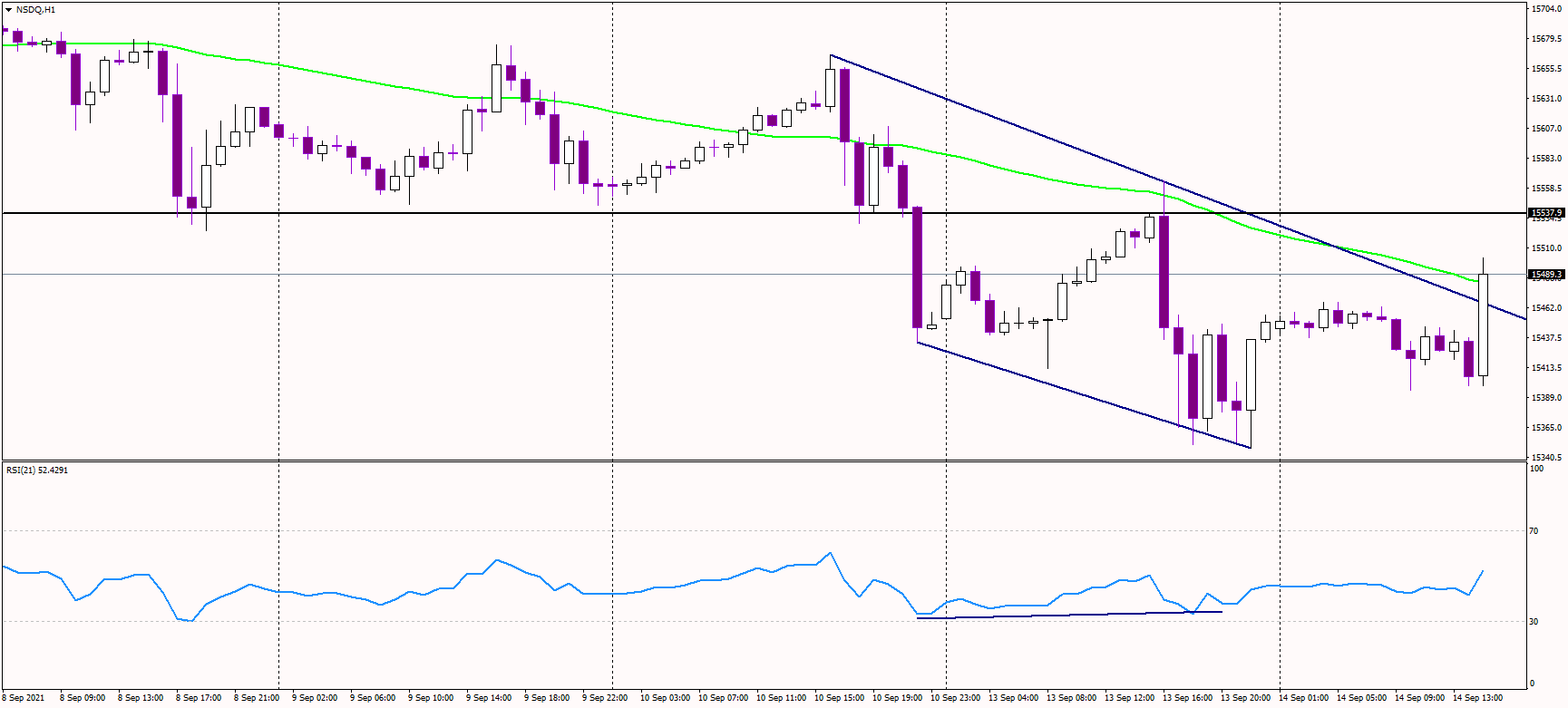

The Nasdaq 100 index is trying to cancel its recent short-term downtrend, and it was up circa 100 USD since US inflation data were released, jumping above the 15,500 USD threshold.

It looks like the hourly candle will finish above the short-term bearish trendline, potentially changing the immediate bias to bullish. The index has been down five days in a row, which is rather unusual. When this occurs, bulls normally buy the dip and push the Nasdaq index to news highs. The same pattern could happen now.

The critical resistance now stands at around 15.545 USD, where previous lows are located. If the index closes above that level, it would confirm the end of the short-term downtrend, targeting the current all-time highs near 15.700 USD.

There is a bullish divergence on the hourly chart between the price and the MACD indicator, supporting the current bounce.

However, if sentiment worsens again and the index starts to decline again, the first important support is located at the broken, bearish trend line near 15,465 USD. Bulls need to defend that area for the breakout to be valid. Another demand zone could be located near the swing lows at 15,350 USD.