USDCAD Attacks 1.30 Resistance

19 August 2022

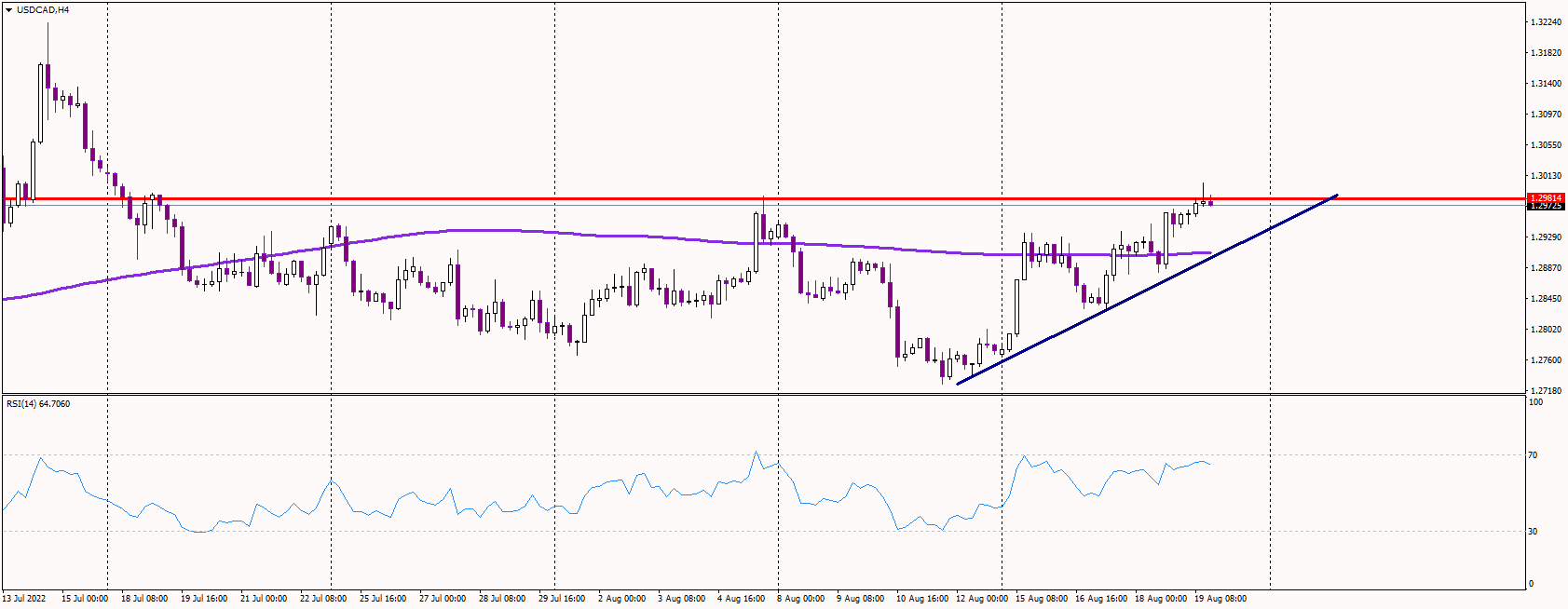

The Loonie slipped on Friday, pushing the USDCAD pair toward the critical resistance of 1.30 as the USD has dominated the FX market again.

Retail sales ignored by traders

Following a 2.3% (revised from 2.2%) increase in retail sales in May, Statistics Canada data released on Friday showed that retail sales in Canada increased by 1.1% on a monthly basis in June. This result was better than the market's forecast of a 0.3% gain.

The publication's further data indicated that a 0.2% fall in retail sales is anticipated for July.

Technical analysis suggests further upside

Technically speaking, the overnight surge beyond the resistance level of 1.2980-1.2985, which corresponded with the 50% Fibonacci retracement level of the July-August decline, strengthens the optimistic picture.

On the daily chart, oscillators have shifted towards a positive zone. As a result, investors are expected to buy into dips, and that the USDCAD pair will move upward along the path of least resistance.

If the pair moves through the 1.30 resistance, stop-losses of short positions could be hit, likely helping the USD to advance toward July's highs above 1.3220.

On the downside, if the pair drops below 1.2950, the short-term outlook could turn negative, possibly targeting the uptrend line near 1.2890.