Foreign exchange quotations explained

When you’re trading online, it’s not always possible to trade with your native currency. In most cases, people trade with foreign currencies such as the United States Dollar or the Euro, simply because they’re the most popular ones.

But one thing you need to consider is that you’re not trading with currencies. You’re trading with currency pairs. All of these currency pairs have their prices, which are referred to as direct quotes and indirect quotes. Whether you're talking about a direct quote or vs indirect quote, there's a simple explanation to be found for either of them. Let’s try to break it down and make it easy to understand.

Let’s break down the USD/EUR pair since we’ve already used it in so many examples. This currency pair consists of:

- A base currency - this is the first currency in the pair. In our case it’s USD

- A quote currency - this is the second currency in the pair. In our case it’s EUR

- A quote - this is the exchange rate or the price of the currency pair. In our case, it’s 0.9083

This is a very important thing to know when trading Forex, so most people usually spend quite a lot of time understanding this concept before they start trading at all.

What is a direct quote?

As already mentioned, a direct quote is a currency pair that has a base currency of something you use natively. Let’s try to explain it with a story.

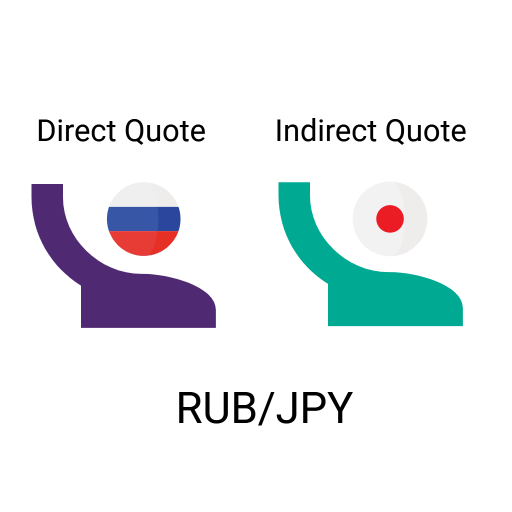

Imagine that you are from Russia and are traveling to Japan. Your native currency is the Ruble, so when you get to Japan you will start looking for a foreign exchange booth to buy some local currency, right?

However, offline exchange booths usually have

“Buy” and “Sell” on them. How would you identify direct and indirect quotes? Simple. Imagine how we explained quotes in general previously.

If it says “Buy”, this means that it’s an indirect quote for you. This would be represented like this: JPY/RUB. The Yen would be the base currency here, which means that you will be using it to buy RUB.

What you’re looking for is the “Sell” option. This is the direct quote. It will be represented like this: RUB/JPY. In this case, you will be buying Yen with Rubles. Let’s say that the rate is 1.7397. This means that you can buy 1.73 Yen with 1 Ruble.

Pros of direct quoting

Simplicity — Direct quotes are straightforward to understand, allowing traders to calculate the value of one unit of the base currency in quoted currency.

Clarity in transactions — Direct quotes in trading eliminate the need for complex calculations for determining trade sizes and potential profits. This simplicity leads to more transparent transactions.

Common practice — The majority of traders opt for direct quoting to align the currency they use with direct quotes. It is a more intuitive way to understand exchange rates.

Easier risk assessment — using direct quotes, it is simpler for traders to assess their risks when trading and determine the value of their trades in their native currency.

Cons of direct quoting

Limited options — can potentially limit the number of available trading pairs, especially when dealing with exotic currencies.

What is an indirect quote?

An indirect quote would be the opposite of what we explained above. Instead of the 1.7397 exchange rate, you’d get 0.5744 because you would be buying Rubbles with Yen.

Pros of indirect quoting

Flexibility — Opposite to direct quoting, indirect quoting offers more flexibility in terms of available currency pairs. Indirect quotes enable traders to access a broader range of markets and explore different trading opportunities.

Global perspective — indirect quotes allow traders to see the currency from the global perspective and not just from the perspective of their native currency. The global view is always valuable for identifying diverse trading scenarios.

Market dynamics — indirect quotes can sometimes reflect market dynamics accurately, especially in the case of less commonly traded currencies.

Cons of indirect quoting

Complexity — unlike direct quotes, indirect quotes are more complete and require additional calculations to determine the value of the base currency in terms of the quote currency. This imposes some challenges for traders.

Difficulty in risk assessment — indirect quotes are more challenging to calculate and make it harder to assess risks, unlike direct quotes. It is always critical to accurately assess the risk exposure when trading financial markets.

Less intuitive — unlike direct quotes, indirect quotes are less intuitive, especially for traders accustomed to direct quoting. Indirect quotes require a learning curve to fully understand and apply them effectively.