Scalping Strategy Explained

Forex trading scalping strategies are built for identifying short-term trading opportunities. These strategies can be coupled with various indicators and trading methods.

Here is the list of seven basic methods of the best scalping strategy:

- Choosing Pairs with Lowest Spreads

- Picking More Volatile Pairs

- Avoid Brokers with Dealing Desk

- Using Simple Moving Averages in trends

- Utilizing Bollinger Bands

- Trading Support and Resistance

- Executing Trades Manually

To get a better idea of what is scalping in Forex and, more precisely, how scalping in the Forex market works, let us go through them one by one.

Choosing Pairs with Lowest Spreads

When using Forex scalping trading strategies, it's important to choose a currency pair with the smallest spreads. As mentioned before, FX scalping strategies are not about making massive returns on one or two trades, it operates on small 5 to 15-pip gains. Therefore, large broker spreads can easily eat into those margins and take out significant portions of the trader’s payout.

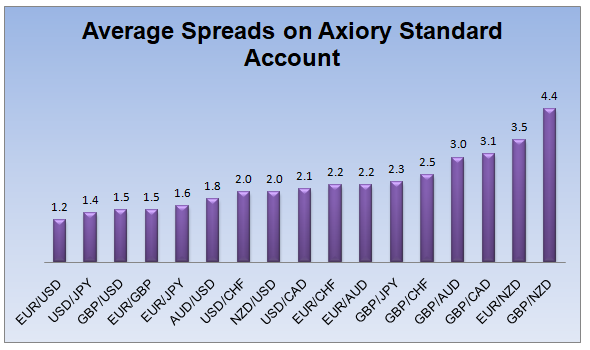

Consequently, those who are considering how to scalp Forex might be more selective about the Brokers and currencies they wish to trade. For a practical example, let us take a look at the

Axiory Forex Spreads.

The company offers three types of accounts to customers, each having different spreads. For the sake of simplicity, we will consider the Standard trading account.

As we can see from the chart above, EUR/USD, as the most traded currency pair, has the lowest spread of 1.2 pips. Traders can also open positions with some other pairs, including USD/JPY, GBP/USD, EUR/GBP, EUR/JPY, and AUD/USD with less than 2 pip spreads.

Consequently, for those traders using Axiory trading platforms, those 6 currency pairs mentioned above are well suited for simple Forex scalping strategies. In general, major currency pairs have the most liquidity and the least spreads.

Pairs in the middle of the chart, EUR/AUD might not be the best option for the type of trade, but in some cases, they might be still useful.

On the other hand, some relatively less liquid pairs, for example, GBP/NZD have an average spread of 4.4 pips, so some traders might not find this to be the best vehicle for scalping trades. So for example, if a trader is aiming for 10 pip payouts in each trade, in the case of EUR/USD he or she simply might need 11 or 12 pip gain to achieve that, but in the case of GBP/NZD – that is 15 pips.

Position traders care less about spread difference than traders who place many trades every day. Best Forex scalping strategies give traders more trading opportunities daily than swing traders, position traders and investors typically get.

Emerging market currencies, like Turkish Lira, Russian Ruble, and others might not be that useful for scalping as these currencies have low liquidity and high spreads. Currencies that are from developing nations are called exotic currencies, and it's best if scalpers avoid them altogether.

Picking More Volatile Pairs

Spreads are not the only useful criteria when choosing currency pairs for a

scalping trading strategy. When using Forex trading scalping methods, you want your currency pairs to be moving actively. Another important factor is volatility. Since this style of trading seeks quick gains, the market has to move faster to produce those results.

Less volatile pairs are not that useful for this purpose, since it might take much more time for the rates to move. Consequently, instead of a 5 or 10-minute trade, the trader might have to wait for half an hour or more for the pair to reach the desired level.

AUD/JPY, GBP/AUD, and GBP/NZD are some examples of currency pairs with relatively higher volatility. Actually, Gold and Silver prices usually also experience a greater degree of variation during trading days.

Avoiding Brokers with Dealing Desk

It goes without saying that, when it comes to trading, finding a broker with a good reputation is always critical. However, if one uses FX scalping techniques, that becomes even more crucial. In this style of trading, every second counts.

Therefore, the worst scenario for any trader would be if he or she opens positions, and achieves 10 or 15 pip gains, but is prevented from closing positions because some dealing desk rejects to execute orders. This can be especially harmful, if some major announcement or event is taking place, since a trader can lose a significant amount of money, because of that.

Fortunately, nowadays, there are many brokers with no dealing desk and conflicts of interest, who also offer competitive spreads on currency pairs.

Using Moving Averages

The scalping strategies Forex traders are using can be coupled with various trading indicators. Keep in mind that moving averages work best in trends, and they do not do well when market conditions change to range. For many traders, the Simple Moving Average (SMA) or Exponential Moving Average (EMA) can be a very helpful tool. Traders can use a 5,10, 50, or even 100 period SMA or EMA or higher depending on his or her preference.

One way to go about this is to use the EMA or SMA trading signals for short-term gains. However, keep in mind that the smaller time frames you use, chart patterns, and technical indicators become less productive due to increased market noise. The indicators are great tools for finding general trend directions that can help you while scalping. For instance, if markets are uptrending, you can only scalp in a long direction to increase your chances

Utilizing Bollinger Bands

Bollinger bands can be a very handy Forex scalping indicator. A flat Bollinger Band line suggests that the market is settling down for a tight range trading. The basic strategy here is very simple: a trader can buy a currency pair if it moves close to the lower bound and sell pairs where the price is close to the upper band.

Clearly, this does not guarantee that all positions will succeed, however, this tactic might help traders to win the majority of the trades.

Trading Support and Resistance

The best Forex scalping strategy doesn't have to be complex. Coupling scalping with the use of

support and resistance trend lines can help intraday traders increase accuracy. Essentially, a trader can take a look at the latest technical data from the Forex news websites, then buy currency pairs near support levels and sell pairs which trade near resistance.

Executing Trades Manually

The importance of placing Stop-Loss orders is underlined in countless Forex manuals and webinars. However, when it comes to scalping, there might be an exception. The fact is that putting a Stop-Loss order in place usually requires precious seconds, during which the price might change by several pips. Especially if you are using 1-minute charts for scalping. Closing trades manually might save time, but it increases dangers. For example, when inexperienced traders trade without a stop loss, they might be hoping that the trade will reverse, but that might never happen and result in a blown-up account.

More tested scalping strategies listed and explained

Below are some of the strategies that can be used to scalp Forex markets profitably.

The Best 1 Minute Forex Scalping Strategy?

Indicator 1:1 minute easy scalping sys v3.0 — Trend Length period: 88 (input section), in the style section, only check the first 3 options and set the 2nd bar color both to yellow

Indicator 2: ADX and Di — Only check DI + and DI- with default settings

This strategy was tested by some blog users and found to be profitable in the short term. The dangers of it include the main bar colors repainting constantly. This makes it difficult to backtest it, but several users tried to forward-test it on a demo and got excellent results. It has been tested on one-minute charts and seems very powerful. The first indicator we want to add to TradingView EURUSD or GBPUSD 1-minute chart is “1 minute easy scalping sys v3.0”. It was developed by a TradingView user and was used in conjunction with ADX and Di which another user developed. Here is the list and settings for each indicator used in this strategy:

The strategy is simple. For buy setups to be valid, the +DI must cross -DI from below and both the previous candle and the moving average of the 1-minute indicator must be colored in green. We check for signals when a new candle opens. The opposite is true for sale signals.

The only way to check the performance of this strategy is forward testing, meaning you must trade on the demo account using this strategy and only after that can you switch to a live account. The risk-to-reward ratio for this scalping method is 1:1.5 meaning you target 1.5 times the risk. If the stop loss is 4 pips away, you set the take profit at 1.5 times 4= 6 pips away from the entry price. The method for setting stop loss is to find recent swing lows and highs and set it slightly below or above these levels (below for buy, above for sell).

The Triple EMA 1-minute scalping system for Forex pairs

Indicator 1: Exponential Moving Average (period:6, color green)

Indicator 2: Exponential Moving Average (period:22, color: yellow)

Indicator 3: Exponential Moving Average (period:300, color: red)

Despite its long name, this strategy is a very robust system that enhances the traditional moving average crossover method with a 3rd very long-term Exponential Moving Average for filtering trend direction. We always want to take positions in the direction of the main trend to avoid many false signals.

The strategy is pretty simple, we are looking for buy signals when the price is above the 300-period EMA and sell signals when it is below the 300-EMA. When the price is above 300 and the 6-period EMA crosses the 22-period EMA from below upwards, we enter the buy trade. Stop loss is set at the recent swing low and the target can be anywhere between 1:2 to 1:5, depending on the trader’s experience and risk appetite. Traders can also use any trend strength indicators to ensure the trend is powerful enough not to get caught in a ranging markets. Trend strategies generally have lower win rates, and using trend meter filters is the best way to ensure we trade only when there is a trend present on the market. Traders can choose any time frame they feel comfortable with, from 1-minute to hours.

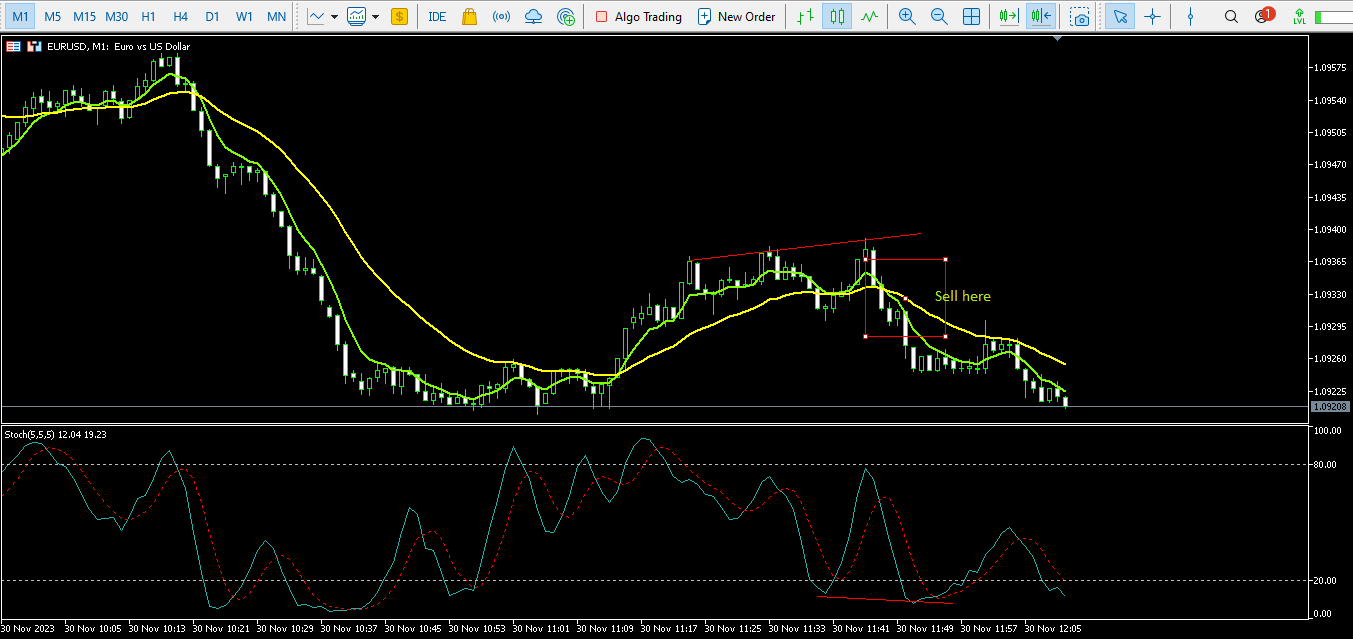

Stochastic Divergence with Double EMA Scalping for Quick Profits

Indicator 1: Exponential Moving Average (period:6, color green)

Indicator 2: Exponential Moving Average (period:22, color: yellow)

Indicator 3: Stochastic Oscillator (5,5,5 settings for all periods)

The stochastic oscillator is a very popular technical indicator that is built-in into all trading platforms, making this strategy a unique go-to for any trader on any platform. What's more exciting, this method can be used for any security or trading asset and any timeframe will do the job.

Being this flexible, this strategy must be learned by anyone thinking about becoming a trader in financial markets.

The basic premise is simple: look for buys when the price is showing lower lows but the stochastic is showing higher highs. The buy signal happens when the divergence is present and two EMAs make a bullish crossover (6-EMA crosses 22-EMA from below).

Set stop loss at the recent swing level and target 1:1 or more for take profit.

Parabolic SAR (Psar) and Larry Williams Large Trade Index (LWTI) Scalping

Indicator 1: Parabolic SAR (default settings)

Indicator 2: Larry Williams Large Trade Index (LWTI)

LWTI was developed by Larry Williams and was described in his book: “Trade Stocks and Commodities with the Insiders: Secrets of the COT Report”. The indicator usage for our case is simple, we are looking at the color of the line. When it switches color from green, we look for bullish Psar signals and vice versa. We look for the first signals after the LWTI changes color, and do not enter the following trading signals by Psar. This is done to filter bad trades and not to get caught in reversals.

Set stop loss at the recent swing high for short positions and at the recent swing low for buy positions. Take profit could be 2 times the risk or 1:2 risk-to-reward ratio. This system is robust and catches many price reversals. Tweak it further to increase the success rate even more.

Bollinger Bands (BBands) Simple scalping method

Indicator: Bollinger Bands (default settings)

Bollinger Bands is a trend following technical indicator that is widely popular among traders. It consists of two bands that are deviated from the center moving average line by user input length. The indicator is super popular, and we are going to discuss the basic strategy for using BBands for quick profits. There are no other indicators involved in this strategy, which makes it a very simple and easy-to-follow system. Similar to Stochastic, BBands are built-in in almost all trading platforms and can be used with any timeframe and asset.

For buy setups, we are looking for the price to test the below band and then the candle must close above the middle line.

In the first case (green colored first circle on the screenshot of the chart), the price tested above the band and immediately reversed to close below the middle band. This is the perfect sell setup as both of our conditions are met. In the second case, the price failed to close above the middle line, which is a failed setup. For the 3rd case, the price tested below the band and then closed above the middle line, confirming the buy signal.

Stop loss is set above or below the swing highs and lows (above the swing high for sell, below the swing low for buy). The target can be 1:1 or more, depending on the trader’s risk appetite and experience. For scalping 1:1 should be acceptable, while for swing traders 1:2 will be a better choice. If you are either long or short and an opposite signal happens, close the current trade and enter the opposite direction.