Introduction

This week saw three central bank decisions, nomination for the new Fed chair, an end to the chronic Dollar weakness, and historic volatility in Gold and Silver.

Global Macro

New Fed Chair

The guessing game is finally over. President Trump has officially nominated Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve when Powell’s term concludes in May.

Warsh’s appointment is particularly interesting given his hawkish reputation during his previous tenure on the Fed Board (2006–2011), which ended with his resignation in protest of Quantitative Easing. However, the "New Warsh" seems aligned with Trump’s demands for lower interest rates.

Warsh has recently suggested that the AI-driven productivity boom could act as a potent disinflationary force, allowing for lower rates without the risk of a resurging inflation.

For now, Powell is in charge until May, but it will be interesting to see what the macro picture looks like by the time Warsh is sworn in.

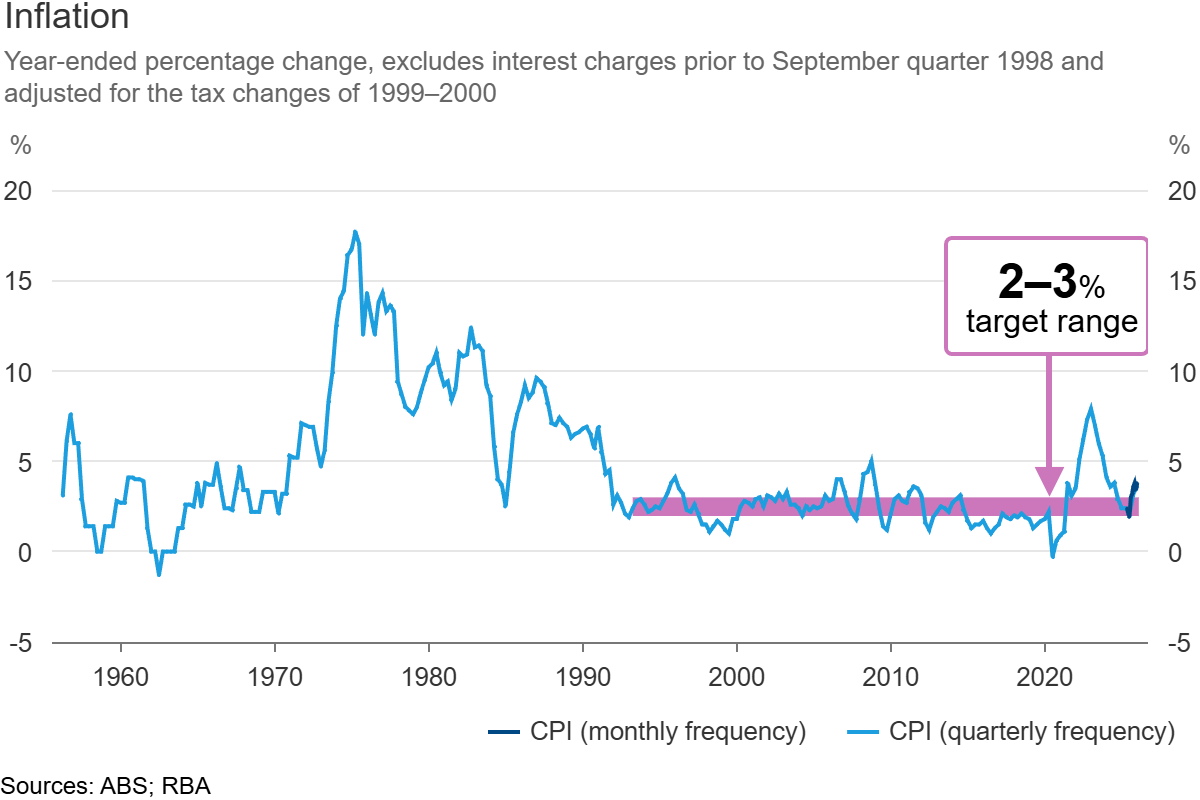

RBA Monetary Policy Decision

The Reserve Bank of Australia (RBA) became the first major central bank to pivot back to hikes this cycle. Inflation had come down to a low of 2.1% in June 2025, but since then, inflation has been resurging, with the latest CPI data point coming in at 3.8% YoY.

Since the RBA doesn’t think this spike is transitory, a rate hike was warranted. With the Australian economy proving more resilient than many anticipated, the decision to tighten was, in their view, a relatively straightforward call.

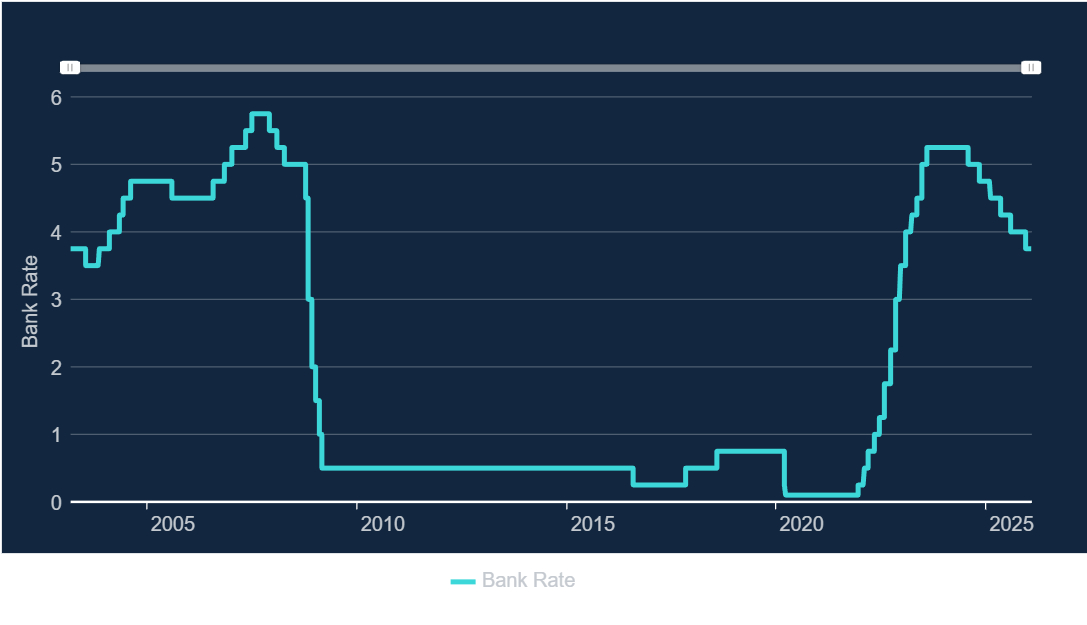

BoE Official Bank Rate Decision

Just like its last meeting, the BoE was again very divided. Ultimately, the MPC voted 5-4 to keep interest rates at 3.75%.

The decision to consider rate cuts so clearly is already quite interesting, as inflation is currently at 3.4%, well above the 2% target. However, inflation has been falling, and the BoE is convinced that it will fall to their 2% target by late spring.

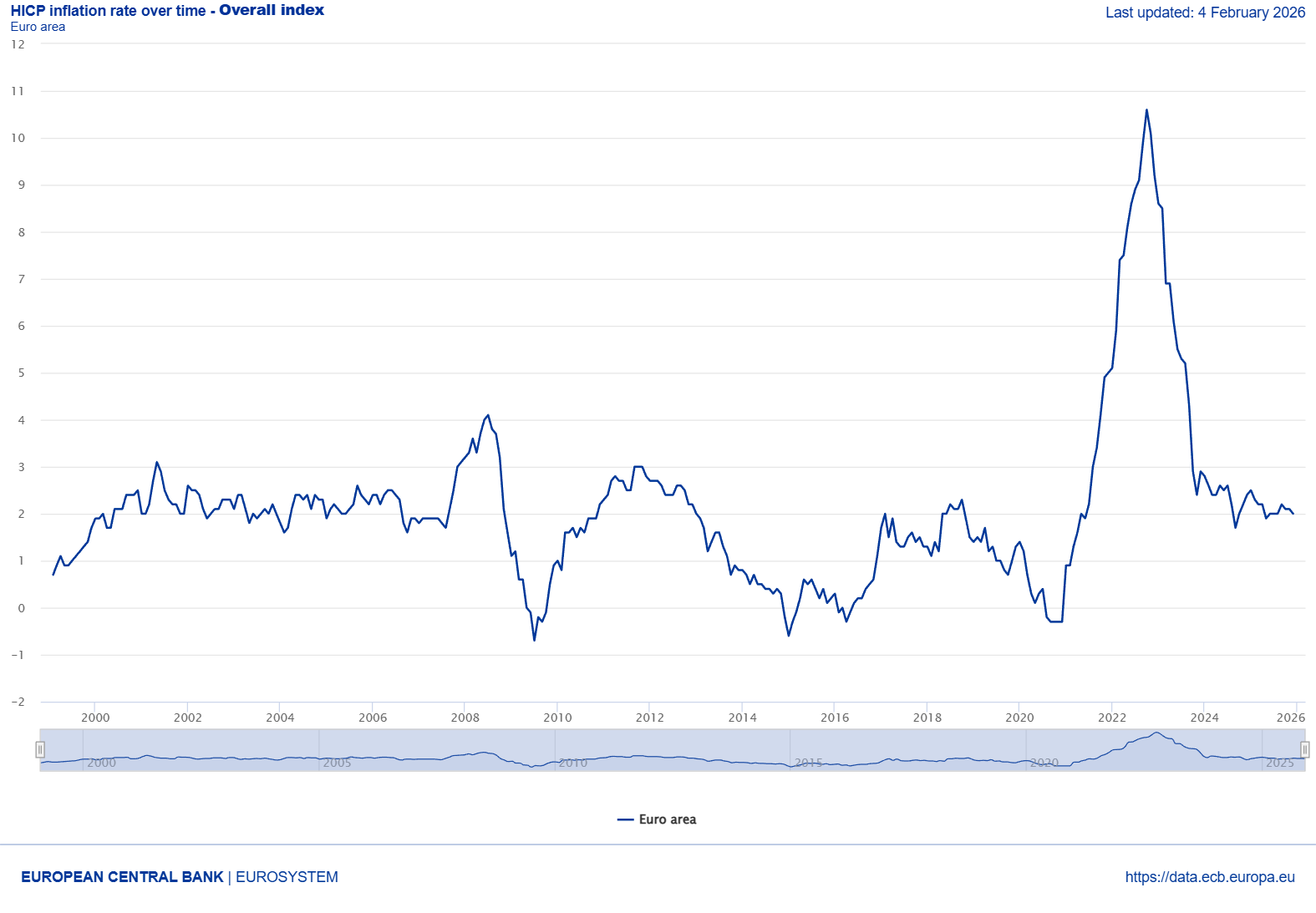

ECB Main Refinancing Rate

In contrast to the drama elsewhere, the European Central Bank (ECB) meeting was the definition of business as usual. Inflation in the Eurozone has essentially landed on the 2% target, and while growth remains modest, it is stable enough to discourage any sudden moves. Despite a slight dip in January inflation to 1.7%, the consensus is that the Main Refinancing Rate will likely stay parked at its current levels for all of 2026.

Equities

This week saw a stark geographical divide. While the Nikkei pushed toward new all-time highs, European indices closed flat, and the S&P 500 and Nasdaq lost quite a bit of terrain.

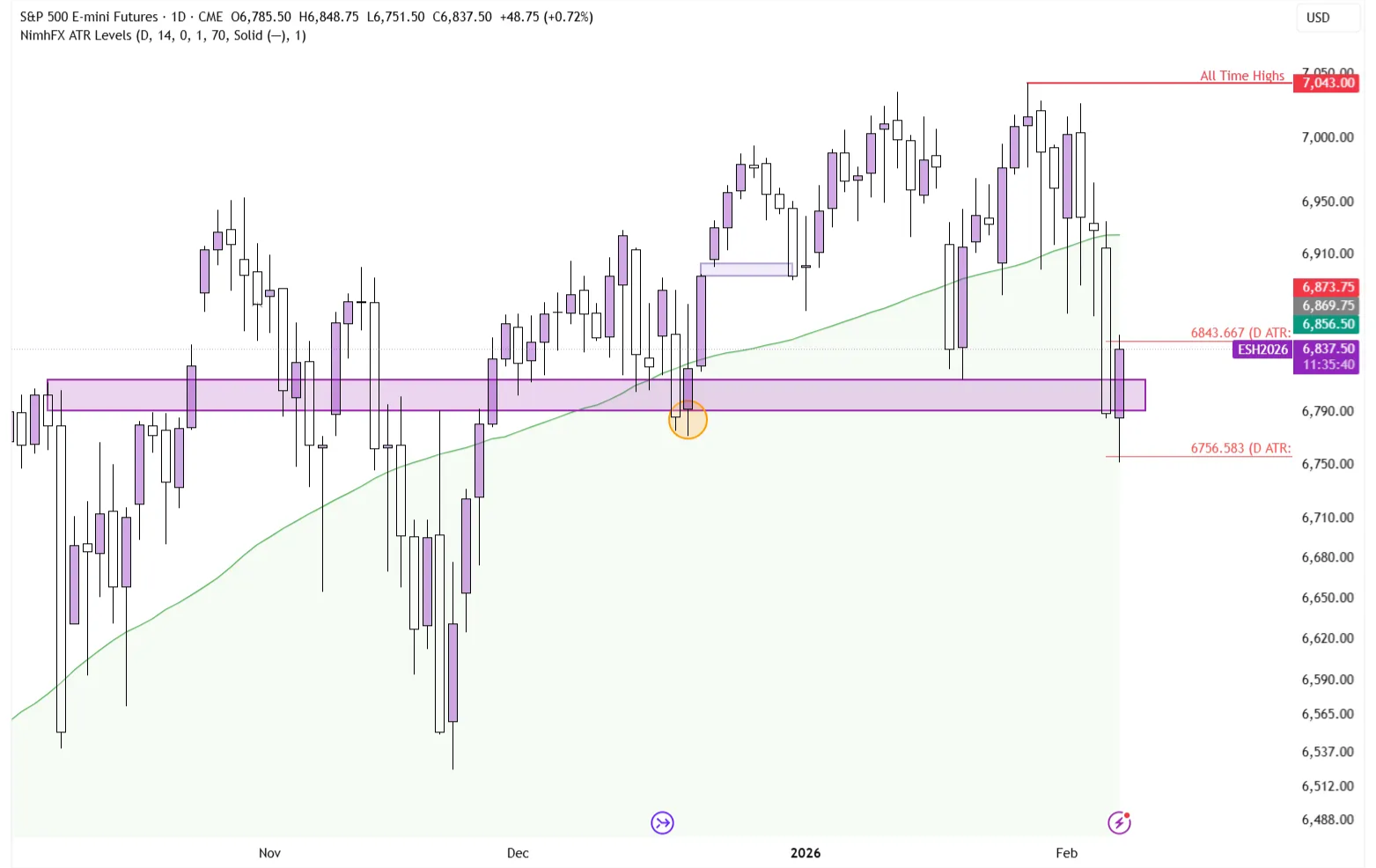

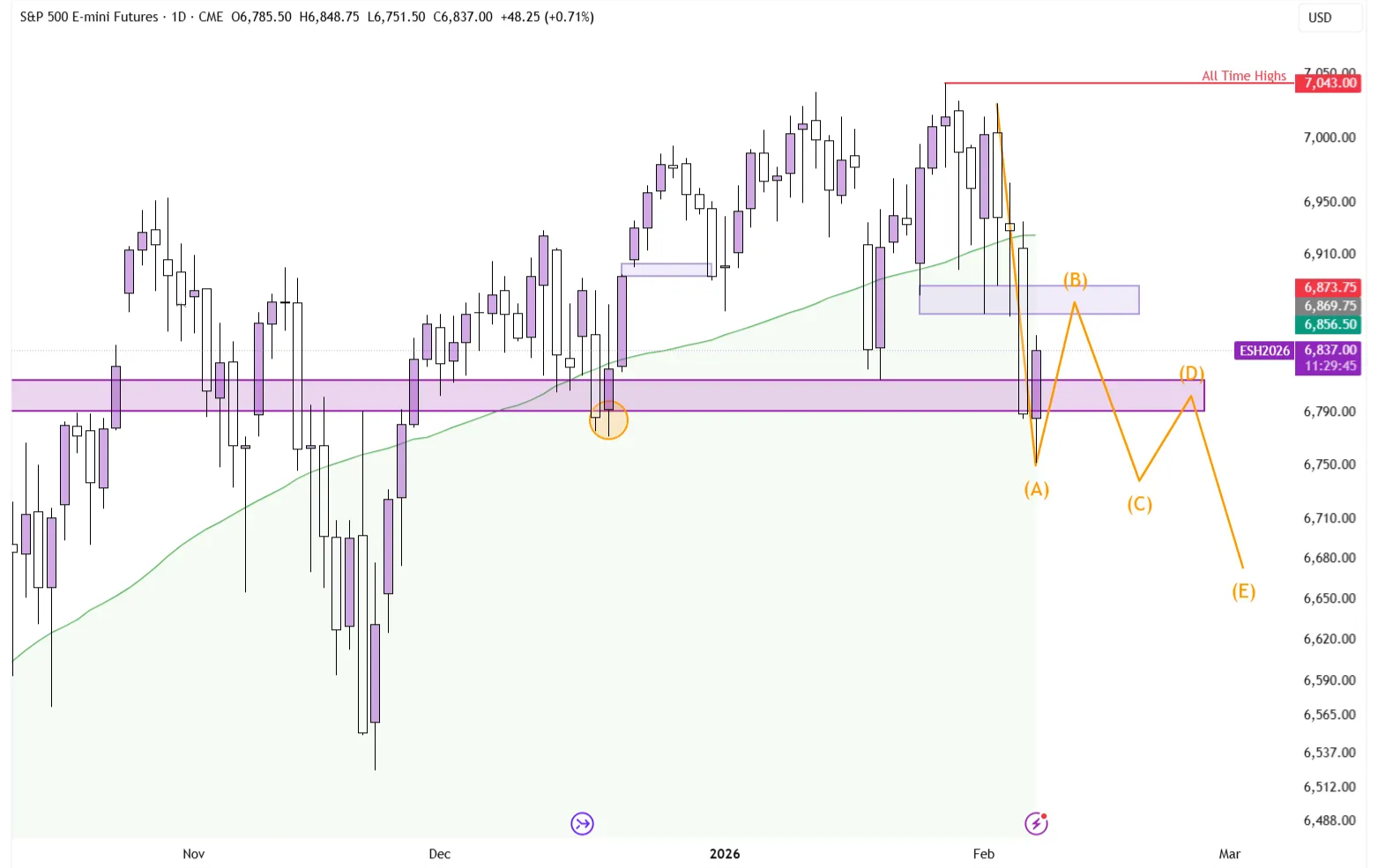

S&P 500 on the Daily Timeframe

In the S&P, the technical outlook is rather bearish. Price is back at the $6,790-6,815 range. However, since this has been the fifth test of this level from the upside, the probabilities of price breaking through have increased considerably. Especially important here is that there’s a series of old daily lows just above current prices, from where the price could easily rotate lower. In practice, this might look somewhat like the following:

Forex

It’s been a strong week for the Dollar. Following Trump’s announcement of Kevin Warsh as the next Fed chair, financial markets interpreted this as bullish USD.

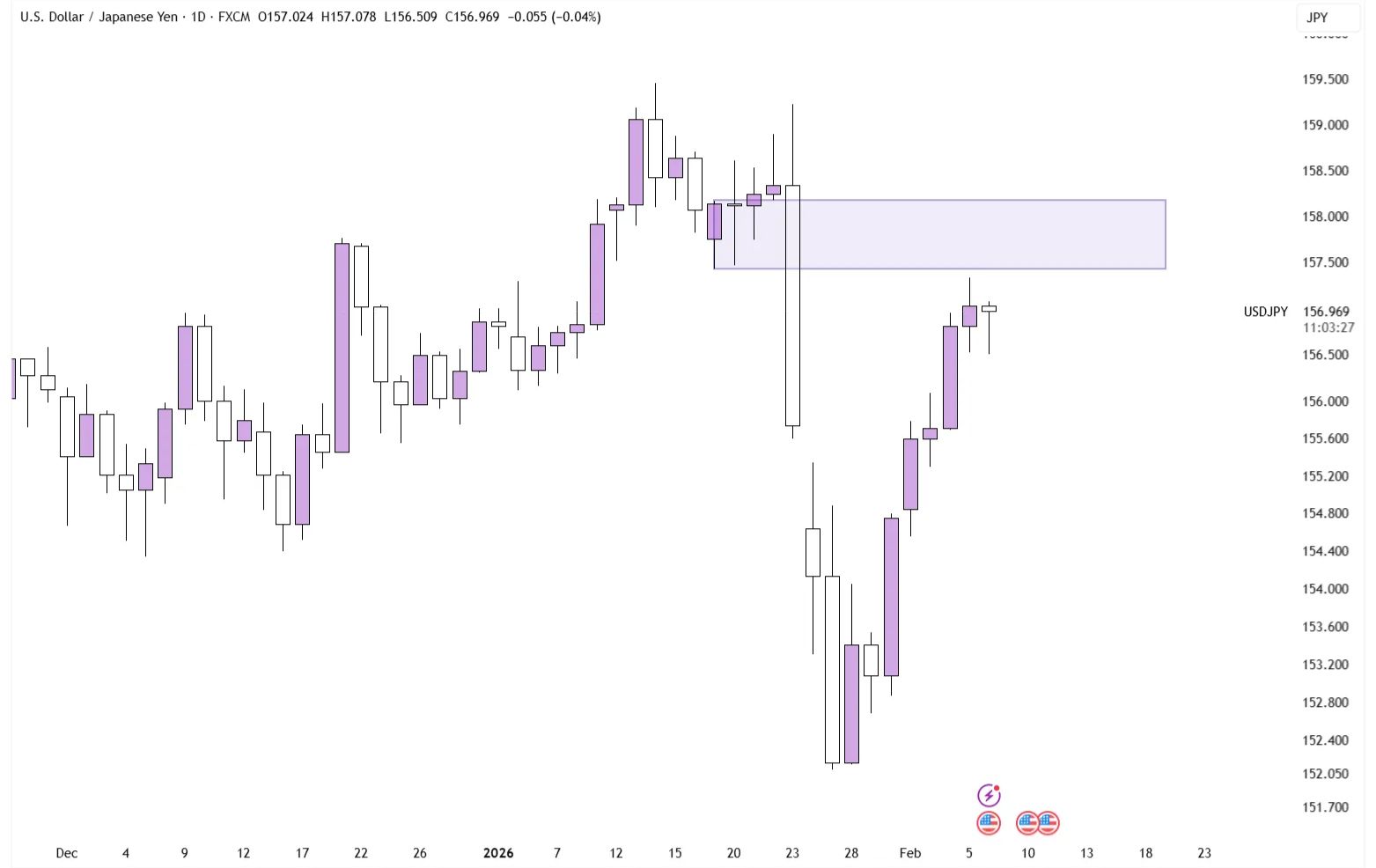

In USD/JPY, this gives a possibly interesting setup. After this week’s strong move, the price seems overdue for a minor pullback, with the marked range of old support as a possible strong area from which to expect a reaction.

USD/JPY on the Daily Timeframe

When price breaks through old daily lows, those levels tend to act as resistance when tested from below. This is the concept of flipped Support and Resistance zones.

As price tests one level multiple times, the level gets weaker. But once price breaks through that level, and tests it from the other side, it is ‘untested’ and thus more likely that price will react to it.

Commodities

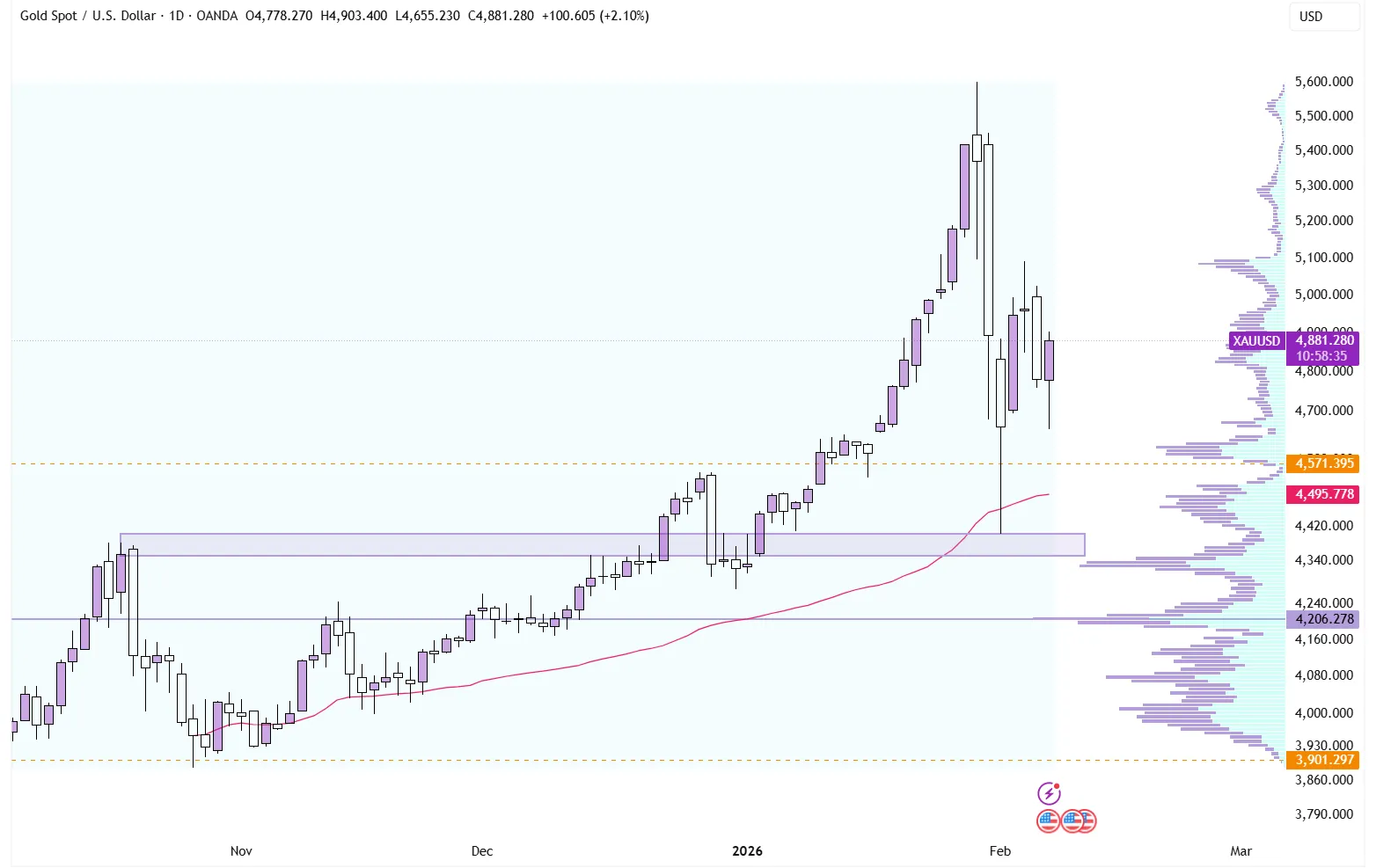

Gold and Silver had yet another rollercoaster week. Following Friday’s historic breakdown, both assets have seen a lot of volatility as they try to claw back their earlier losses.

XAU/USD on the Daily Timeframe

At this point, it’s very difficult to predict what price will do here. Gold has historically traded as a safe haven asset, meaning slow moves with a deep orderbook. But current price action has it resembling a small-cap tech with erratic moves.

Conclusion

One-sentence summary of the week:

Monetary policy was hawkish, USD up on Warsh nomination, and Gold trading like a tech stock.