Introduction

American politicians managed to put an end to the data blackbox, reopening the U.S. Goverment. In risk-on markets, equities experience a sudden sell-off in the S&P 500 and Nasdaq, with the Euro Stoxx 50 as the unexpected outperformer. Additionally, we’re checking back in on the AUD/NZD and Live Cattle price action we analyzed last week.

Global Macro

The U.S. government shutdown has been resolved. Following rumors earlier in the week that negotiations were progressing, the shutdown officially ended, and all government officials have returned to work.

Controversially, the Bureau of Labor Statistics (BLS) has indicated that the October unemployment data will likely never be released. This highly unusual move is raising many questions about the state of the unemployment data in October. Eyes will be fixed on the next Non-Farm Payrolls and Unemployment Rate.

While certainly odd, the end of the government shutdown also signifies the end of the "data black box." The Federal Reserve (Fed) will finally be able to rely on its usual economic indicators again to inform its monetary policy decisions.

Ever since the October FOMC Meeting, the odds of a 25 basis point (bps) rate cut have dramatically shifted from being almost 90% certain. Prediction markets are now seeing a near coin toss on whether or not rates will be cut. Last week, numerous individual Fed members delivered speeches, and the overall impression was of a deeply divided Fed, which seems uncertain about its next move. This particular setup could potentially introduce significant volatility as we approach the December FOMC Meeting.

Equities

American indices experienced a whipsaw week. After starting very strong and extending the late Friday reversal into the early parts of the week, they ultimately topped out on Wednesday. This was followed by a rapid sell-off into late Thursday, resulting in a weekly close very similar to the weekly open.

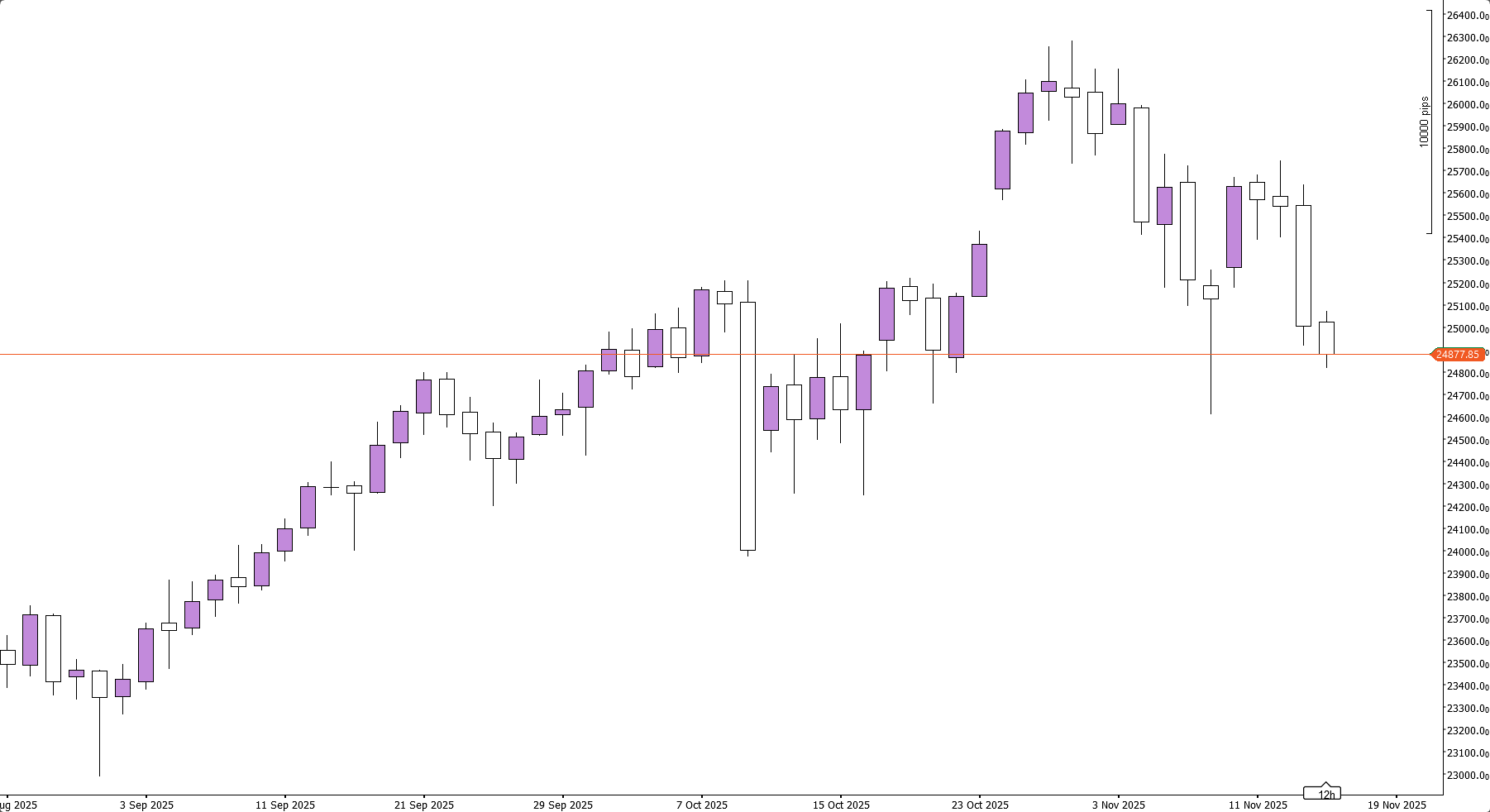

Nasdaq on the Daily Timeframe

This price action has created a rather bearish-looking chart, where price failed to sustain the momentum initially caused by an exhaustion candle on the Daily timeframe.

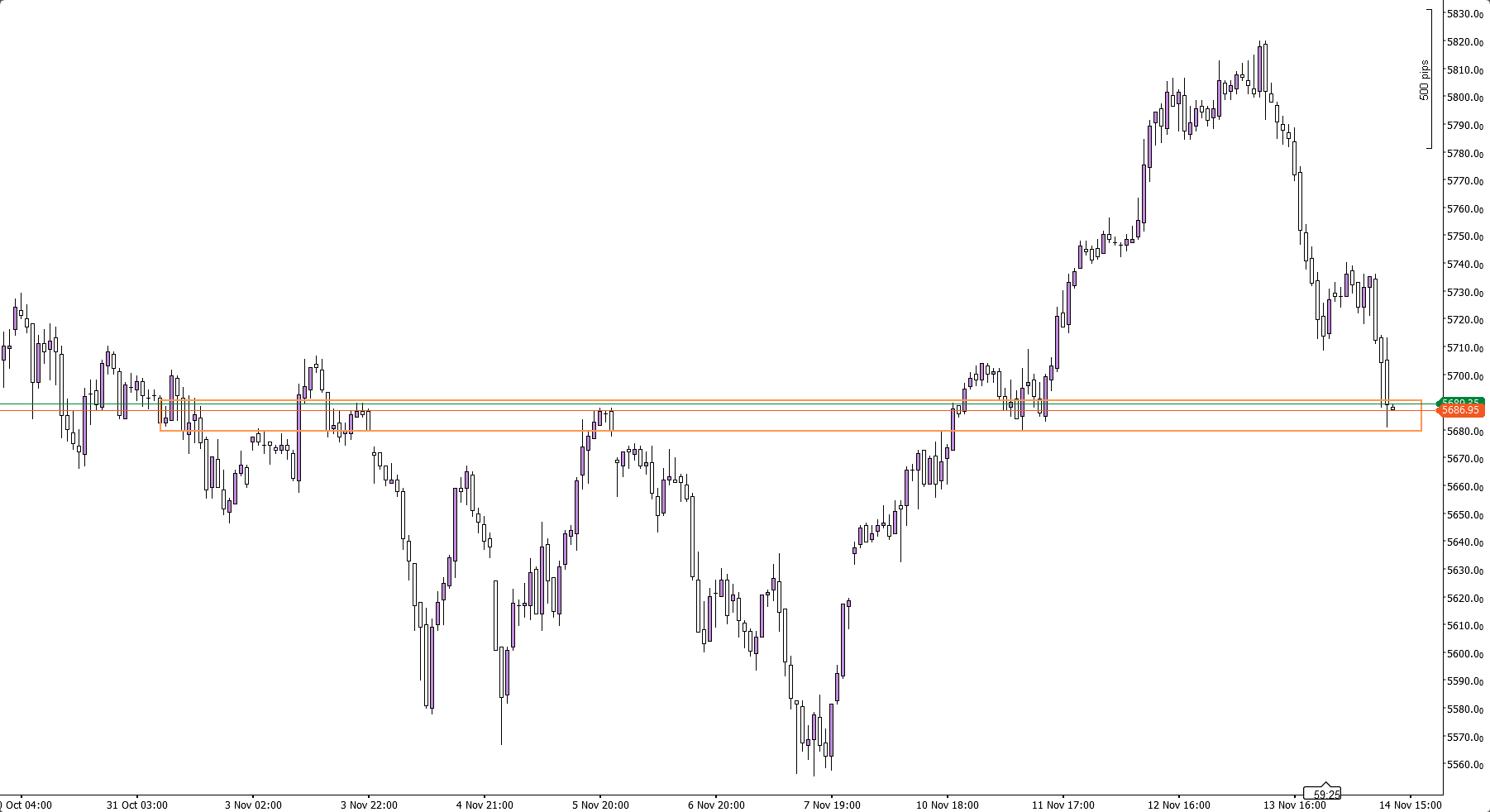

Euro Stoxx 50 on the 1h Timeframe

The Euro Stoxx 50 was this week's unexpected champion, setting new All-Time Highs while other indices were trading just below their own previous highs. It held up significantly better during the Thursday retracement, allowing it to preserve most of its gains and finish the week in the green.

Forex

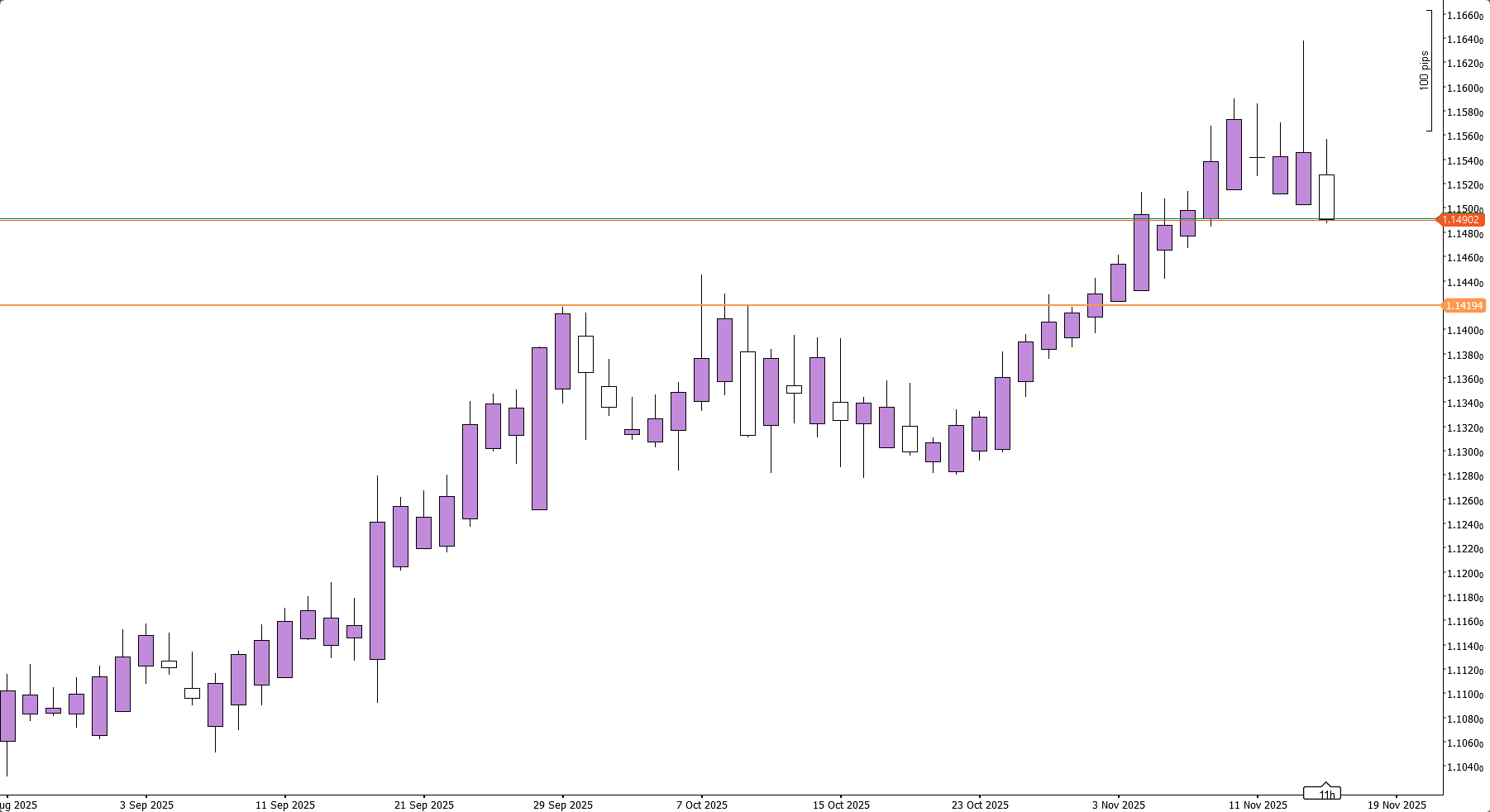

Last week, we discussed the NZD/USD approaching a major resistance area within a decade-long range. We outlined two possible setups to potentially trade this price action:

- Wait for a decisive breakthrough and look to trade it from the other side on a flipped Support/Resistance level.

- Utilize bearish price action to consider entering a short position within this key resistance area.

AUDNZD on the Daily Timeframe

Price attempted to sustain its earlier upward momentum, but Thursday's action created a Swing Failure Pattern (SFP). A bearish SFP is characterized by a candle with a long upward wick that briefly goes beyond a key swing point but ultimately closes the candle back below that level.

While SFPs on their own are not always highly reliable, the context of this candle, where price actively sweeps a recent high, elevates its significance. Currently, this chart looks quite bearish, with price seemingly prone to potentially test the 1.142 area.

Commodities

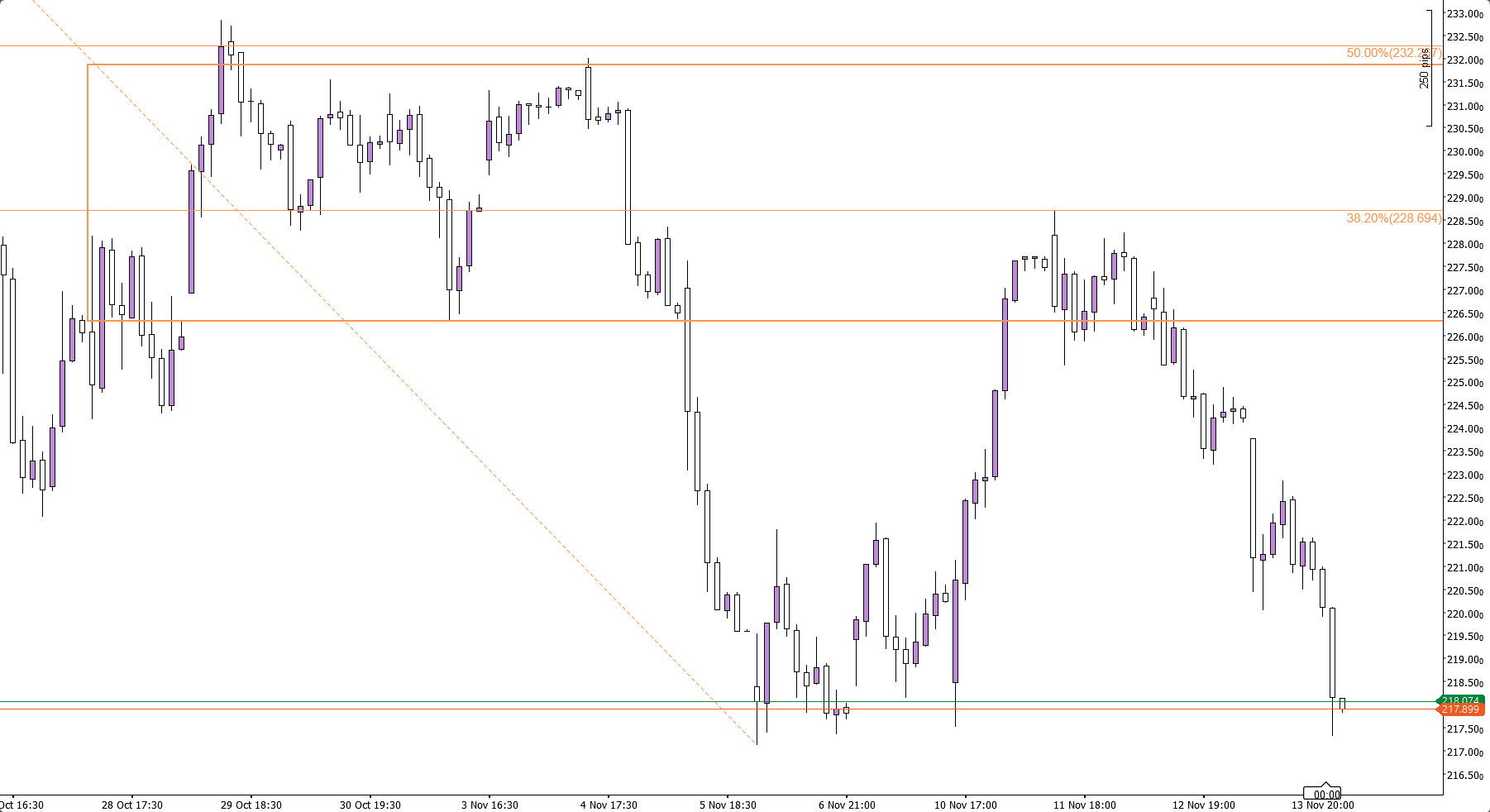

Last week we also discussed a potential short setup on the Live Cattle market. Following a sharp initial drop, price consolidated in a tight range before dropping further. A potential setup consisted of shorting this supply area which had confluence with the 0.382 Fibonacci level.

Live Cattle on the 30min Timeframe

This setup played out effectively, with price reversing almost exactly from the 0.382 Fibonacci level and now retesting its former lows.

Gold and Silver have continued their consolidation but are showing eagerness to retest their prior ATHs. Silver, in particular, seems poised to attempt a breakout next week, with prices currently consolidating just under the All-Time-High at $54.5

XAGUSD (Silver) on the 4hr Timeframe

Conclusion

One-sentence summary of the week:

The government shutdown was resolved, an unexpected risk-on sell-off ensued, and the AUD/NZD pair is currently showing technical weakness.