. This essentially means, for example, converting low-yielding USD funds to higher-yielding currencies.

This can be done in two ways. For example, an investor can sell his or her USD assets and deposit this amount to the Russian ruble savings account. Since the Bank of Russia still keeps interest rates above 5%, then it is possible to earn similar returns. The obvious problem here is the exchange rate risk. To tackle this issue, an investor can buy a forward contract and lock in the exchange rate, once the term expires and he or she converts the investment back into US dollars.

Alternatively, an individual can open a short USD/RUB position, earning up to 5% annually on the interest swaps. At the same time, a trader can purchase an option to protect the investment from a possible Ruble depreciation.

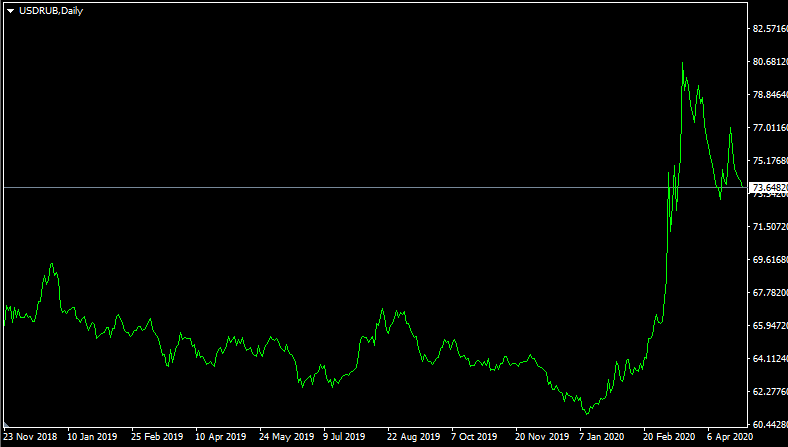

To see how this type of arbitrage trading in Forex can be explained, let us take a look at this Daily USD/RUB chart:

So let us suppose that a group of traders has decided to use the covered interest arbitration method with this pair. So they have opened a $100,000 short position with USD/RUB at 65, while at the same time purchasing an option, which gives them the right to close this trade at 65.50.

If those market participants decide to close the position by the early January 2020, at 62, then traders would earn approximately $4,839 profit from this trade and $5,420 in interest swaps. So in total that would represent a nice $10,259 payout.

On the other hand, if they had waited longer and faced a ruble depreciation that took place, traders would have exercised the option and closed the trade at 65.50, instead of 74. As a result, those market participants would have lost $763 because of the exchange rate, however, would have gained $7,080 on the interest swaps. This would represent quite a decent $6,317 payout.

As we can see from this example, traders can benefit from both scenarios. So this is the essence of Forex covered interest arbitration strategy.

How to use Statistical Forex arbitrage strategies?

One can argue that no Forex arbitrage guide will be complete without mentioning the Statistical Forex arbitration method. This approach is quite different from the other ones mentioned above. Basically, this strategy aims to identify underperforming currencies and buy them against the overperforming currencies. The reasoning behind this method is as follows: unlike in the Stock market, which over the long term has a tendency to rise significantly, the Forex Major pairs mostly move in cycles.

For example, if we take a look at the historical charts, we can see that in some years USD was the strongest currency. While in some other periods, the Euro or the Japanese yen were the best performers in the market. So in Forex, there is no one single currency that constantly rises, instead, all of them go through the

bullish and bearish cycles to some extent.

Here it might be helpful to mention that when it comes to using a statistical arbitration strategy, there is no single universal method of measuring currency valuations. In fact, there are dozens of indicators, some of them using complex formulas or patterns to come up with some results.

Luckily, traders do not have to go through those complicated measurements. Instead, they can use the Purchasing Power Parity. The basic idea behind this theory is that over the long term, currency exchange rates converge towards the PPP level, which is a rate at which the prices of goods and services will be equalized between the two countries.

The Purchasing Power Parity is measured by the Organization for Economic Cooperation and Development, as well as by the British financial magazine, the ‘Economist’. The updated version of PPP data is available from the websites of those two organizations.

So how can this method work in practice? According to the Economist’s Big Mac Index (BMI), the Japanese yen is one of the most undervalued major currencies. In fact, by the time of publishing the latest report, it was 24% undervalued against the Pound and 29% undervalued against the Euro.

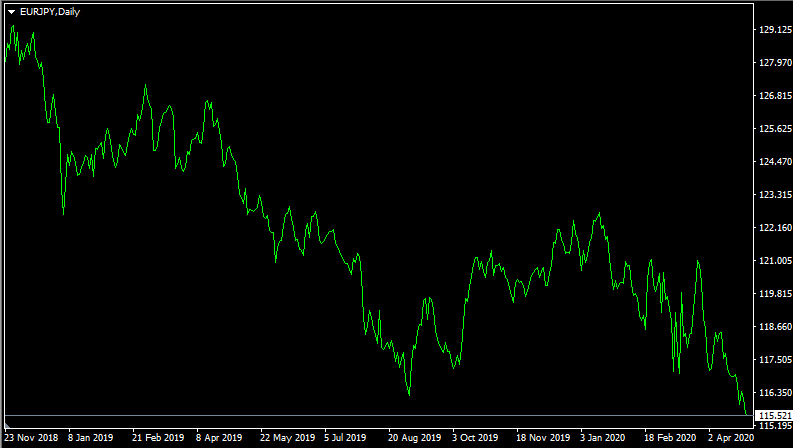

Then, what would have happened if a trader decided to buy the Japanese yen against those overvalued currencies? To answer this question, let us take a look at this daily EUR/JPY chart:

As can be seen from the above, during recent months the EUR/JPY pair did fluctuate significantly, but at the same time, the Euro is clearly in the long term downtrend against the Yen.

So how can this be explained? Well, according to the Economist, the Purchasing Power Parity for those two currencies is at 106 mark, yet as we can see at the beginning of this chart the pair traded well above 128 level.

According to the PPP theory, this disparity made the Japanese goods much cheaper and consequently more attractive compared to their European counterparts. Therefore, businesses and individuals recognized this opportunity to purchase raw materials and other goods at lower prices. However, in order to access those, investors and businesses had to convert their currencies to JPY. As a result, the demand for the Japanese currency increased, and it started appreciating against the Euro.

Also, most traders using this strategy do not usually confine their trades to one currency pair, instead, they create a basket of undervalued currencies and open several positions accordingly.

Finally, it might be useful to point out that currencies do not always converge towards PPP levels in a short time frame. Sometimes it might take months or even longer for the market to adjust, therefore this arbitrage strategy might be more effective for long-term trading.

Arbitrage trading Forex pairs requires preparation. Traders need high-speed internet and great trading algorithms to catch price inefficiency the moment they appear.

Triangular arbitrage explained

Triangular arbitrage refers to the method of trading the Forex by exploiting price inefficiencies between three currency pairs. Traders can take advantage of inconsistencies in exchange rates to make a profit by trading three currencies, hence the name triangular. Currency exchange rates should be consistent, but market fluctuations sometimes can create temporary discrepancies that traders can exploit for quick profits.

The method for employing the triangular arbitrage method includes identifying opportunities, executing trades, and realizing profits by closing all trades. To identify the best opportunities, traders have to constantly monitor exchange rates among different currencies to find inefficiencies. The simplest approach would be to select and monitor a limited number of currency rates, while the more advanced approach is to use algorithms and automated robots that can catch inefficiencies much faster than humans. After a trader finds inefficiencies, they initiate a series of trades to exploit the inconsistency and make profits. Again, this process could also be automated, which typically is a more expensive option. The sequence for executing the trades usually involves converting an initial currency to a second currency, the second to a third currency, and finally, the third back to the original or first currency. As you can see, this is not something recommended for beginners, as it requires some time and effort to master. The final step is profit realization, where if executed correctly, traders end up with more initial currency on their balance than they started with.

One downside of triangular arbitrage and all forms of arbitrage in general is that markets adjust very quickly and traders often have several seconds to capitalize on opportunities. This is why using preprogrammed algorithms and trading robots could be a more expensive but also more effective way. To use triangular arbitrage effectively traders will need to practice and understand the underlying exchange rate concepts very well.

Why do some brokers not allow arbitrage?

Not all brokers allow arbitrage, as it can be dangerous for new brokerage companies. The arbitrage opportunities are typically occurring on the new broker platforms. There are many reasons why both new and established brokers might prohibit their traders from using all forms of arbitrage. Here is the list of top reasons:

Risk management — Arbitrage strategies can introduce large trading volumes that can increase risks for brokers if not managed properly. Especially susceptible to these risks are beginner brokers as they can experience substantial losses.

Technology and latency — High-frequency arbitrage (involves algorithms) relies on ultra-fast execution and some brokers may not have the technological infrastructure to support such rapid trading activities.

Operational complexity — It requires advanced risk management systems and constant surveillance to detect and prevent arbitrage opportunities, and not all new and small brokers possess such resources.

Profit reduction for brokers — Brokers rely on spreads or differences between buy and sell prices. Arbitrage makes money on the price differentials which can reduce profits for brokers.

Liquidity issues — Arbitrage takes advantage of small price differences, and new and small brokers often lack the liquidity to handle the increased trading volumes caused by arbitrage strategies.

Compliance and legal risks — Different jurisdictions have varying regulations and guidelines regarding arbitrage. Brokers need to stay compliant with the regulations, and they may prohibit arbitrage to stay relevant with their regulators.

Broker reputation — Allowing certain forms of arbitrage may expose brokers to reputation risks affecting their credibility and trustworthiness. Brokers try to have high-quality price data and having inefficiencies in prices can harm their image.