The Australian dollar was down four days this week, dropping to fresh one-year lows as it was trading at 0.7050 during the US session, down 0.5% on the day.

Volatility rose after the latest US labor market data, which showed the US economy created only 210,000 jobs in November, the smallest monthly increase since December and well below the expectations of 550,000.

The unemployment rate improved notably to 4.2%, down from 4.6% in October. At the same time, average hourly earnings stayed at 4.8% year-on-year (against expectations of 5.0%). The USD initially declined after the data, but losses were temporary, and the dip was quickly bought.

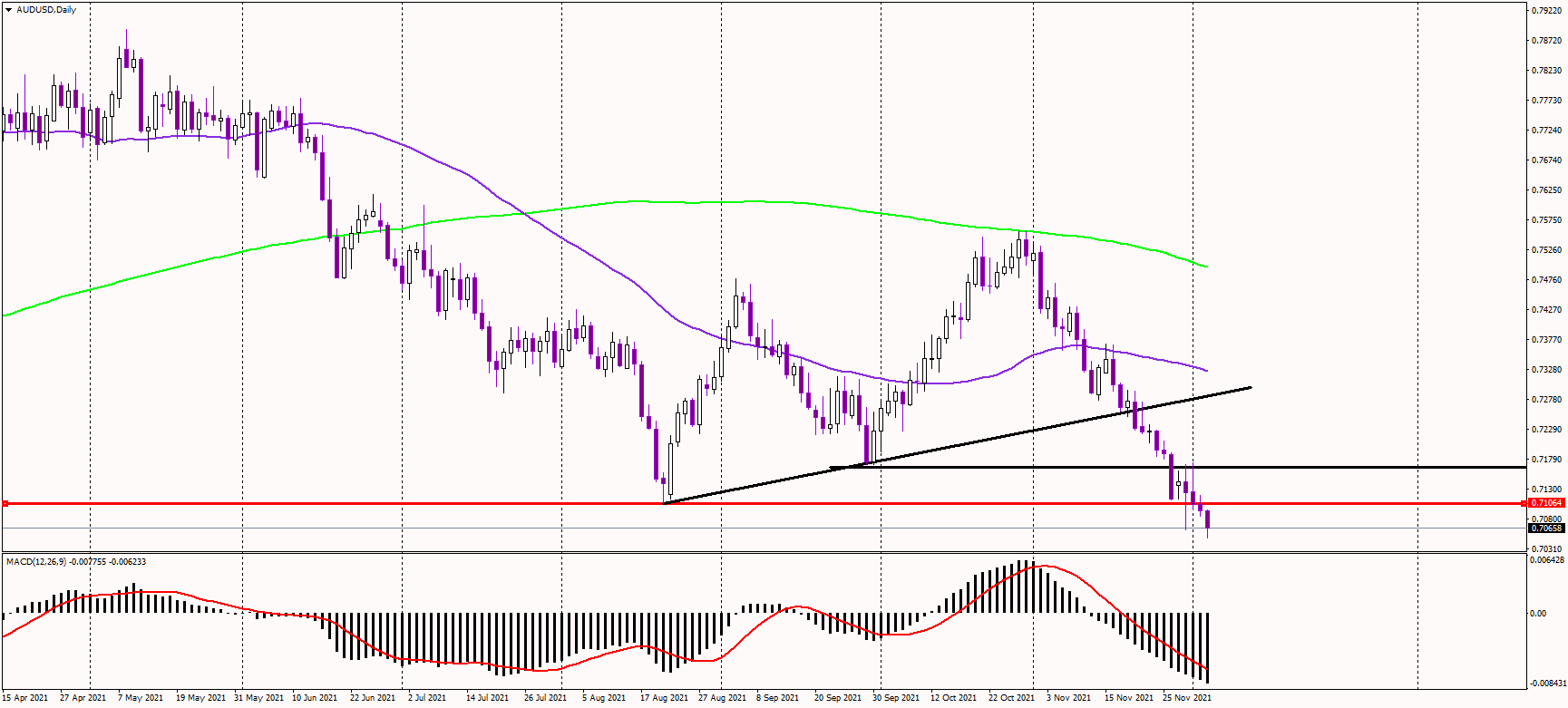

As long as the Aussie trades below previous lows of 0.7105, the medium and long-term downtrends remain intact. Therefore, rallies to this level are expected to be sold. The next target for bears might be at September/October 2020 lows at 0.70, where the psychological level also is.

However, since the Aussie has been dropping since November, it looks oversold on many time frames, possibly setting the stage for a corrective bounce. Should the pair advance above the mentioned 0.7105 level, we could see a quick rally toward 0.7160. Only a return above 0.7160 might cancel the immediate bearish momentum.